Answered step by step

Verified Expert Solution

Question

1 Approved Answer

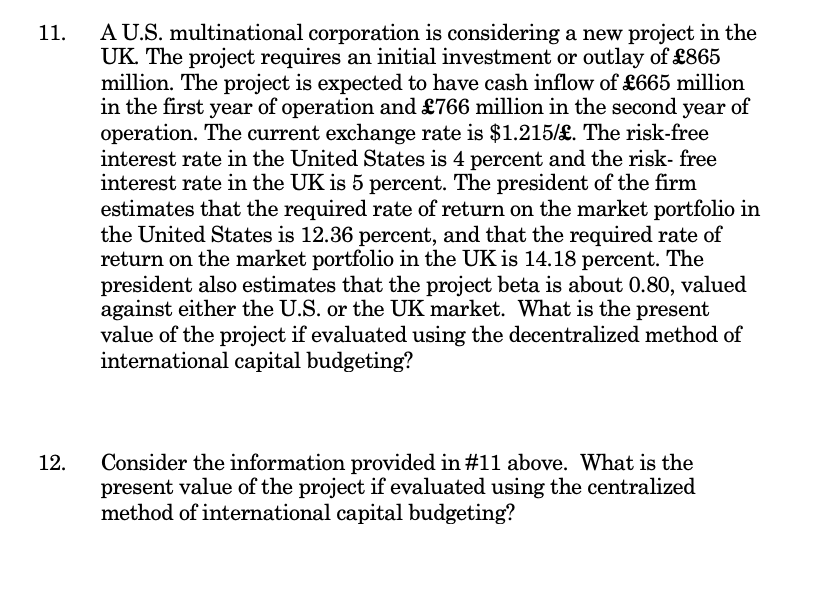

11. 12. A U.S. multinational corporation is considering a new project in the UK. The project requires an initial investment or outlay of 865

11. 12. A U.S. multinational corporation is considering a new project in the UK. The project requires an initial investment or outlay of 865 million. The project is expected to have cash inflow of 665 million in the first year of operation and 766 million in the second year of operation. The current exchange rate is $1.215/. The risk-free interest rate in the United States is 4 percent and the risk-free interest rate in the UK is 5 percent. The president of the firm estimates that the required rate of return on the market portfolio in the United States is 12.36 percent, and that the required rate of return on the market portfolio in the UK is 14.18 percent. The president also estimates that the project beta is about 0.80, valued against either the U.S. or the UK market. What is the present value of the project if evaluated using the decentralized method of international capital budgeting? Consider the information provided in #11 above. What is the present value of the project if evaluated using the centralized method of international capital budgeting?

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the present value of the project using the decentralized method of international capital budgeting we need to discount the cash inflows a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started