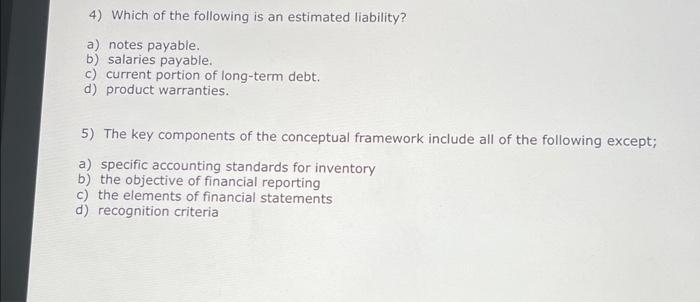

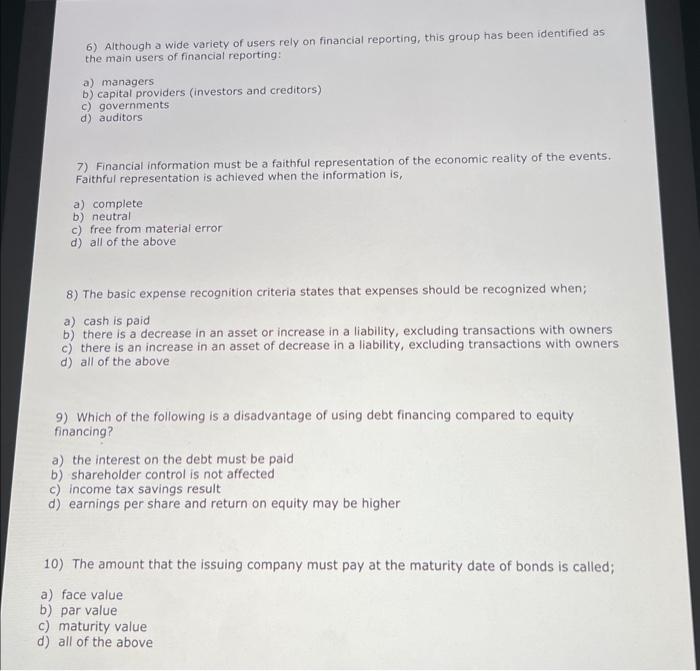

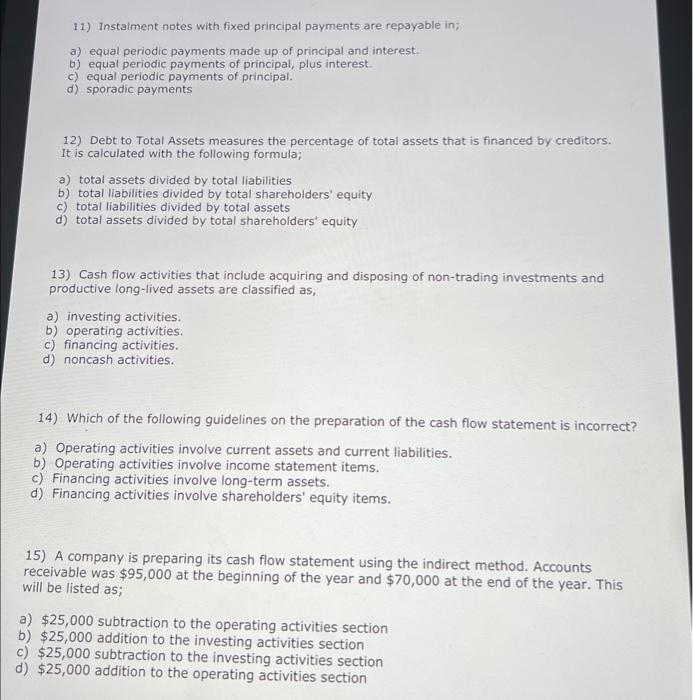

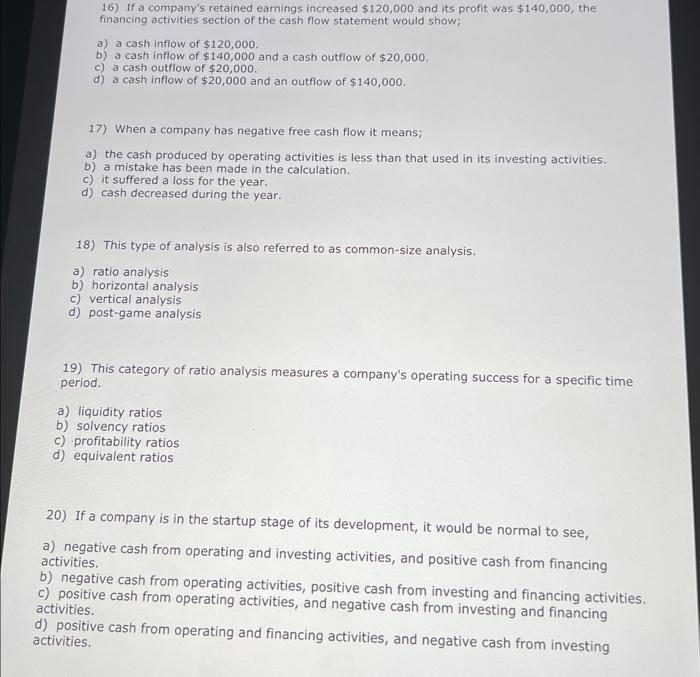

11) Instaiment notes with fixed principal payments are repayable in; a) equal periodic payments made up of principal and interest. b) equal periodic payments of principal, plus interest. c) equal periodic payments of principal. d) sporadic payments 12) Debt to Total Assets measures the percentage of total assets that is financed by creditors. It is calculated with the following formula; a) total assets divided by total liabilities b) total liabilities divided by total shareholders' equity c) total liabilities divided by total assets d) total assets divided by total shareholders' equity 13) Cash flow activities that include acquiring and disposing of non-trading investments and productive long-lived assets are classified as, a) investing activities. b) operating activities. c) financing activities. d) noncash activities. 14) Which of the following guidelines on the preparation of the cash flow statement is incorrect? a) Operating activities involve current assets and current liabilities. b) Operating activities involve income statement items. c) Financing activities involve long-term assets. d) Financing activities involve shareholders' equity items. 15) A company is preparing its cash flow statement using the indirect method. Accounts receivable was $95,000 at the beginning of the year and $70,000 at the end of the year. This will be listed as; a) $25,000 subtraction to the operating activities section b) $25,000 addition to the investing activities section c) $25,000 subtraction to the investing activities section d) $25,000 addition to the operating activities section 4) Which of the following is an estimated liability? a) notes payable. b) salaries payable. c) current portion of long-term debt. d) product warranties. 5) The key components of the conceptual framework include all of the following except; a) specific accounting standards for inventory b) the objective of financial reporting c) the elements of financial statements d) recognition criteria 16) If a company's retained earnings increased $120,000 and its profit was $140,000, the financing activities section of the cash flow statement would show; a) a cash inflow of $120,000. b) a cash inflow of $140,000 and a cash outflow of $20,000. c) a cash outflow of $20,000. d) a cash inflow of $20,000 and an outflow of $140,000. 17) When a company has negative free cash flow it means: a) the cash produced by operating activities is less than that used in its investing activities. b) a mistake has been made in the calculation. c) it suffered a loss for the year. d) cash decreased during the year. 18) This type of analysis is also referred to as common-size analysis. a) ratio analysis b) horizontal analysis c) vertical analysis d) post-game analysis 19) This category of ratio analysis measures a company's operating success for a specific time period. a) liquidity ratios b) solvency ratios c) profitability ratios d) equivalent ratios 20) If a company is in the startup stage of its development, it would be normal to see, a) negative cash from operating and investing activities, and positive cash from financing activities. b) negative cash from operating activities, positive cash from investing and financing activities. c) positive cash from operating activities, and negative cash from investing and financing activities. d) positive cash from operating and financing activities, and negative cash from investing activities. 6) Although a wide variety of users rely on financial reporting, this group has been identified as the main users of financial reporting: a) managers b) capital providers (investors and creditors) c) governments d) auditors 7) Financial information must be a faithful representation of the economic reality of the events. Faithful representation is achieved when the information is, a) complete b) neutral c) free from material error d) all of the above 8) The basic expense recognition criteria states that expenses should be recognized when; a) cash is paid b) there is a decrease in an asset or increase in a liability, excluding transactions with owners c) there is an increase in an asset of decrease in a liability, excluding transactions with owners d) all of the above 9) Which of the following is a disadvantage of using debt financing compared to equity financing? a) the interest on the debt must be paid b) shareholder control is not affected c) income tax savings result d) earnings per share and return on equity may be higher 10) The amount that the issuing company must pay at the maturity date of bonds is called; a) face value b) par value c) maturity value d) all of the above