Answered step by step

Verified Expert Solution

Question

1 Approved Answer

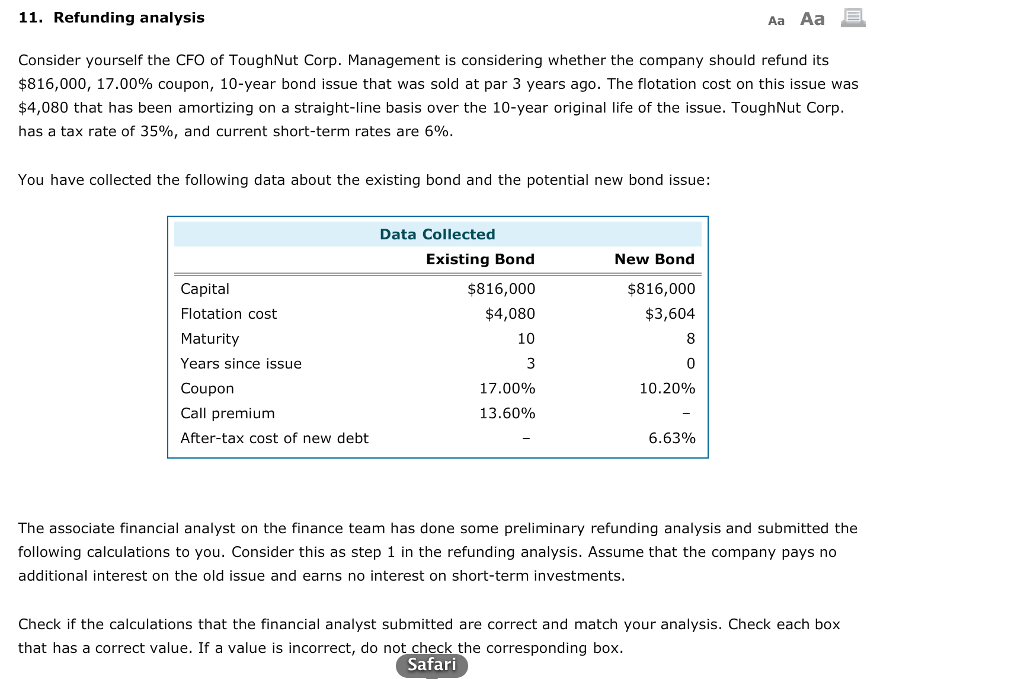

11. Refunding analysis Aa Aa E Consider yourself the CFO of ToughNut Corp. Management is considering whether the company should refund its $816,000, 17.00% coupon,

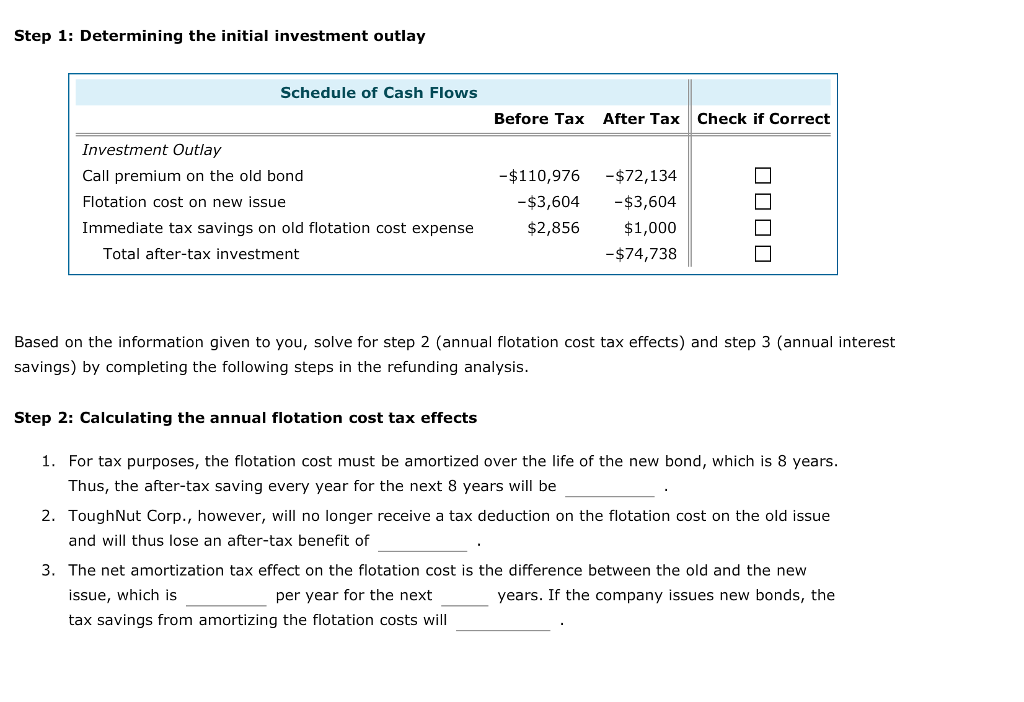

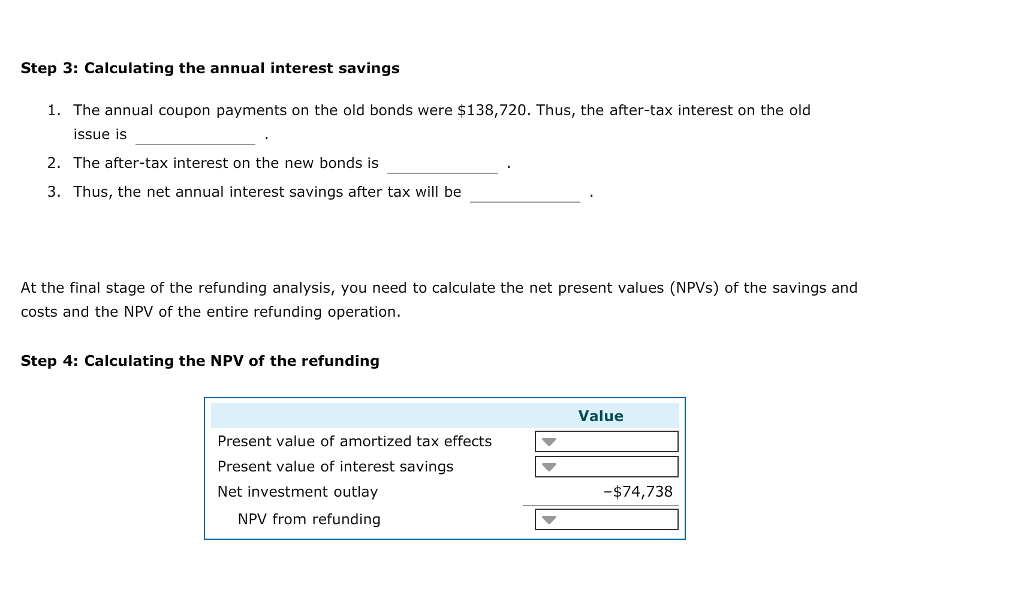

11. Refunding analysis Aa Aa E Consider yourself the CFO of ToughNut Corp. Management is considering whether the company should refund its $816,000, 17.00% coupon, 10-year bond issue that was sold at par 3 years ago. The flotation cost on this issue was $4,080 that has been amortizing on a straight-line basis over the 10-year original life of the issue. ToughNut Corp has a tax rate of 35%, and current short-term rates are 6%. You have collected the following data about the existing bond and the potential new bond issue Data Collected New Bond Existing Bond Capital $816,000 $816,000 Flotation cost $4,080 $3,604 Maturity 10 Years since issue 10.20% 17.00% Coupon Call premium 13.60% After-tax cost of new debt 6.63% The associate financial analyst on the finance team has done some preliminary refunding analysis and submitted the following calculations to you. Consider this as step 1 in the refunding analysis. Assume that the company pays no additional interest on the old issue and earns no interest on short-term investments, Check if the calculations that the financial analyst submitted are correct and match your analysis. Check each box that has a correct value. If a value is incorrect, do not check the corresponding box. Safari

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started