Question

10.1. Financial Condition of Banks. The file Banks.xls includes data on a sample of 20 banks. The Financial Condition column records the judgment of an

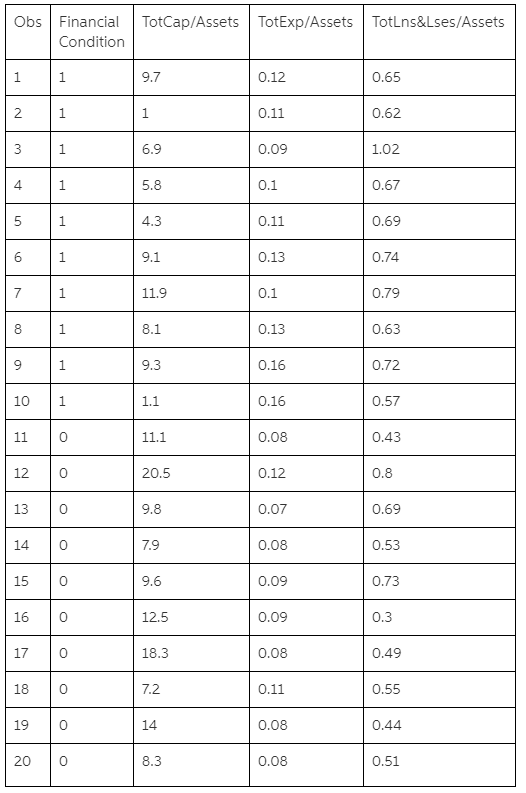

10.1. Financial Condition of Banks. The file Banks.xls includes data on a sample of 20 banks. The Financial Condition column records the judgment of an expert on the financial condition of each bank. This dependent variable takes one of two possible valuesweak or strongaccording to the financial condition of the bank. The predictors are two ratios used in the financial analysis of banks: TotLns&Lses/Assets is the ratio of total loans and leases to total assets and TotExp/Assets is the ratio of total expenses to total assets. The target is to use the two ratios for classifying the financial condition of a new bank. Run a logistic regression model (on the entire dataset) that models the status of a bank as a function of the two financial measures provided. Specify the success class as weak (this is similar to creating a dummy that is 1 for financially weak banks and 0 otherwise), and use thedefault cutoff value of 0.5.

d. Interpret the estimated coefficient for the total loans & leases to total assets ratio (TotLns&Lses/Assets) in terms of the odds of being financially weak.

e. When a bank that is in poor financial condition is misclassified as financially strong, the misclassification cost is much higher than when a financially strong bank is misclassified as weak. To minimize the expected cost of misclassification, should the cutoff value for classification (which is currently at 0.5) be increased or decreased?

Obs Financial Condition TotCap/Assets TotExp/Assets TotLns&Lses/Assets 1 1 9.7 0.12 0.65 2. 1 1 0.11 0.62 3 1 6 9 0.09 1.02 4 1 5.8 0.1 0.67 5 1 4.3 0.11 0.69 09 1 9.1 0.13 0.74 7 1 11.9 0.1 0.79 8 1 8.1 0.13 0.63 9 1 9.3 0.16 0.72 10 1 1.1 0.16 0.57 11 0 11.1 0.08 0.43 12 0 20.5 0.12 0.8 13 0 9.8 0.07 0.69 14 0 7.9 0.08 0.53 15 0 9.6 0.09 0.73 16 0 12.5 0.09 0.3 17 0 18.3 0.08 0.49 18 0 7.2. 0.11 0.55 19 0 14 0.08 0.44 20 O 8.3 0.08 0.51

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started