Answered step by step

Verified Expert Solution

Question

1 Approved Answer

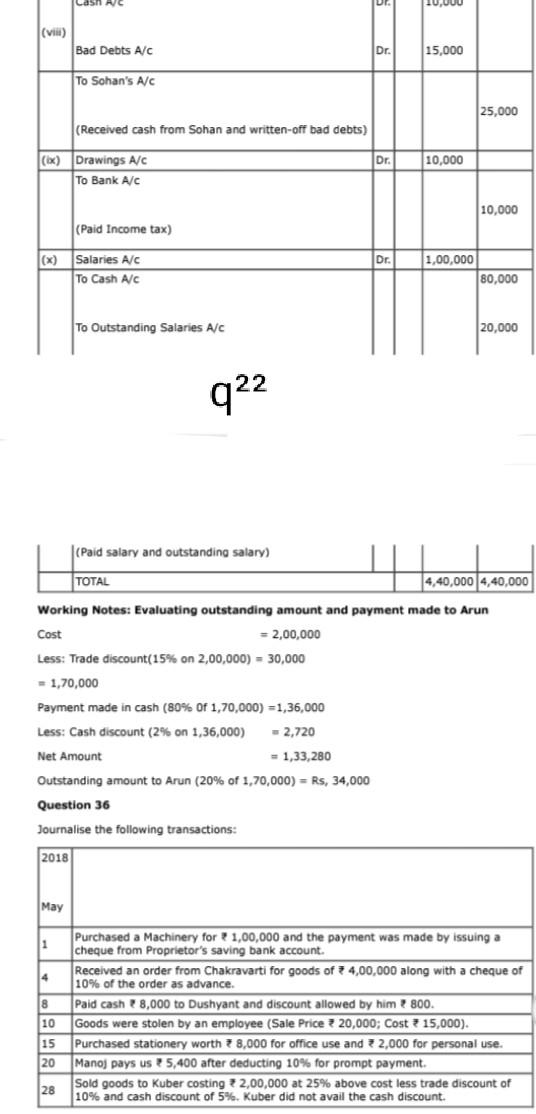

10,00u (ville) Bad Debts A/C Dr. 15,000 To Sohan's A/C 25,000 (Received cash from Sohan and written-off bad debts) Dr. 10,000 Drawings A/C To Bank

10,00u (ville) Bad Debts A/C Dr. 15,000 To Sohan's A/C 25,000 (Received cash from Sohan and written-off bad debts) Dr. 10,000 Drawings A/C To Bank A/C 10,000 (Paid Income tax) Dr. (x) Salaries A/C To Cash Ac 1,00,000 80,000 To Outstanding Salaries A/C 20,000 10,000 922 (Paid salary and outstanding salary) TOTAL 4,40,000 4,40,000 Working Notes: Evaluating outstanding amount and payment made to Arun Cost = 2,00,000 Less: Trade discount(15% on 2,00,000) - 30,000 1,70,000 Payment made in cash (80% of 1,70,000) =1,36,000 Less: Cash discount (2% on 1,36,000) - 2,720 Net Amount = 1,33,280 Outstanding amount to Arun (20% of 1,70,000) = Rs, 34,000 Question 36 Journalise the following transactions: 2018 May 1 4 8 10 15 20 Purchased a Machinery for ? 1,00,000 and the payment was made by issuing a cheque from Proprietor's saving bank account. Received an order from Chakravarti for goods of 4,00,000 along with a cheque of 10% of the order as advance. Paid cash 8,000 to Dushyant and discount allowed by him ? 800. Goods were stolen by an employee (Sale Price 20,000; Cost? 15,000). Purchased stationery worth 78,000 for office use and 2,000 for personal use. Manoj pays us 25,400 after deducting 10% for prompt payment. Sold goods to Kuber costing + 2,00,000 at 25% above cost less trade discount of 10% and cash discount of 5%. Kuber did not avail the cash discount 28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started