Answered step by step

Verified Expert Solution

Question

1 Approved Answer

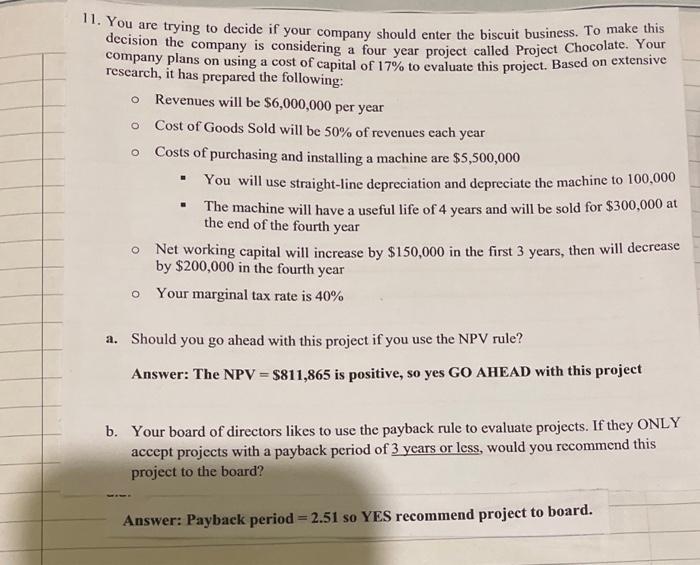

11. You are trying to decide if your company should enter the biscuit business. To make this decision the company is considering a four

11. You are trying to decide if your company should enter the biscuit business. To make this decision the company is considering a four year project called Project Chocolate. Your company plans on using a cost of capital of 17% to evaluate this project. Based on extensive research, it has prepared the following: o Revenues will be $6,000,000 per year Cost of Goods Sold will be 50% of revenues each year o Costs of purchasing and installing a machine are $5,500,000 O You will use straight-line depreciation and depreciate the machine to 100,000 The machine will have a useful life of 4 years and will be sold for $300,000 at the end of the fourth year . Net working capital will increase by $150,000 in the first 3 years, then will decrease by $200,000 in the fourth year Your marginal tax rate is 40% a. Should you go ahead with this project if you use the NPV rule? Answer: The NPV = $811,865 is positive, so yes GO AHEAD with this project b. Your board of directors likes to use the payback rule to evaluate projects. If they ONLY accept projects with a payback period of 3 years or less, would you recommend this project to the board? Answer: Payback period=2.51 so YES recommend project to board.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

11 You are trying to decide if your company should enter the biscuit business To make this decision ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started