Answered step by step

Verified Expert Solution

Question

1 Approved Answer

11. A pst option is out-of-the-money if the: a. strike price of the option is less than the current price of the underlying asset b.

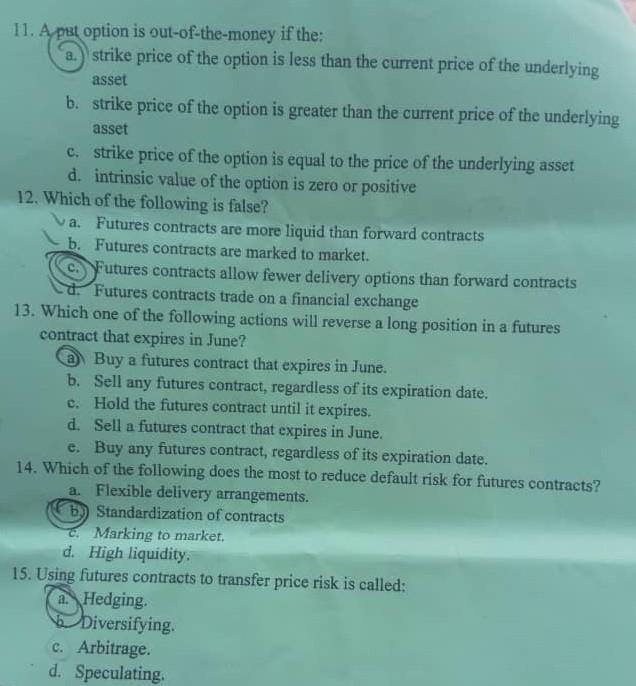

11. A pst option is out-of-the-money if the: a. strike price of the option is less than the current price of the underlying asset b. strike price of the option is greater than the current price of the underlying asset c. strike price of the option is equal to the price of the underlying asset intrinsic value of the option is zero or positive d. 12. Which of the following is false? va. Futures contracts are more liquid than forward contracts b. Futures contracts are marked to market. Futures contracts allow fewer delivery options than forward contracts Futures contracts trade on a financial exchange 13. Which one of the following actions will reverse a long position in a futures contract that expires in June? a Buy a futures contract that expires in June. b. Sell any futures contract, regardless of its expiration date. c. Hold the futures contract until it expires. d. Sell a futures contract that expires in June. e. Buy any futures contract, regardless of its expiration date. 14. Which of the following does the most to reduce default risk for futures contracts? a. Flexible delivery arrangements. b) Standardization of contracts C. Marking to market. d. High liquidity. 15. Using futures contracts to transfer price risk is called: a. Hedging. Diversifying. c. Arbitrage. d. Speculating

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started