Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.1 What criteria would be used to classify a Property as either an Investment Property or as Property, Plant and Equipment? 1.2 Give 3 examples

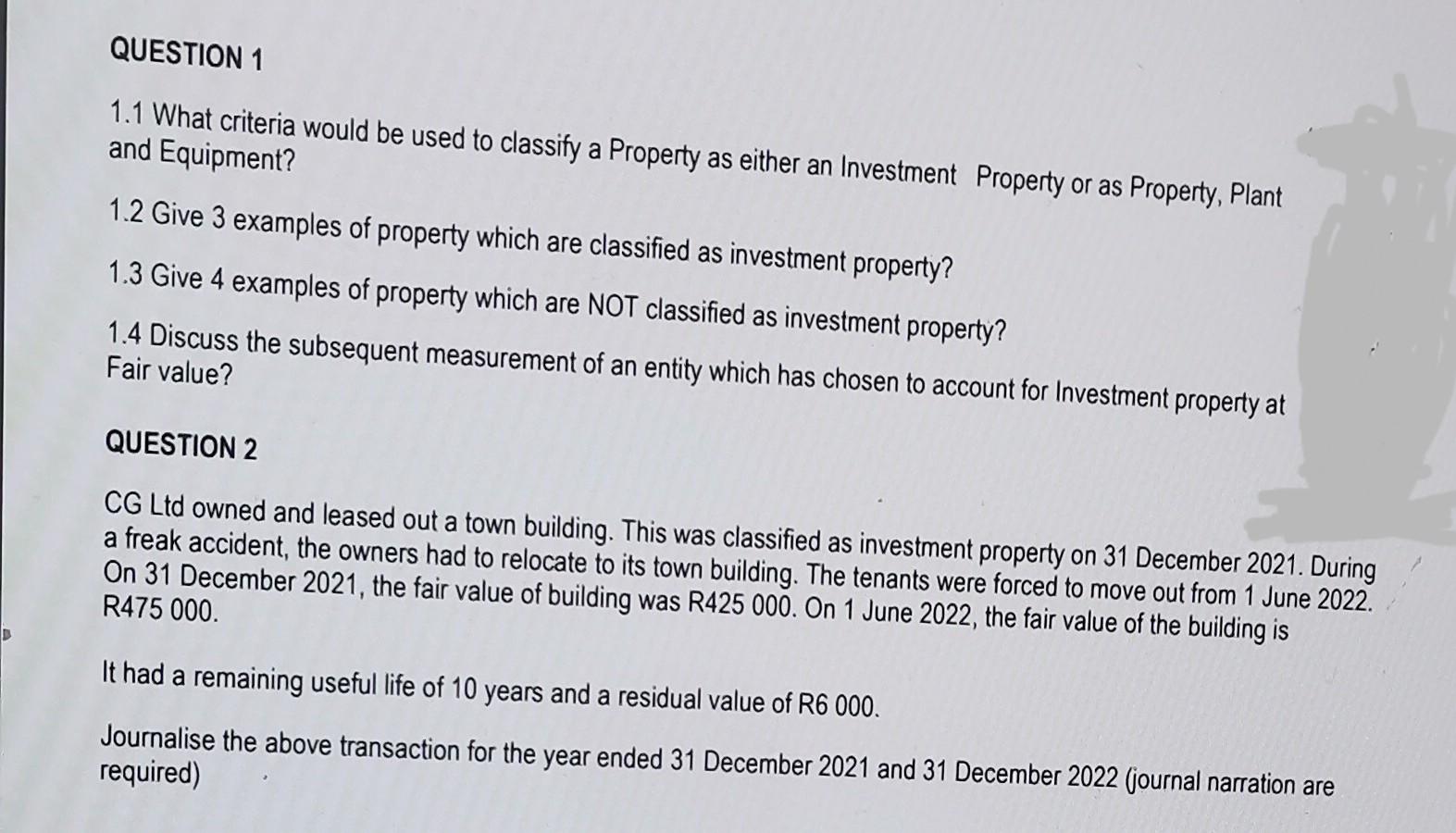

1.1 What criteria would be used to classify a Property as either an Investment Property or as Property, Plant and Equipment? 1.2 Give 3 examples of property which are classified as investment property? 1.3 Give 4 examples of property which are NOT classified as investment property? 1.4 Discuss the subsequent measurement of an entity which has chosen to account for Investment property at Fair value? QUESTION 2 CG Ltd owned and leased out a town building. This was classified as investment property on 31 December 2021. During a freak accident, the owners had to relocate to its town building. The tenants were forced to move out from 1 June 2022. On 31 December 2021, the fair value of building was R425 000. On 1 June 2022, the fair value of the building is R475 000 . It had a remaining useful life of 10 years and a residual value of R6000. Journalise the above transaction for the year ended 31 December 2021 and 31 December 2022 (journal narration are required)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started