Question: 11. (10 points) A 3-year, $1,000 face value bond has a coupon rate of 9%. The current yield of this bond is 9.083% from year

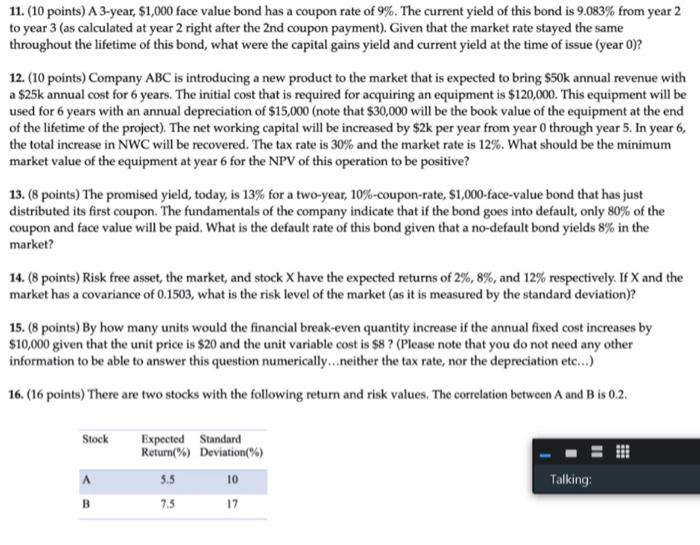

11. (10 points) A 3-year, $1,000 face value bond has a coupon rate of 9%. The current yield of this bond is 9.083% from year 2 to year 3 (as calculated at year 2 right after the 2nd coupon payment). Given that the market rate stayed the same throughout the lifetime of this bond, what were the capital gains yield and current yield at the time of issue (year 0)? 12. (10 points) Company ABC is introducing a new product to the market that is expected to bring 50k annual revenue with a $25k annual cost for 6 years. The initial cost that is required for acquiring an equipment is $120,000. This equipment will be used for 6 years with an annual depreciation of $15,000 (note that $30,000 will be the book value of the equipment at the end of the lifetime of the project). The net working capital will be increased by $2k per year from year o through year 5. In year 6, the total increase in NWC will be recovered. The tax rate is 30% and the market rate is 12%. What should be the minimum market value of the equipment at year 6 for the NPV of this operation to be positive? 13. (8 points) The promised yield, today, is 13% for a two-year, 10%-coupon-rate, $1,000-face-value bond that has just distributed its first coupon. The fundamentals of the company indicate that if the bond goes into default, only 80% of the coupon and face value will be paid. What is the default rate of this bond given that a no-default bond yields 8% in the market? 14. (8 points) Risk free asset, the market, and stock X have the expected returns of 2%, 8%, and 12% respectively. If X and the market has a covariance of 0.1503, what is the risk level of the market (as it is measured by the standard deviation)? 15. (8 points) By how many units would the financial break-even quantity increase if the annual fixed cost increases by $10,000 given that the unit price is $20 and the unit variable cost is $8 ? (Please note that you do not need any other information to be able to answer this question numerically...neither the tax rate, nor the depreciation etc...) 16. (16 points) There are two stocks with the following return and risk values. The correlation between A and B is 0.2. Stock Expected Standard Return(%) Deviation(%) 5.5 10 A Talking B 7.5 17 11. (10 points) A 3-year, $1,000 face value bond has a coupon rate of 9%. The current yield of this bond is 9.083% from year 2 to year 3 (as calculated at year 2 right after the 2nd coupon payment). Given that the market rate stayed the same throughout the lifetime of this bond, what were the capital gains yield and current yield at the time of issue (year 0)? 12. (10 points) Company ABC is introducing a new product to the market that is expected to bring 50k annual revenue with a $25k annual cost for 6 years. The initial cost that is required for acquiring an equipment is $120,000. This equipment will be used for 6 years with an annual depreciation of $15,000 (note that $30,000 will be the book value of the equipment at the end of the lifetime of the project). The net working capital will be increased by $2k per year from year o through year 5. In year 6, the total increase in NWC will be recovered. The tax rate is 30% and the market rate is 12%. What should be the minimum market value of the equipment at year 6 for the NPV of this operation to be positive? 13. (8 points) The promised yield, today, is 13% for a two-year, 10%-coupon-rate, $1,000-face-value bond that has just distributed its first coupon. The fundamentals of the company indicate that if the bond goes into default, only 80% of the coupon and face value will be paid. What is the default rate of this bond given that a no-default bond yields 8% in the market? 14. (8 points) Risk free asset, the market, and stock X have the expected returns of 2%, 8%, and 12% respectively. If X and the market has a covariance of 0.1503, what is the risk level of the market (as it is measured by the standard deviation)? 15. (8 points) By how many units would the financial break-even quantity increase if the annual fixed cost increases by $10,000 given that the unit price is $20 and the unit variable cost is $8 ? (Please note that you do not need any other information to be able to answer this question numerically...neither the tax rate, nor the depreciation etc...) 16. (16 points) There are two stocks with the following return and risk values. The correlation between A and B is 0.2. Stock Expected Standard Return(%) Deviation(%) 5.5 10 A Talking B 7.5 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts