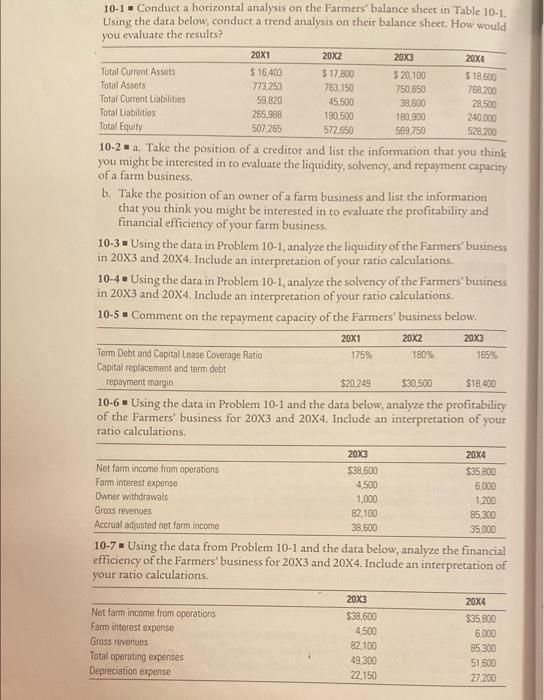

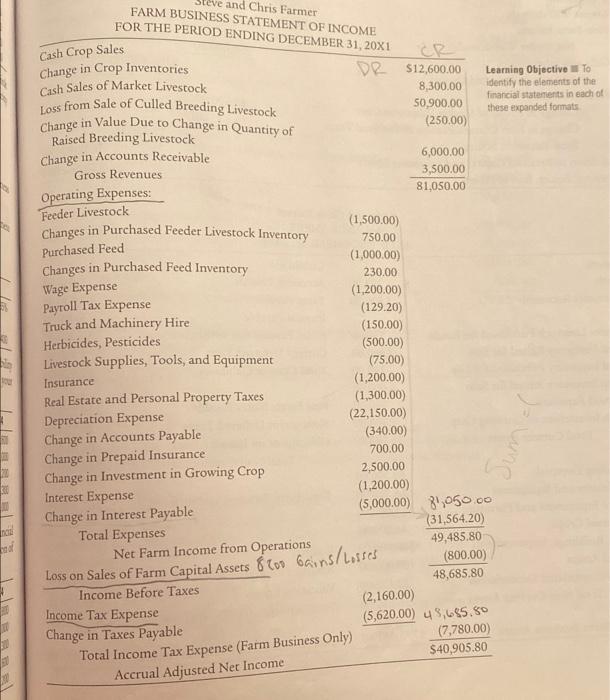

10-1 Conduct a horizontal analysis on the Farmers' balance sheet in Table 10-1. Using the data below, conduct a trend analysis on their balance sheet. How would you evaluate the results? 20X1 20X2 20X3 20X1 Total Current Assets $ 16.403 $ 17.000 $ 20,100 $18.600 Total Assets 773,253 753.150 750 550 758.200 Total Current Liabilities 59,820 45.500 38 600 2.500 Total Liabilities 265,988 190.500 180.900 240.000 Total Equity 507,265 572,550 569.750 528.200 10-2. Take the position of a creditor and list the information that you think you might be interested in to evaluate the liquidity, solvency, and repayment capacity of a farm business b. Take the position of an owner of a farm business and list the information that you think you might be interested in to evaluate the profitability and financial efficiency of your farm business 10-3 Using the data in Problem 10-1, analyze the liquidity of the Farmers' business in 20x3 and 20X4. Include an interpretation of your ratio calculations. 10-4 Using the data in Problem 10-1, analyze the solvency of the Farmers' business in 20x3 and 20X4. Include an interpretation of your ratio calculations. 10-5 - Comment on the repayment capacity of the Farmers' business below, 20X1 20X2 20X3 Term Debt and Capital Lease Coverage Ratio 175% 180% 1658 Capital replacement and term debt repayment margin $20.249 $30.500 $18.400 10-6. Using the data in Problem 10-1 and the data below, analyze the profitability of the Farmers' business for 20x3 and 20X4. Include an interpretation of your ratio calculations 20X3 20X4 Net farm income from operations $38,600 $35 800 Farm interest expense 4.500 6,000 Owner withdrawals 1.000 1.200 Gross revenues 82.100 85.300 Accrual adjusted net farm income 38.600 35.000 10-7 Using the data from Problem 10-1 and the data below, analyze the financial efficiency of the Farmers' business for 20x3 and 20X4. Include an interpretation of your ratio calculations. 20X3 20X4 Net farm income from operations $38,600 $35.800 Farm interest expense 4,500 6.000 Gross revenues 82,100 85300 Total operating expenses 49 300 51.600 Depreciation expense 22,150 27 200 ve and Chris Farmer FARM BUSINESS STATEMENT OF INCOME FOR THE PERIOD ENDING DECEMBER 31, 20X1 Cash Crop Sales Change in Crop Inventories DR $12,600.00 Learning Objectives To Cash Sales of Market Livestock 8,300.00 identify the elements of the Loss from Sale of Culled Breeding Livestock financial statements in each of 50,900.00 Change in Value Due to Change in Quantity of these expanded formats (250.00) Raised Breeding Livestock Change in Accounts Receivable 6,000.00 Gross Revenues 3,500.00 Operating Expenses: 81,050.00 Feeder Livestock Changes in Purchased Feeder Livestock Inventory (1,500.00) 750.00 Purchased Feed (1,000.00) Changes in Purchased Feed Inventory 230.00 Wage Expense (1,200.00) Payroll Tax Expense (129.20) Truck and Machinery Hire (150.00) Herbicides, Pesticides (500.00) Livestock Supplies, Tools, and Equipment (75.00) Insurance (1,200.00) Real Estate and Personal Property Taxes (1,300,00) Depreciation Expense (22,150.00) Change in Accounts Payable (340.00) Change in Prepaid Insurance 700.00 Change in Investment in Growing Crop 2,500.00 Interest Expense (1.200.00) Change in Interest Payable (5,000.00) 81,050.00 Total Expenses (31,564.20) 49,485.80 Net Farm Income from Operations (800.00) Loss on Sales of Farm Capital Assets 6200 Gains/losses 48,685.80 Income Before Taxes (2,160,00) Income Tax Expense (5,620.00) 45,685.50 Change in Taxes Payable (7,780.00) Total Income Tax Expense (Farm Business Only) $40,905.80 Accrual Adjusted Net Income Suma CE