Answered step by step

Verified Expert Solution

Question

1 Approved Answer

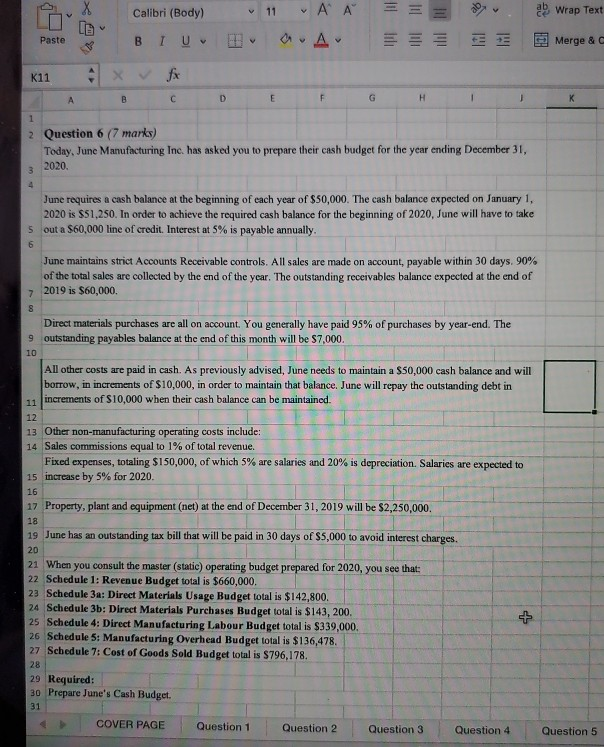

11 = = = A A a.lv 2 Wrap Text Merge &c Paste Calibri (Body) I U fx & B D K11 2 Question 6

11 = = = A A a.lv 2 Wrap Text Merge &c Paste Calibri (Body) I U fx & B D K11 2 Question 6 (7 marks) Today, June Manufacturing Inc. has asked you to prepare their cash budget for the year ending December 31, 3 2020 June requires a cash balance at the beginning of each year of $50,000. The cash balance expected on January 1, 2020 is $$1,250. In order to achieve the required cash balance for the beginning of 2020, June will have to take 5 out a $60,000 line of credit. Interest at 5% is payable annually. June maintains strict Accounts Receivable controls. All sales are made on account, payable within 30 days. 90% of the total sales are collected by the end of the year. The outstanding receivables balance expected at the end of 7 2019 is $60,000. Direct materials purchases are all on account. You generally have paid 95% of purchases by year-end. The outstanding payables balance at the end of this month will be $7,000. 9 All other costs are paid in cash. As previously advised, June needs to maintain a $50,000 cash balance and will borrow, in increments of $10,000, in order to maintain that balance. June will repay the outstanding debt in increments of $10,000 when their cash balance can be maintained 13 Other non-manufacturing operating costs include: 14 Sales commissions equal to 1% of total revenue. Fixed expenses, totaling $150,000, of which 5% are salaries and 20% is depreciation. Salaries are expected to 15 increase by 5% for 2020. 17 Property, plant and equipment (net) at the end of December 31, 2019 will be $2,250,000 19 June has an outstanding tax bill that will be paid in 30 days of $5,000 to avoid interest charges. 20 21 When you consult the master (static) operating budget prepared for 2020, you see that: 22 Schedule 1: Revenue Budget total is $660,000. 23 Schedule 3a: Direct Materials Usage Budget total is $142,800. 24 Schedule 3b: Direct Materials Purchases Budget total is $143,200. 25 Schedule 4: Direct Manufacturing Labour Budget total is $339,000. 26 Schedule 5: Manufacturing Overhead Budget total is $136,478. 27 Schedule 7: Cost of Goods Sold Budget total is $796,178 1 28 29 Required: 30 Prepare June's Cash Budget. COVER PAGE 1 Question 1 Question 2 Question 3 Question 4 Question 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started