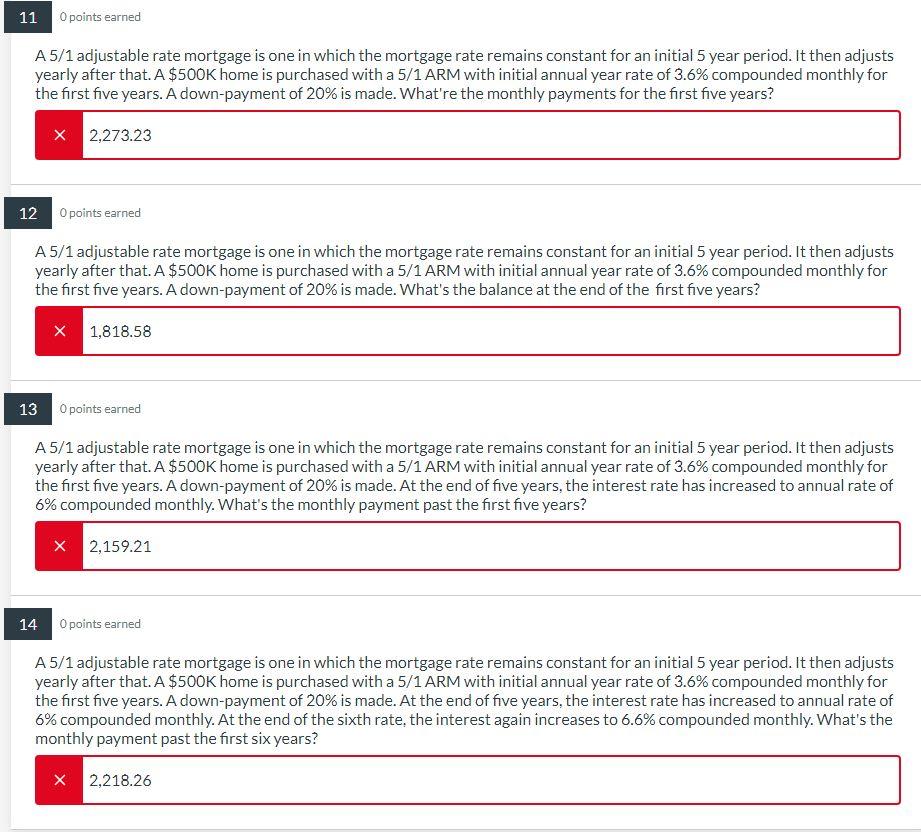

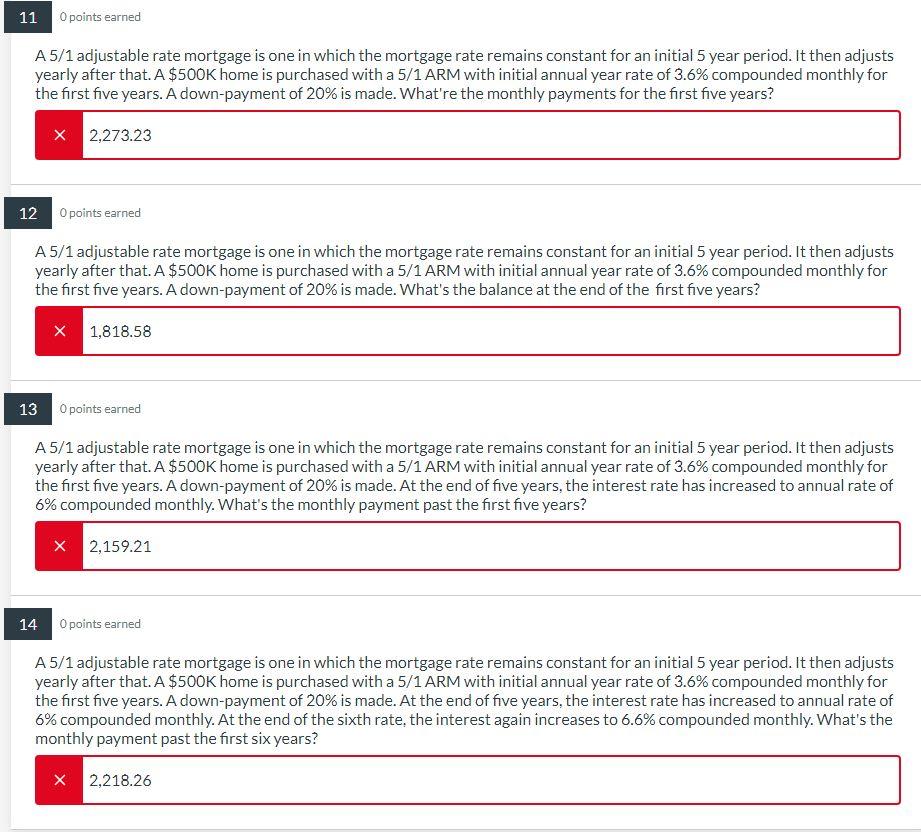

11 0 points earned A 5/1 adjustable rate mortgage is one in which the mortgage rate remains constant for an initial 5 year period. It then adjusts yearly after that. A $500K home is purchased with a 5/1 ARM with initial annual year rate of 3.6% compounded monthly for the first five years. A down-payment of 20% is made. What're the monthly payments for the first five years? X 2,273.23 12 O points earned A 5/1 adjustable rate mortgage is one in which the mortgage rate remains constant for an initial 5 year period. It then adjusts yearly after that. A $500K home is purchased with a 5/1 ARM with initial annual year rate of 3.6% compounded monthly for the first five years. A down-payment of 20% is made. What's the balance at the end of the first five years? 13 X 1,818.58 O points earned A 5/1 adjustable rate mortgage is one in which the mortgage rate remains constant for an initial 5 year period. It then adjusts yearly after that. A $500K home is purchased with a 5/1 ARM with initial annual year rate of 3.6% compounded monthly for the first five years. A down-payment of 20% is made. At the end of five years, the interest rate has increased to annual rate of 6% compounded monthly. What's the monthly payment past the first five years? 14 X 2,159.21 0 points earned A 5/1 adjustable rate mortgage is one in which the mortgage rate remains constant for an initial 5 year period. It then adjusts yearly after that. A $500K home is purchased with a 5/1 ARM with initial annual year rate of 3.6% compounded monthly for the first five years. A down-payment of 20% is made. At the end of five years, the interest rate has increased to annual rate of 6% compounded monthly. At the end of the sixth rate, the interest again increases to 6.6% compounded monthly. What's the monthly payment past the first six years? X 2,218.26 11 0 points earned A 5/1 adjustable rate mortgage is one in which the mortgage rate remains constant for an initial 5 year period. It then adjusts yearly after that. A $500K home is purchased with a 5/1 ARM with initial annual year rate of 3.6% compounded monthly for the first five years. A down-payment of 20% is made. What're the monthly payments for the first five years? X 2,273.23 12 O points earned A 5/1 adjustable rate mortgage is one in which the mortgage rate remains constant for an initial 5 year period. It then adjusts yearly after that. A $500K home is purchased with a 5/1 ARM with initial annual year rate of 3.6% compounded monthly for the first five years. A down-payment of 20% is made. What's the balance at the end of the first five years? 13 X 1,818.58 O points earned A 5/1 adjustable rate mortgage is one in which the mortgage rate remains constant for an initial 5 year period. It then adjusts yearly after that. A $500K home is purchased with a 5/1 ARM with initial annual year rate of 3.6% compounded monthly for the first five years. A down-payment of 20% is made. At the end of five years, the interest rate has increased to annual rate of 6% compounded monthly. What's the monthly payment past the first five years? 14 X 2,159.21 0 points earned A 5/1 adjustable rate mortgage is one in which the mortgage rate remains constant for an initial 5 year period. It then adjusts yearly after that. A $500K home is purchased with a 5/1 ARM with initial annual year rate of 3.6% compounded monthly for the first five years. A down-payment of 20% is made. At the end of five years, the interest rate has increased to annual rate of 6% compounded monthly. At the end of the sixth rate, the interest again increases to 6.6% compounded monthly. What's the monthly payment past the first six years? X 2,218.26