Answered step by step

Verified Expert Solution

Question

1 Approved Answer

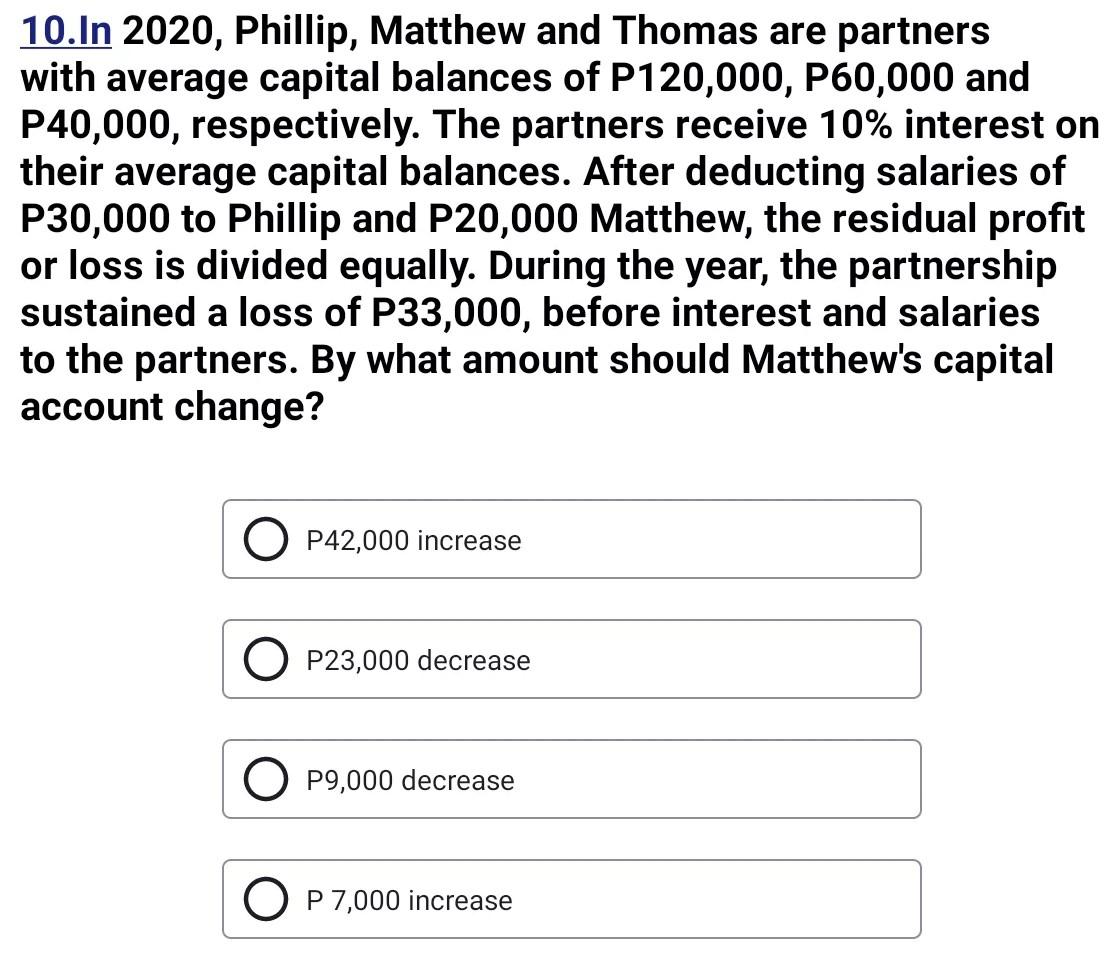

10.In 2020, Phillip, Matthew and Thomas are partners with average capital balances of P120,000, P60,000 and P40,000, respectively. The partners receive 10% interest on their

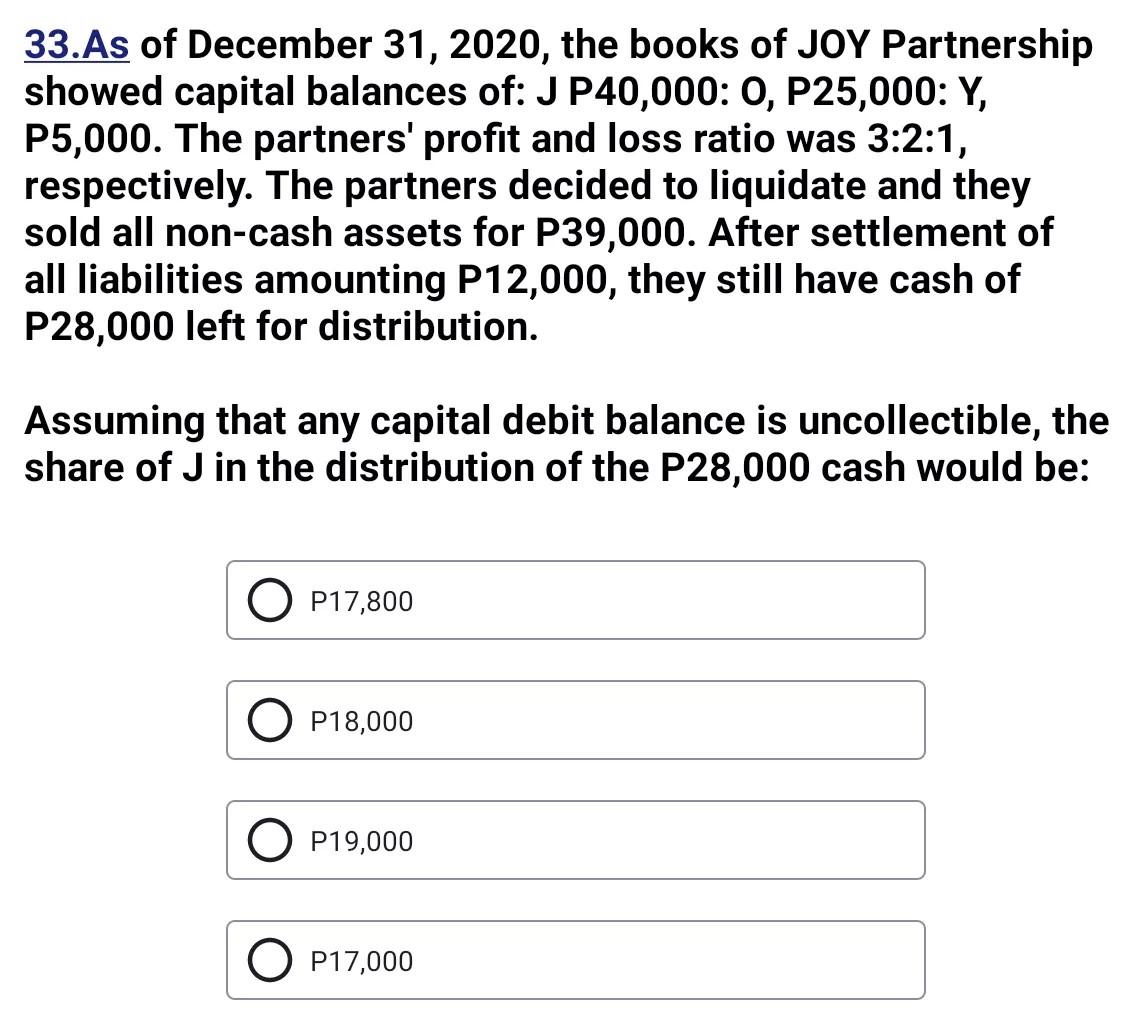

10.In 2020, Phillip, Matthew and Thomas are partners with average capital balances of P120,000, P60,000 and P40,000, respectively. The partners receive 10% interest on their average capital balances. After deducting salaries of P30,000 to Phillip and P20,000 Matthew, the residual profit or loss is divided equally. During the year, the partnership sustained a loss of P33,000, before interest and salaries to the partners. By what amount should Matthew's capital account change? O P42,000 increase O P23,000 decrease O P9,000 decrease O P 7,000 increase 33.As of December 31, 2020, the books of JOY Partnership showed capital balances of: JP40,000: 0, P25,000: Y, P5,000. The partners' profit and loss ratio was 3:2:1, respectively. The partners decided to liquidate and they sold all non-cash assets for P39,000. After settlement of all liabilities amounting P12,000, they still have cash of P28,000 left for distribution. Assuming that any capital debit balance is uncollectible, the share of J in the distribution of the P28,000 cash would be: O P17,800 O P18,000 O P19,000 P17,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started