Question

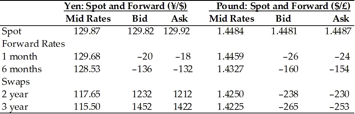

11) Refer to Table 5.1. According to the information provided in the table, the 6-month yen is selling at a forward ________ of approximately ________

11) Refer to Table 5.1. According to the information provided in the table, the 6-month yen is selling at a forward ________ of approximately ________ per annum. (Use the mid rates to make your calculations.)

A) discount; 2.09%

B) discount; 2.06%

C) premium; 2.09%

D) premium; 2.06%

12) Given the following exchange rates, which of the multiple-choice choices represents a potentially profitable intermarket arbitrage opportunity?

129.87/$

1.1226/$

0.00864/

A) 115.69/

B) 114.96/

C) $0.8908/

D) $0.0077/

13) The U.S. dollar suddenly changes in value against the euro moving from an exchange rate of 0.8909/ to $0.8709/. Thus, the dollar has ________ by ________.

A) appreciated; 2.30%

B) depreciated; 2.30%

C) appreciated; 2.24%

D) depreciated; 2.24%

please show the solution.

Yen: Spot and Forward (V Pound: Spot and Forward SEM Mid Rates Bid Ask Mid Rates Bid Ask Spot 129.87 1.484 1.4481 1.4487 129,82 129,92 Forward Rates 1 month 129,68 20 18 24 6 months 128.53 136 132 1.4327 160 -1 Swaps 2 year 117.65 1232 1212 1.4250 238 230 115.50 1452 1422 1.4225 265 253Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started