Answered step by step

Verified Expert Solution

Question

1 Approved Answer

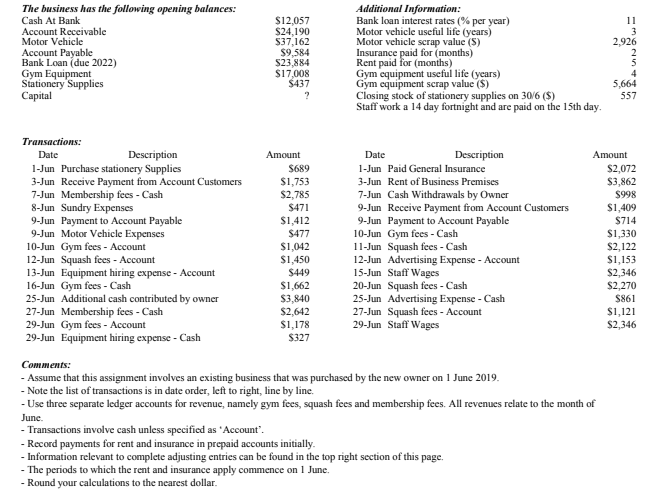

- 10-column worksheet - properly classified income statement for the month ended 30 June 2019 - properly classified balance sheet as at 30 June 2019

-

-

10-column worksheet - properly classified income statement for the month ended 30 June 2019 - properly classified balance sheet as at 30 June 2019

The business has the following opening balances: Cash At Bank Account Receivable Motor Vehicle Account Payable Bank Loan (due 2022) Gym Equipment Stationery Supplies Capital $12,057 $24,190 $37,162 $9,584 $23,884 $17,008 $437 ? Additional Information: Bank loan interest rates (% per year) Motor vehicle useful life (years) Motor vehicle scrap value (S) Insurance paid for months) Rent paid for months) Gym equipment useful life (years) Gym equipment scrap value ($) Closing stock of stationery supplies on 30/6 ($) Staff work a 14 day fortnight and are paid on the 15th day. 11 3 2.926 2 5 4 5,664 557 Transactions: Date Description 1-Jun Purchase stationery Supplies 3-Jun Receive Payment from Account Customers 7-Jun Membership fees - Cash 8-Jun Sundry Expenses 9-Jun Payment to Account Payable 9-Jun Motor Vehicle Expenses 10-Jun Gym fees - Account 12-Jun Squash foes - Account 13-Jun Equipment hiring expense - Account 16-Jun Gym fees - Cash 25-Jun Additional cash contributed by owner 27-Jun Membership fees - Cash 29-Jun Gym fees - Account 29-Jun Equipment hiring expense - Cash Amount $689 $1,753 $2,785 $471 $1,412 $477 $1,042 $1,450 $449 $1,662 $3,840 $2,642 $1,178 $327 Date Description 1-Jun Paid General Insurance 3-Jun Rent of Business Premises 7-Jun Cash Withdrawals by Owner 9-Jun Receive Payment from Account Customers 9-Jun Payment to Account Payable 10-Jun Gym fees - Cash 11-Jun Squash fees - Cash 12-Jun Advertising Expense - Account 15-Jun Staff Wages 20-Jun Squash fees - Cash 25-Jun Advertising Expense - Cash 27-Jun Squash fees - Account 29-Jun Staff Wages Amount $2,072 $3,862 $998 $1,409 $714 $1,330 $2,122 $1,153 $2,346 S2 270 $861 $1,121 $2,346 Comments: - Assume that this assignment involves an existing business that was purchased by the new owner on 1 June 2019. - Note the list of transactions is in date order, left to right, line by line - Use three separate ledger accounts for revenue, namely gym fees, squash fees and membership fees. All revenues relate to the month of June - Transactions involve cash unless specified as 'Account. - Record payments for rent and insurance in prepaid accounts initially. - Information relevant to complete adjusting entries can be found in the top right section of this page - The periods to which the rent and insurance apply commence on 1 June. - Round your calculations to the nearest dollarStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started