Answered step by step

Verified Expert Solution

Question

1 Approved Answer

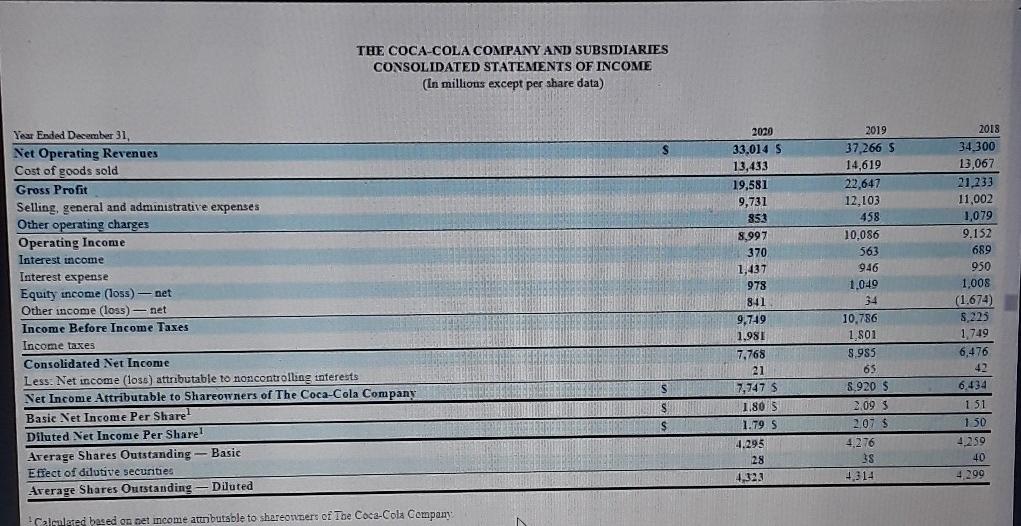

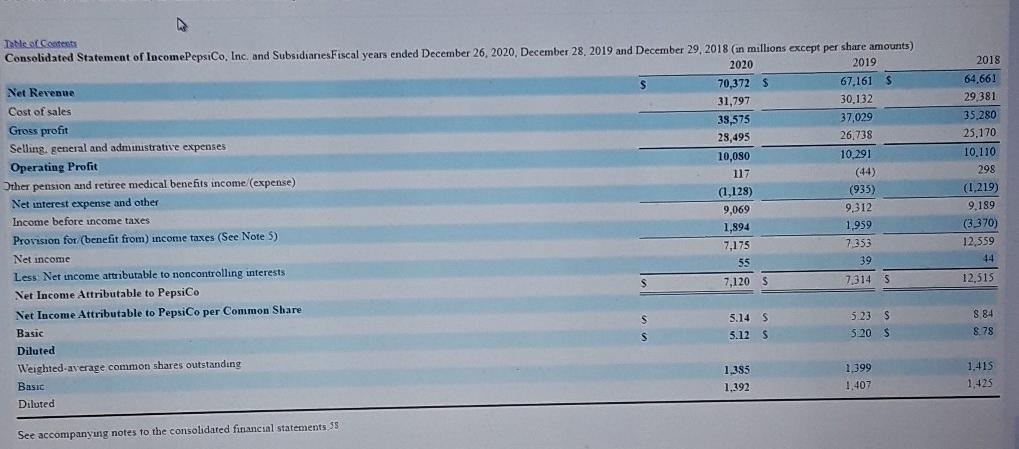

10-k report for Coca-cola co. 10-k report for PepsiCo. After looking at the 10-ks provided, calculate the financial ratios for the income statement for the

10-k report for Coca-cola co.

10-k report for PepsiCo.

After looking at the 10-ks provided, calculate the financial ratios for the income statement for the last three years for both companies?

How did the companies compare? What do these ratios mean, specifically for these companies?

THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per share data) Year Ended December 31 Net Operating Revenues Cost of goods sold Gross Profit Selling, general and administrative expenses Other operating charges Operating Income Interest income Interest expense Equity income (loss) net Other income (loss) net Income Before Income Taxes Income taxes Consolidated Net Income Less. Net income (loss) attributable to noncontrolling interests Net Income Attributable to Shareowners of The Coca-Cola Company Basic Net Income Per Share Diluted Net Income Per Share! Average Shares Outstanding - Basic Effect of dutive securities Average Shares Outstanding - Diluted 2020 33.014 S 13,433 19,581 9,731 853 8.997 370 1,437 978 841 9,749 1.981 7,768 21 7,747 $ 1.80 S 2019 37,266 $ 14,619 22,647 12,103 458 10.086 563 946 1.049 34 10,786 1,801 8.985 65 8.920 S 2,095 2.07 $ 4276 38 +314 2018 34.300 13,067 21,233 11,002 1,079 9.152 689 950 1,005 (1.674) 8 225 1.749 6,476 42 6,434 151 150 4.259 40 4.299 S S $ 1.79 S 4.295 28 4,323 Calculated based on net income attributable to shareonders of Toe Coca-Cola Company To Me Contents Consolidated Statement of locomePepsiCo, Inc. and SubsidianesFiscal years ended December 26, 2020, December 28, 2019 and December 29, 2018 (in millions except per share amounts) 2020 2019 Net Revenue S 70,372 5 67,161 $ Cost of sales 31,797 30.132 Gross profit 38,575 37,029 Selling general and administrative expenses 23,495 26,738 Operating Profit 10,080 10,291 Other pension and retiree medical benefits income (expense) 117 (44) Net interest expense and other (1,128) (935) Income before income taxes 9,069 9,312 Provision for benefit from) income taxes (See Note 5) 1,894 1,959 Net income 7,175 7.353 Less Net income attributable to noncontrolling interests 55 39 Net Income Attributable to PepsiCo 7,120 5 7314 Net Income Attributable to PepsiCo per Common Share Basic 5.14 S 5.23 $ Diluted 5.12 s 5.20 S Weighted average common shares outstanding Basic 1,385 1.399 1.392 1.407 Diluted 2018 64.661 29 381 35.280 25,170 10.110 298 (1,219) 9.189 (3.370) 12.559 44 12,515 8 84 8.78 1.415 1,425 See accompanyug notes to the consolidated financial statements 55Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started