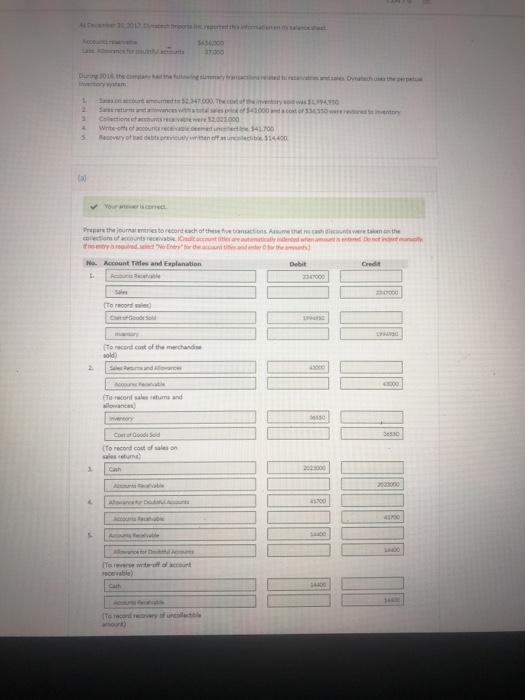

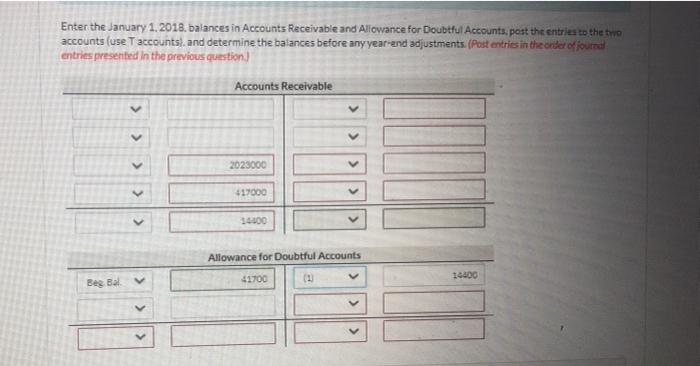

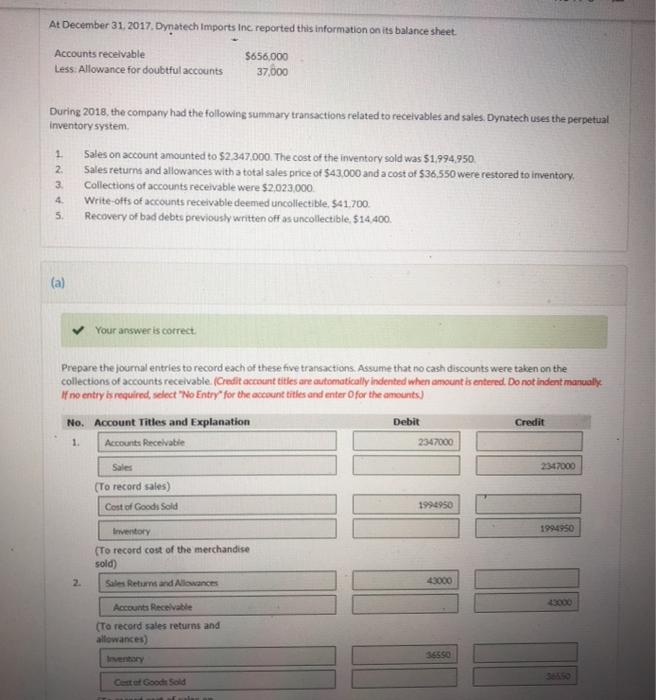

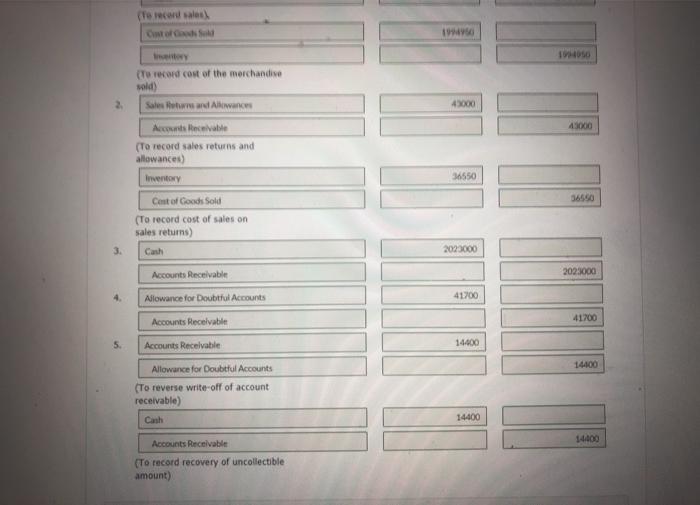

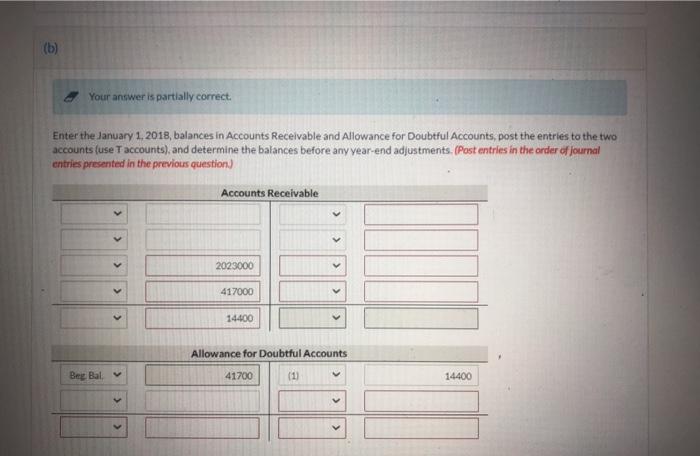

10000 1 3 40. This Sartreuse60003545 Cotton 2016 Winte om det 341.700 Rayonce 1400 5 Prepare them to record of the the control de No Account Tules and Explanation Crede Debi OOO To run any (Tercant cost of the case old for consume and Code od To record coolson were 2003 200 At December 31, 2017. Dynatech Imports Inc reported this information on its balance sheet. $656,000 Accounts receivable Less. Allowance for doubtful accounts 37.000 During 2018, the company had the following summary transactions related to receivables and sales Dynatech uses the perpetual Inventory system Sales on account amounted to $2.347.000. The cost of the inventory sold was 51,994.950 Sales returns and allowances with a total sales price of $43,000 and a cost of $36,550 were restored to inventory 3 Collections of accounts receivable were $2,023,000 Write-offs of accounts receivable deemed uncollectible. 541.700 Recovery of bad debts previously written off as uncollectible. $14.400. 1 2. 4 5 (a) Your answer is correct Prepare the journal entries to record each of these five transactions Assume that no cash discounts were taken on the collections of accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manual If no entry is required, select "No Entry for the account titles and enter for the amounts) No. Account Titles and Explanation Debit Credit Accounts Receivable 1. 2347000 Sales 2347000 (To record sales) Cost of Goods Sold 1994950 Investory 1994950 To record cost of the merchandise sold) 2 Sales Returns and Allowances Accounts Receivable (To record sales returns and allowances) Cette Good Sold (To record cost of the merchandise sold) Sales and Awan 4000 43000 Accounts Receive (To record sales returns and allowances) Inventory 30550 Cost of Goods Sold (To record cost of sales on sales returns) Cash 3. 2023000 Accounts Receivable 2023000 Allowance for Doubtful Accounts 41700 41700 Accounts Receivable 5. Accounts Receivable 14400 14400 Allowance for Doubtful Accounts To reverse write-off of account receivable) Cash 14400 14400 Accounts Receivable (To record recovery of uncollectible amount) (b) Your answer is partially correct Enter the January 1, 2018, balances in Accounts Receivable and Allowance for Doubtful Accounts, post the entries to the two accounts (use Taccounts), and determine the balances before any year-end adjustments. (Post entries in the order of journal entries presented in the previous question) Accounts Receivable > 2023000 > 417000 > 14400 Allowance for Doubtful Accounts > Beg Bal 41700 (1) 14400 > >