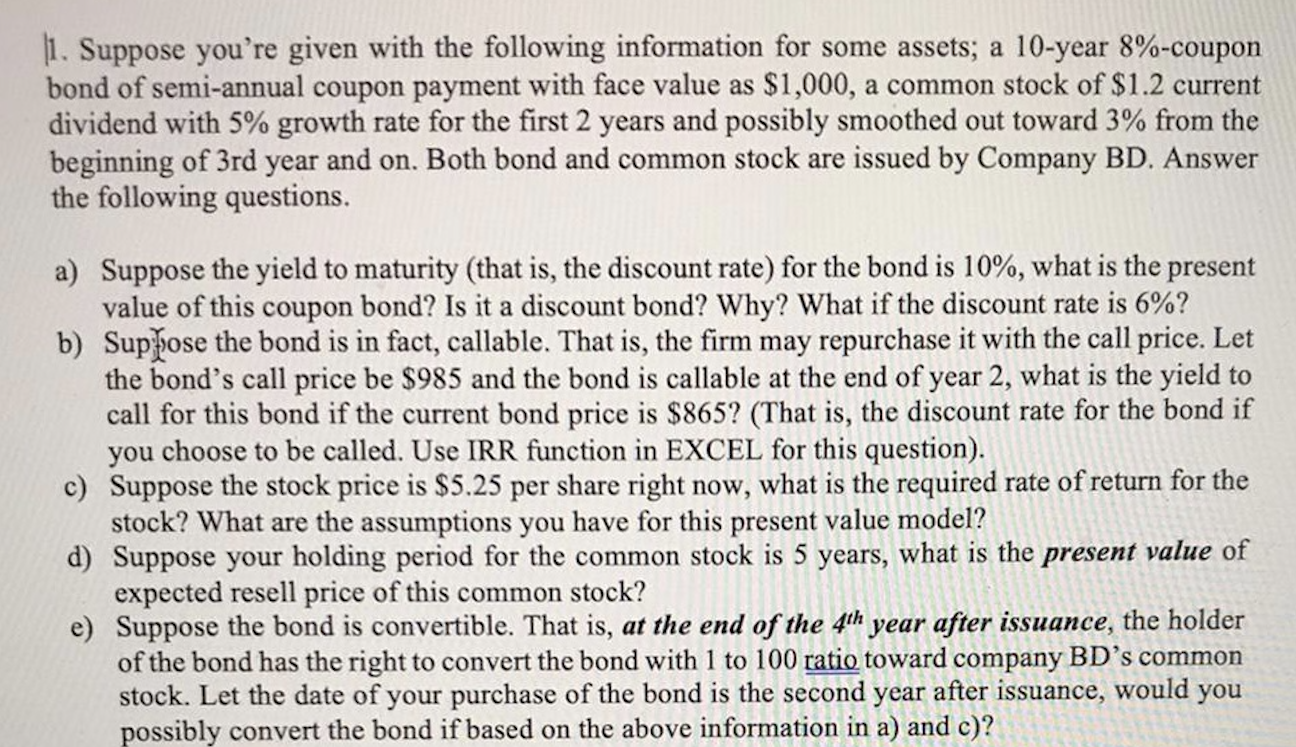

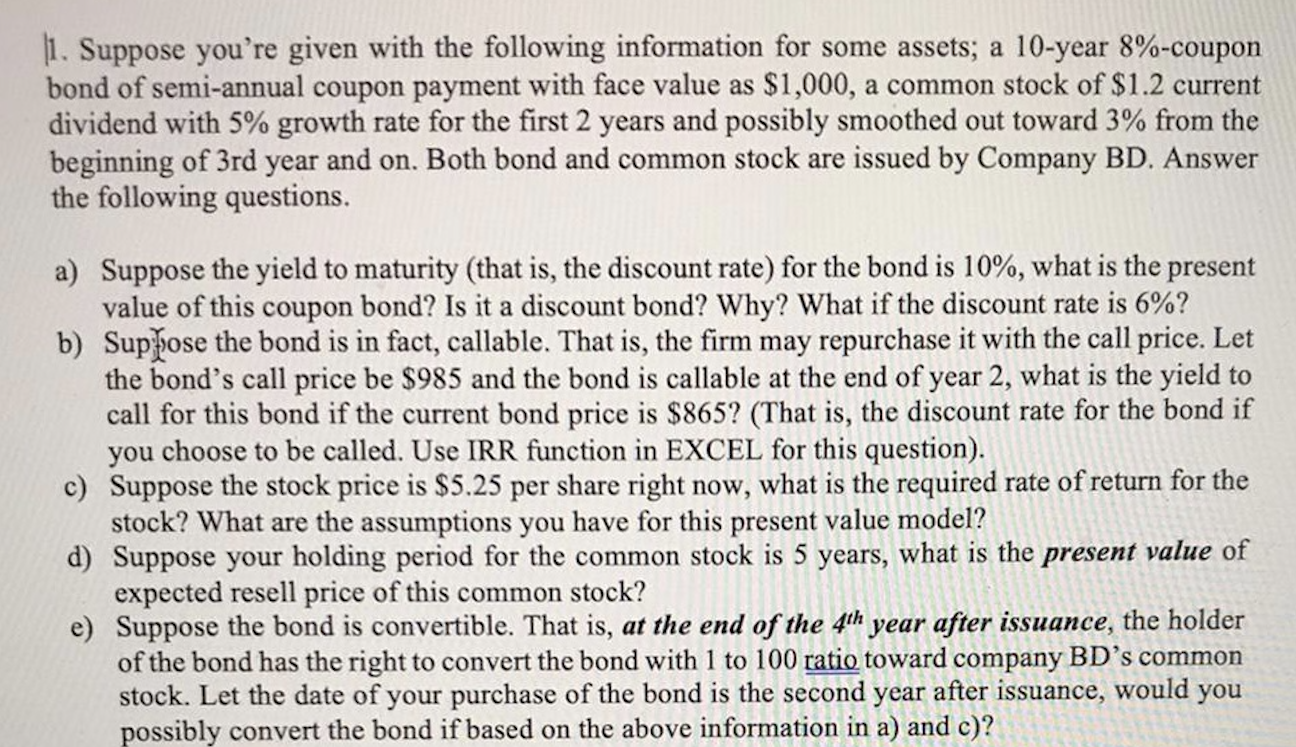

11. Suppose you're given with the following information for some assets; a 10-year 8%-coupon bond of semi-annual coupon payment with face value as $1,000, a common stock of $1.2 current dividend with 5% growth rate for the first 2 years and possibly smoothed out toward 3% from the beginning of 3rd year and on. Both bond and common stock are issued by Company BD. Answer the following questions. a) Suppose the yield to maturity (that is, the discount rate) for the bond is 10%, what is the present value of this coupon bond? Is it a discount bond? Why? What if the discount rate is 6%? b) Suppose the bond is in fact, callable. That is, the firm may repurchase it with the call price. Let the bond's call price be $985 and the bond is callable at the end of year 2, what is the yield to call for this bond if the current bond price is $865? (That is, the discount rate for the bond if you choose to be called. Use IRR function in EXCEL for this question). c) Suppose the stock price is $5.25 per share right now, what is the required rate of return for the stock? What are the assumptions you have for this present value model? d) Suppose your holding period for the common stock is 5 years, what is the present value of expected resell price of this common stock? e) Suppose the bond is convertible. That is, at the end of the 4th year after issuance, the holder of the bond has the right to convert the bond with 1 to 100 ratio toward company BD's common stock. Let the date of your purchase of the bond is the second year after issuance, would you possibly convert the bond if based on the above information in a) and c)? 11. Suppose you're given with the following information for some assets; a 10-year 8%-coupon bond of semi-annual coupon payment with face value as $1,000, a common stock of $1.2 current dividend with 5% growth rate for the first 2 years and possibly smoothed out toward 3% from the beginning of 3rd year and on. Both bond and common stock are issued by Company BD. Answer the following questions. a) Suppose the yield to maturity (that is, the discount rate) for the bond is 10%, what is the present value of this coupon bond? Is it a discount bond? Why? What if the discount rate is 6%? b) Suppose the bond is in fact, callable. That is, the firm may repurchase it with the call price. Let the bond's call price be $985 and the bond is callable at the end of year 2, what is the yield to call for this bond if the current bond price is $865? (That is, the discount rate for the bond if you choose to be called. Use IRR function in EXCEL for this question). c) Suppose the stock price is $5.25 per share right now, what is the required rate of return for the stock? What are the assumptions you have for this present value model? d) Suppose your holding period for the common stock is 5 years, what is the present value of expected resell price of this common stock? e) Suppose the bond is convertible. That is, at the end of the 4th year after issuance, the holder of the bond has the right to convert the bond with 1 to 100 ratio toward company BD's common stock. Let the date of your purchase of the bond is the second year after issuance, would you possibly convert the bond if based on the above information in a) and c)