Answered step by step

Verified Expert Solution

Question

1 Approved Answer

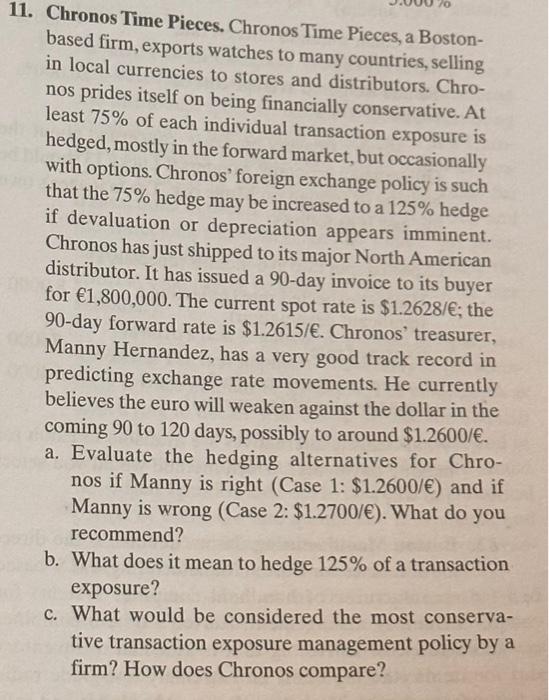

11. Chronos Time Pieces. Chronos Time Pieces, a Boston- based firm, exports watches to many countries, selling in local currencies to stores and distributors. Chro-

11. Chronos Time Pieces. Chronos Time Pieces, a Boston- based firm, exports watches to many countries, selling in local currencies to stores and distributors. Chro- nos prides itself on being financially conservative. At least 75% of each individual transaction exposure is hedged, mostly in the forward market, but occasionally with options. Chronos' foreign exchange policy is such that the 75% hedge may be increased to a 125% hedge if devaluation or depreciation appears imminent. Chronos has just shipped to its major North American distributor. It has issued a 90-day invoice to its buyer for 1,800,000. The current spot rate is $1.2628/; the 90-day forward rate is $1.2615/. Chronos' treasurer, Manny Hernandez, has a very good track record in predicting exchange rate movements. He currently believes the euro will weaken against the dollar in the coming 90 to 120 days, possibly to around $1.2600/. a. Evaluate the hedging alternatives for Chro- nos if Manny is right (Case 1: $1.2600/) and if Manny is wrong (Case 2: $1.2700/). What do recommend? you b. What does it mean to hedge 125% of a transaction exposure? c. What would be considered the most conserva- tive transaction exposure management policy by a firm? How does Chronos compare?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started