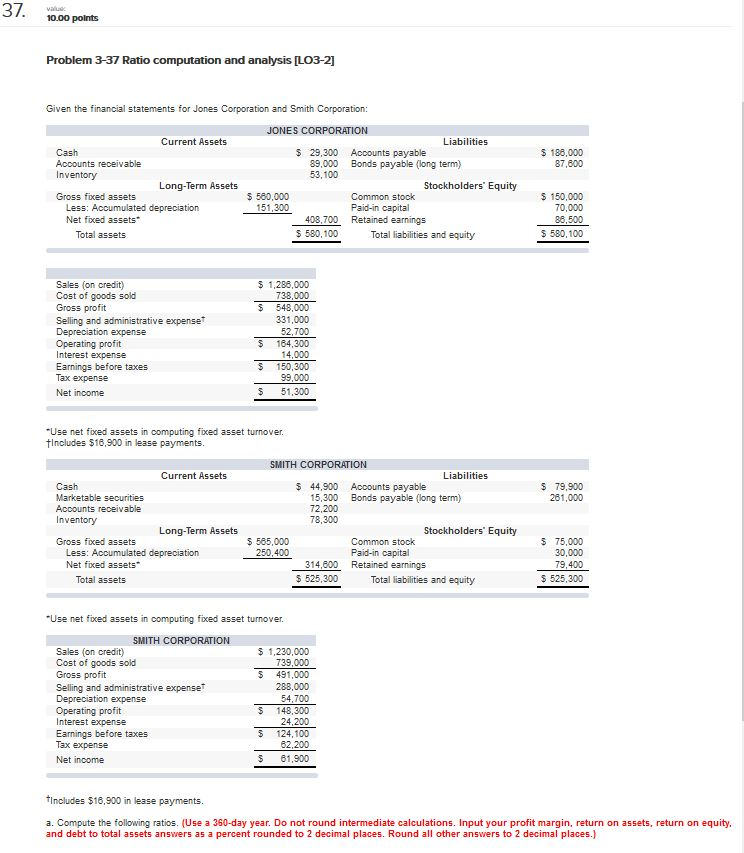

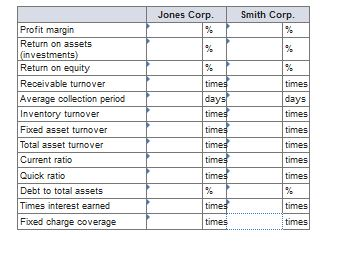

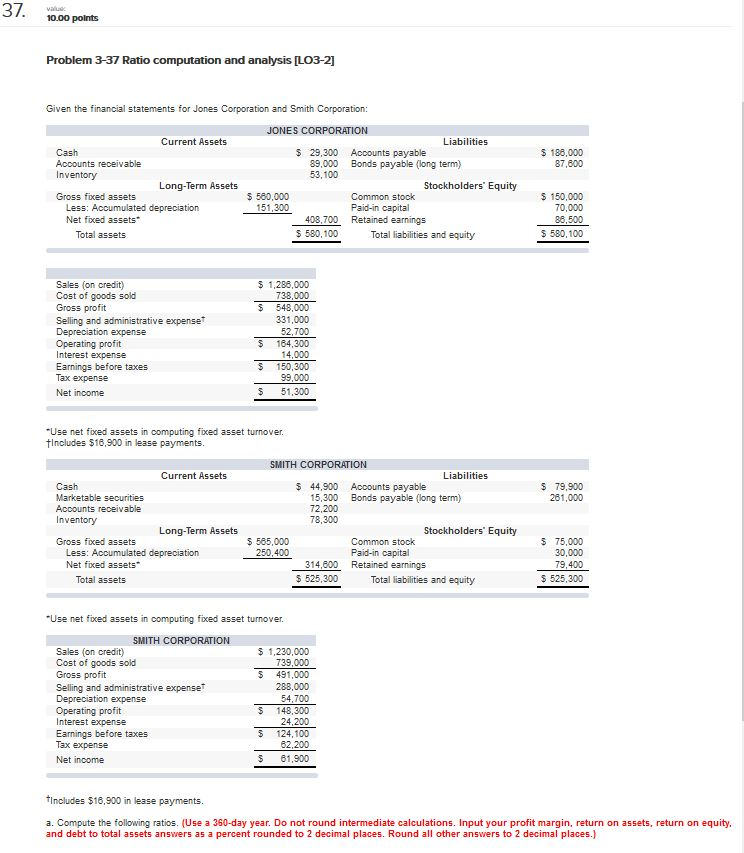

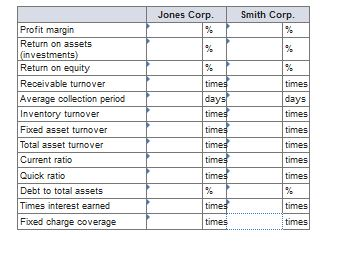

10.00 polnts Problem 3-37 Ratio computation and analysis [LO3-2] Given the financial statements for Jones Corporation and Smith Corporation: JONES CORPORATION Current Assets Liabilities Cash Accounts receivable Inventory 29,300 Accounts payable 89,000 Bonds payable (long term) 53,100 188,000 87,800 Long-Term Assets Stockholders Equity 5 580,000 51,300 Gross foxed assets Common stock Paid-in capital Retained earnings 150,000 70,000 88,500 5 580,100 Less: Accumulated depreciation Net fixed assets 408,700 5 580,100 Total assets Total liabilities and equity Sales (on credit) Cost of goods sold Gross profit Selling and administrative expenset Depreciation expense Operating profit Interest expense Earnings before taxes Tax expense 5 1,288,000 738,000 5 548,000 331,000 52,700 5 164,300 4,000 5 150,300 99,000 5 51,300 ncome Use net fixed assets in computing fixed asset turnover tIncludes $18,900 in lease payments SMITH CORPORATION Current Assets Liabilities Cash 44,900 Accounts payable 15,300 Bonds payable (long term) 72,200 78,300 79,900 281,000 Accounts receivable Inventory Long-Term Assets Stockholders Equity Gross fxed assets 5 565,000 250,400 Common stock Paid-in capital 3 75,000 30,000 79,400 5 525,300 Less: Accumulated depreciation Net fixed assets -S 14,800 Retained earnings Total assets 5 525,300 Total liabilities and equity Use net foxed assets in computing fixed asset turnover. SMITH CORPORATION Sales (on credit) Cost of goods sold Gross profit Selling and administrative expense Depreciation expense Operating profit Interest expense Earnings before taxes Tax expense Net income 5 1,230,000 739,000 5 491,000 288,000 54,700 5 148,300 24,200 5 124,100 2,200 5 61,900 includes $18,900 in lease payments a. Compute the following ratios. (Use a 360-day year. Do not round intermediate calculations. Input your profit margin, return on assets, return on equity and debt to total assets answers as a percent rounded to 2 decimal places. Round all other answers to 2 decimal places.] Jones Corp. Smith Corp. Profit margin Return on assets investments Return on equity Receivable turnover Average collection period nventory turnover Fixed asset turnover Total asset turnover Current ratio Quick ratio Debt to total assets Times interest earned times days times times times times times days time time times Fixed charge coverage times times