Answered step by step

Verified Expert Solution

Question

1 Approved Answer

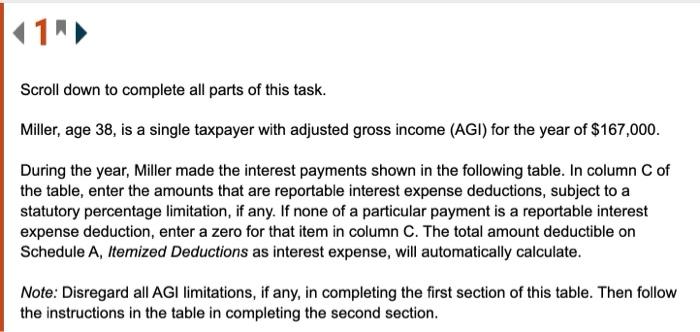

11 Scroll down to complete all parts of this task. Miller, age 38, is a single taxpayer with adjusted gross income (AGI) for the year

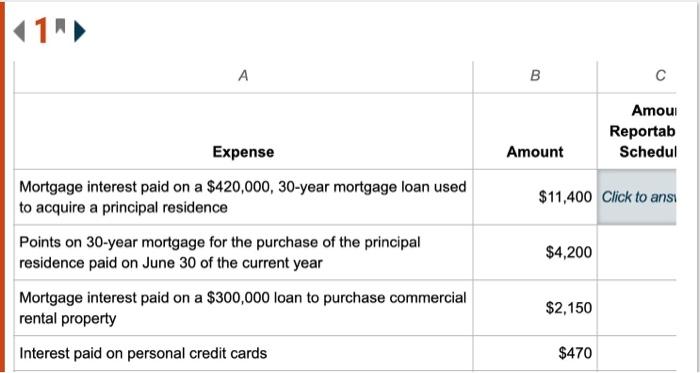

11 Scroll down to complete all parts of this task. Miller, age 38, is a single taxpayer with adjusted gross income (AGI) for the year of $167,000. During the year, Miller made the interest payments shown in the following table. In column C of the table, enter the amounts that are reportable interest expense deductions, subject to a statutory percentage limitation, if any. If none of a particular payment is a reportable interest expense deduction, enter a zero for that item in column C. The total amount deductible on Schedule A, Itemized Deductions as interest expense, will automatically calculate. Note: Disregard all AGI limitations, if any, in completing the first section of this table. Then follow the instructions in the table in completing the second section.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started