Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10.2 2. The weighted average cost of capital The importance of knowing a firm's cost of capital PBBC is considering investing in a project whose

10.2

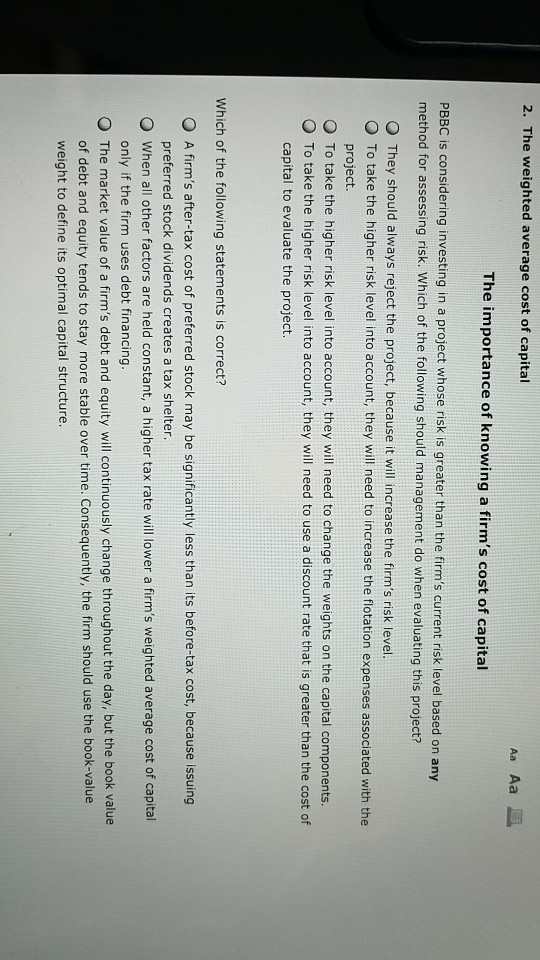

2. The weighted average cost of capital The importance of knowing a firm's cost of capital PBBC is considering investing in a project whose risk is greater than the firm's current risk level based on any method for assessing risk. Which of the following should management do when evaluating this project? O They should always reject the project, because it will increase the firm's risk level. O To take the higher risk level into account, they will need to increase the flotation expenses associated with the project. O To take the higher risk level into account, they will need to change the weights on the capital components. O To take the higher risk level into account, they will need to use a discount rate that is greater than the cost of capital to evaluate the project. Which of the following statements is correct? O A firm's after-tax cost of preferred stock may be significantly less than its before-tax cost, because issuing O When all other factors are held constant, a higher tax rate will lower a firm's weighted average cost of capital O The market value of a firm's debt and equity will continuously change throughout the day, but the book value preferred stock dividends creates a tax shelter. only if the firm uses debt financing. of debt and equity tends to stay more stable over time. Consequently, the firm should use the book-value weight to define its optimal capital structureStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started