Answered step by step

Verified Expert Solution

Question

1 Approved Answer

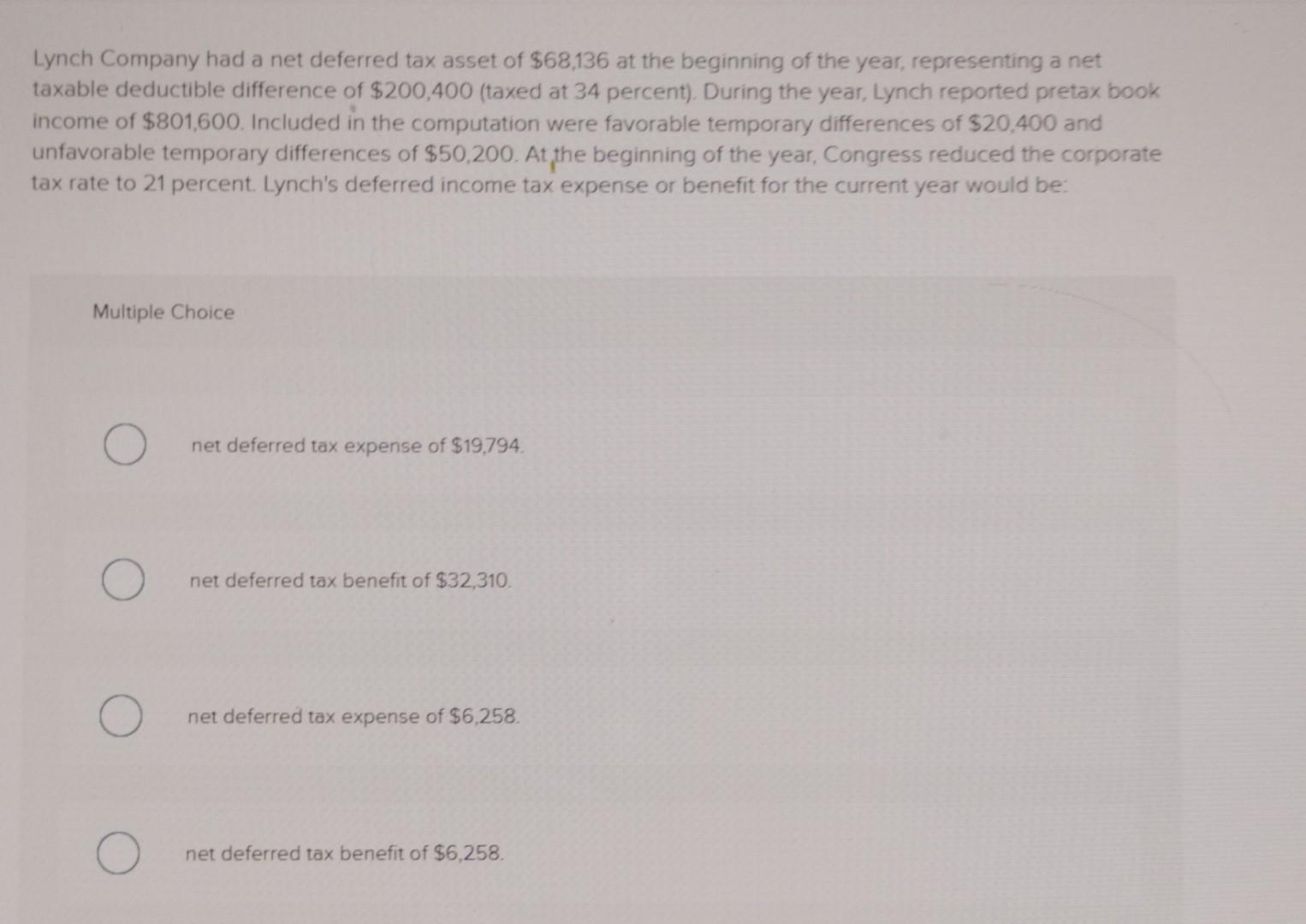

11 Lynch Company had a net deferred tax asset of $68,136 at the beginning of the year, representing a net taxable deductible difference of $200,400

11

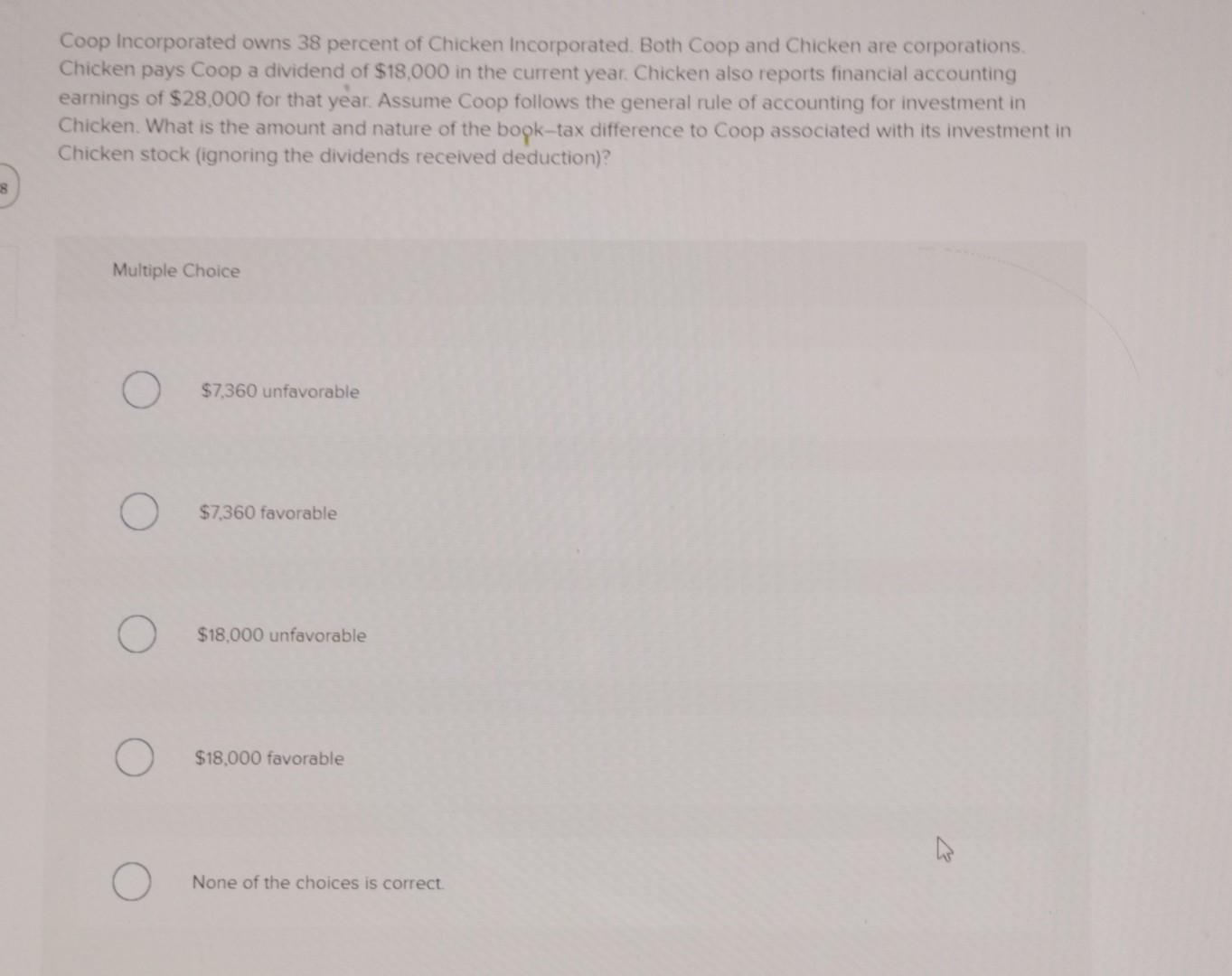

Lynch Company had a net deferred tax asset of $68,136 at the beginning of the year, representing a net taxable deductible difference of $200,400 (taxed at 34 percent). During the year, Lynch reported pretax book income of $801,600. Included in the computation were favorable temporary differences of $20,400 and unfavorable temporary differences of $50,200. At the beginning of the year, Congress reduced the corporate tax rate to 21 percent. Lynch's deferred income tax expense or benefit for the current year would be: Multiple Choice net deferred tax expense of $19,794. net deferred tax benefit of $32,310. net deferred tax expense of $6,258. net deferred tax benefit of $6,258. Coop Incorporated owns 38 percent of Chicken Incorporated. Both Coop and Chicken are corporations. Chicken pays Coop a dividend of $18,000 in the current year. Chicken also reports financial accounting earnings of $28,000 for that year. Assume Coop follows the general rule of accounting for investment in Chicken. What is the amount and nature of the bopk-tax difference to Coop associated with its investment in Chicken stock (ignoring the dividends received deduction)? Multiple Choice $7,360 unfavorable $7,360 favorable $18,000 unfavorable $18,000 favorable None of the choices is correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started