Question

$10,000 is used to purchase an appropriate size annuity that has level annual payments for 16 years. The price of the annuity is based

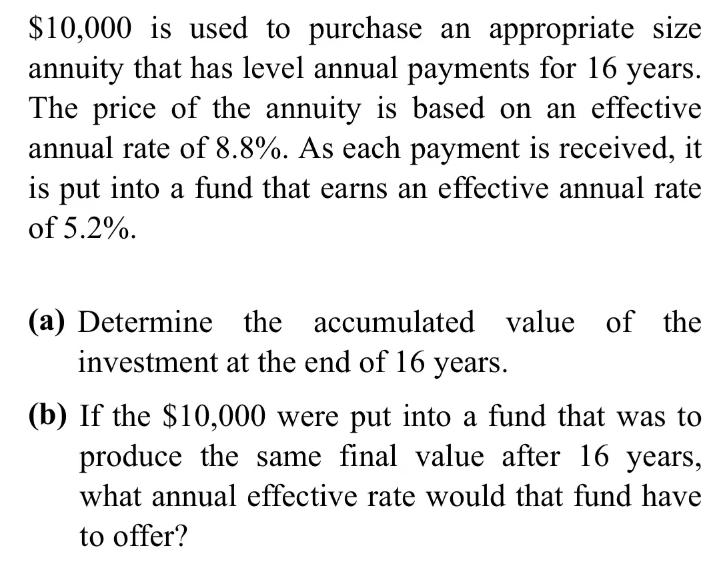

$10,000 is used to purchase an appropriate size annuity that has level annual payments for 16 years. The price of the annuity is based on an effective annual rate of 8.8%. As each payment is received, it is put into a fund that earns an effective annual rate of 5.2%. (a) Determine the accumulated value of the investment at the end of 16 years. (b) If the $10,000 were put into a fund that was to produce the same final value after 16 years, what annual effective rate would that fund have to offer?

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem well use the formulas for the accumulated value of an annuity and the present value of a lump sum a Accumulated value of the investment at the end of 16 years Given data Principa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial management theory and practice

Authors: Eugene F. Brigham and Michael C. Ehrhardt

12th Edition

978-0030243998, 30243998, 324422695, 978-0324422696

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App