Question

Analysis of Errors: Correcting Entries and Correct Pretax Income Travis Inc. has just completed its nancial statements for the reporting year ended December 31 of

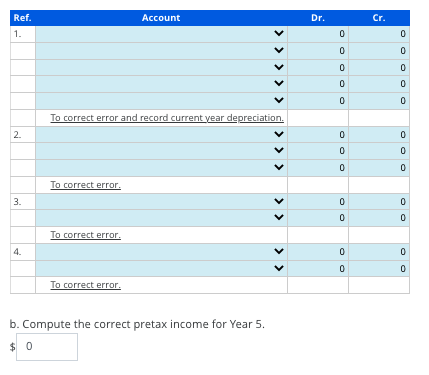

Analysis of Errors: Correcting Entries and Correct Pretax Income Travis Inc. has just completed its nancial statements for the reporting year ended December 31 of Year 5. Pretax income is $160,000. The accounts have not been closed for December 31 of Year 5. Further consideration and review of the records revealed the following items related to the Year 5 statements. 1. On January 1 of Year 1, a machine was acquired that cost $10,000. The estimated useful life was 10 years, and the residual value was $2,000 . At the time of acquisition, the full cost of the machine was incorrectly debited to the land account. The company uses straight-line depreciation. 2. On January 1 of Year 3, a long-term investment of $18,000 was made by purchasing a $20,000, 8% bond of FDC Corporation. The investment account was debited for $18,000. Each year, starting on December 31 of Year 3, the company has recognized and reported investment revenue on these bonds of $1,600. The bonds mature in 10 years from the date of purchase. Assume that any amortization would follow the straight-line method and that Travis intends to hold the bonds to maturity. 3. The Year 4 ending inventory was overstated by $7,000 (periodic inventory system). 4. An $11,000 credit purchase of merchandise occurred on December 18 of Year 4. Because the merchandise was held on December 31 of Year 4, it was included in the Year 4 ending inventory. The purchase was recorded on January 18 of Year 5, when the invoice was paid (periodic inventory system). Required a. Prepare correcting entries that should be made on December 31 of Year 5 for each of the four errors identied. Ignore income tax eects.

b. Compute the correct pretax income for Year 5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the errors and compute the correct pretax income lets proceed with the necessary steps a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started