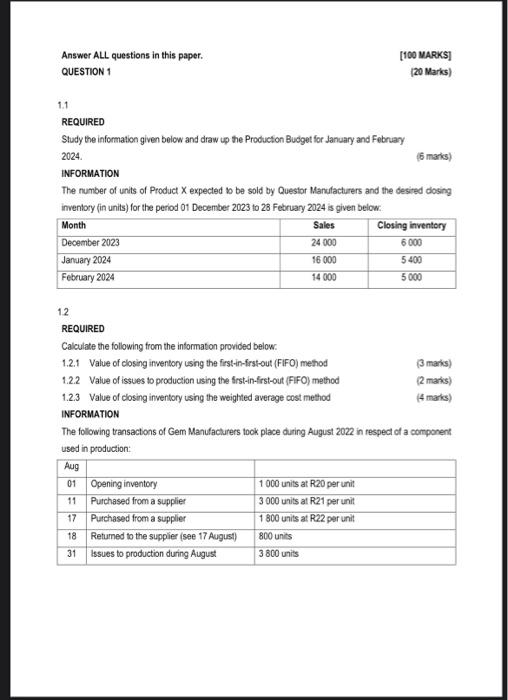

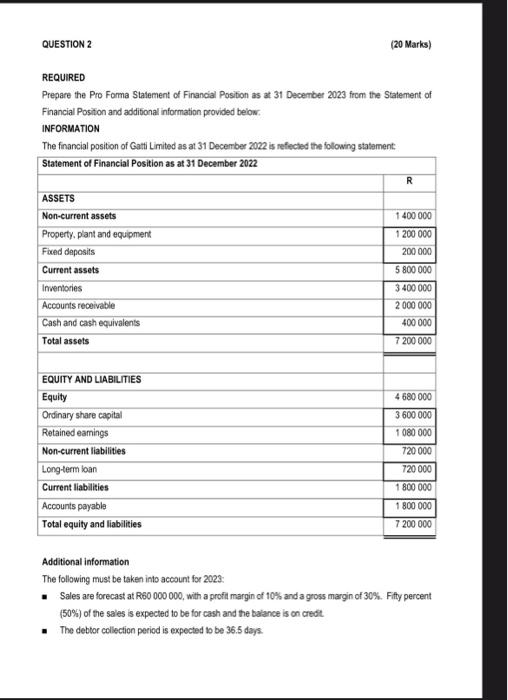

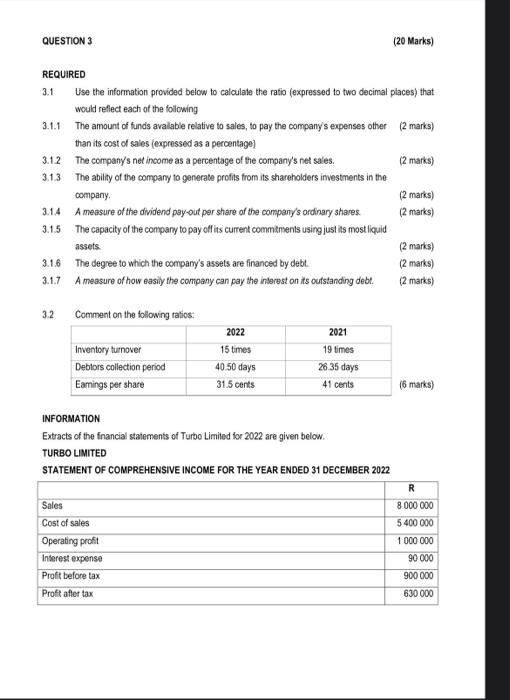

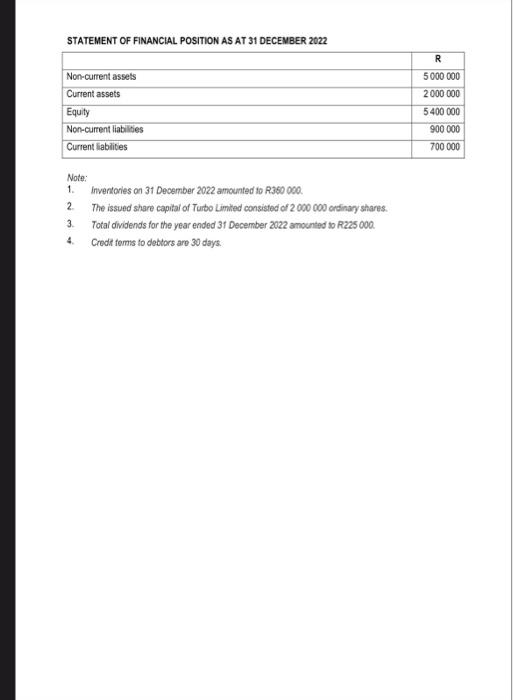

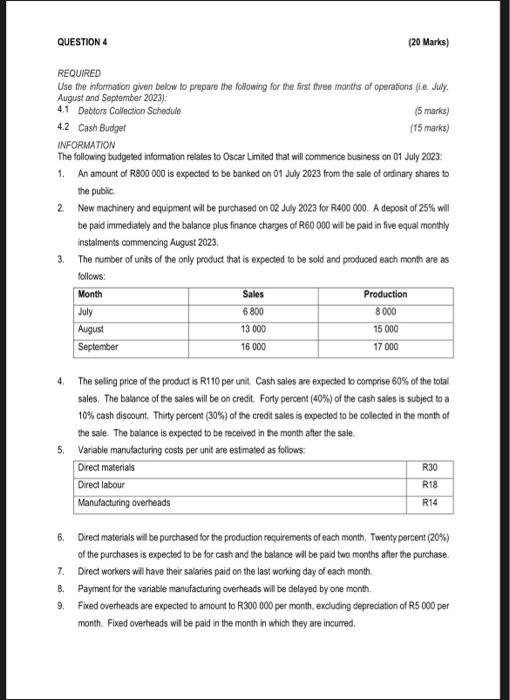

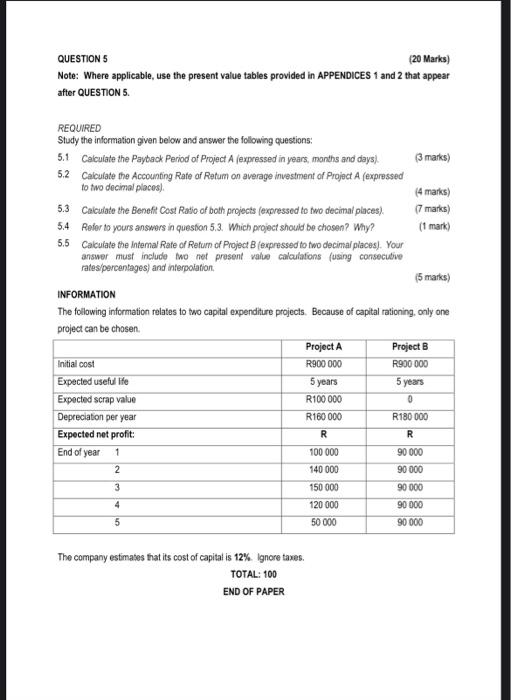

1.1 REQUIRED Study the information given below and draw up the Production Budget for January and February 2024. (6 marks) INFORMATION The number of units of Product X expected to be sold by Questor Manulacturers and the desired dosing inventory (in units) for the period 01 December 2023 to 28 February 2024 is given below: 1.2 REQUIRED Calculate the following from the intormation provided below: 1.2.1 Value of closing invertory using the first-in-frst-out (FIFO) method (3 mans) 1.2.2 Value of issues to production using the first-in-first-out (FFF) method ( 2 maris) 1.2.3 Value of closing inventory using the weightted average cost method (4 marks) INFORMATION The following transactions of Gem Manufacturers took place during August 2022 in respect of a component used in production: 1.3 REQUIRED Use the information given below to calculate the most economic quanity to order each time for 2023 (expressed to naxt whole number). (5 marks) INFORMATION Mition Wholesalers expects to sell approximavely 3600 cases of soap per month during 2023. Each case of soap costs R200. The cost of placing an order for soap is estmated to be R20. The inventory holding cost of one case of soap is 5% of the unit purchase price. REQUIRED Prepare the Pro Forma Statement of Financial Position as at 31 December 2023 from the Statement of Financial Position and additional information provided below: INFORMATION The financial position of Gati Limited as at 31 December 2022 is refected the following statement: Additional information The following must be taken into account for 2023: - Sales are forecast at R60 000000 , with a profli margin of 10% and a gross margin of 30%. Fifty percent (50%) of the sales is expected to be for cash and the balance is on credt - The debtor collection period is expected to be 36.5 days. - All purchases of inventories are expected to be on credt and are estimated to total R48 000000 . The credilor payment period is estmated to be 73 dyss. - Equipment with a cost price of R8 000000 is expected to be purchased on 01 July 2023. Total depreciation is expected to be R 800000 for the year. - The maturity dales of the fred deposits are as follows: R80 00001May2023 R120 000 31 May 2025 - The loan balance is expected to be reduced by R60 000. - The diectors are expected to recommend a final dividend of R4 000000 , payable during 2024 . - A bank balanoe of 1\% of sales is desired. - Ordirary share capital will remain unchanged. - The amount of exsernal non-cument funding required must be calculated (balancing figure). QUESTION 3 (20 Marks) REQUIRED 3.1 Use the information provided below to calculale the ratio (expressed to two decimal places) that would reflect each of the following 3.1.1 The amount of funds avalable relative to sales, to pay the companys expenses other (2 marks) than its cost d sales (expressed as a percentage) 3.1. The companys net income as a percentage of the company's net sales. (2 marks) 3.1.3 The abiliy of the company to generate profits from its shareholders imvestments in the company. ( 2 marks) 3.1.4 A measure of the dividend pay-out per share of the company's ordinary shares. ( 2 marks) 3.1.5 The capacity of the compary to pay off its current comminsents using just its most iquid assets (2 marks) 3.1.6 The degree to which the company's assets are financed by debt. ( 2 marks) 3.1.7 A measure of how easily the company can pay the interest on its cutstanding debt. (2 marks) 3.2. Comment on the following ratios: 6 marks) INFORMATION Extracts of the fnancial statements of Turbo Limited for 2022 are given below. TURBO LIMITED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 Note: 1. Inventories on 31 December 2022 amounted to R360 000 . 2. The issued share capilal of Tuibo Limited consisted of 2000000 erdinay shares. 3. Total dividends for the year ended 31 December 2022 amounted to R22s 000 . 4. Crodt foms to debtors are 30 days. REQUIRED Use the information given below to prepare the following for the first thee months of operafions fite. Jily, August and September 2023): 4,1 Debtors Collection Schedite (5marks ) 4.2 Cash Budgef (15 marks) INFORMATION The following budgeted intormation relates to Oscar Limiled that will commence business on 01 July 20z3: 1. An amount of R800 000 is expected to be banked on 01 July 2023 from the sale of ordinary shares to the public 2. New machinery and equipment will be purchased on 02 July 2023 for R400 000. A deposit of 25% will be paid immedialely and the belance plus finance charges of R60 000 wil be paid in five equal monthly instaiments commencing August 2023. 3. The number of units of the only product that is expected to be sold and produced each month are as follows: 4. The seling price of the product is R110 per unit. Cash sales are expected to comprise 60% of the total sales. The balance of the sales will be on credit. Forty percent (40\%) of the cash sales is subject to a 10% cash disosunt. Thiry percent (30%) of the credit sales is expected to be colected in the month of the sale. The balance is expected to be received in the month after the sale. 5. Variable manufacturing costs per unit are estimated as follows: 6. Drect materials will be purchased for the production requirements of each month. Twenty percent (20\%) of the purchases is expected to be for cash and the balance wil be paid two months atter the purchase. 7. Drect workers will have their salaries paid on the last working day of each month. B. Payment for the variable manufacturing overheads will be delayed by one month. 9. Fixed overheads are expected to amount to R300 000 per month, excluding depreciation of R5 000 per month. Fixed overheads will be paid in the month in which they are incurred. QUESTION 5 (20 Marks) Note: Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after QUESTION 5. INFORMATION The following information relates to two capital expenditure projects. Because of capital rationing, only one project can be chasen. The company estimates that its cost of capital is 12% ignore taxes. TOTAL: 100 END OF PAPER