Answered step by step

Verified Expert Solution

Question

1 Approved Answer

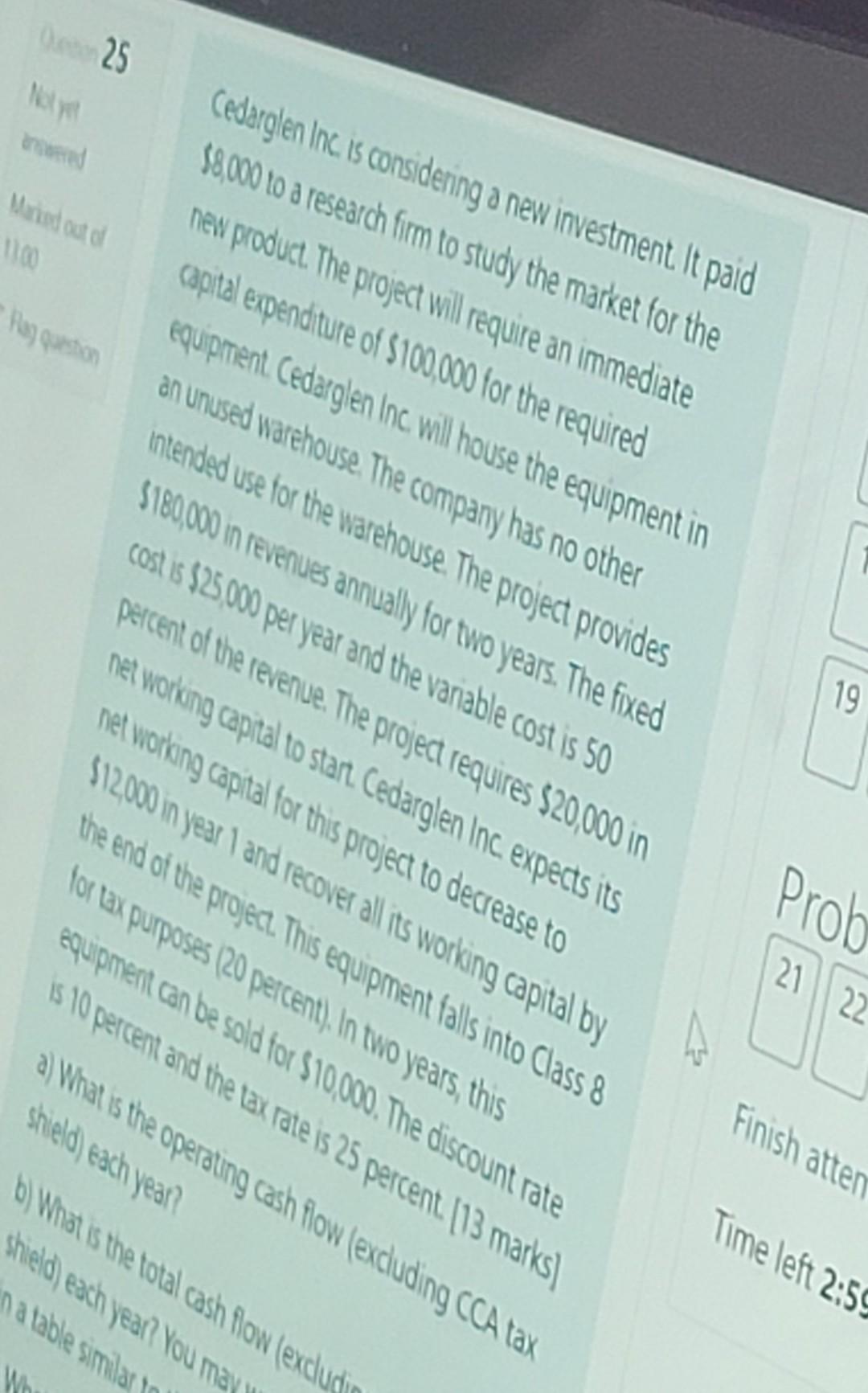

1100 Cedarglen Inc. is considering a new investment. It paid $8,000 to a research firm to study the market for the new product . The

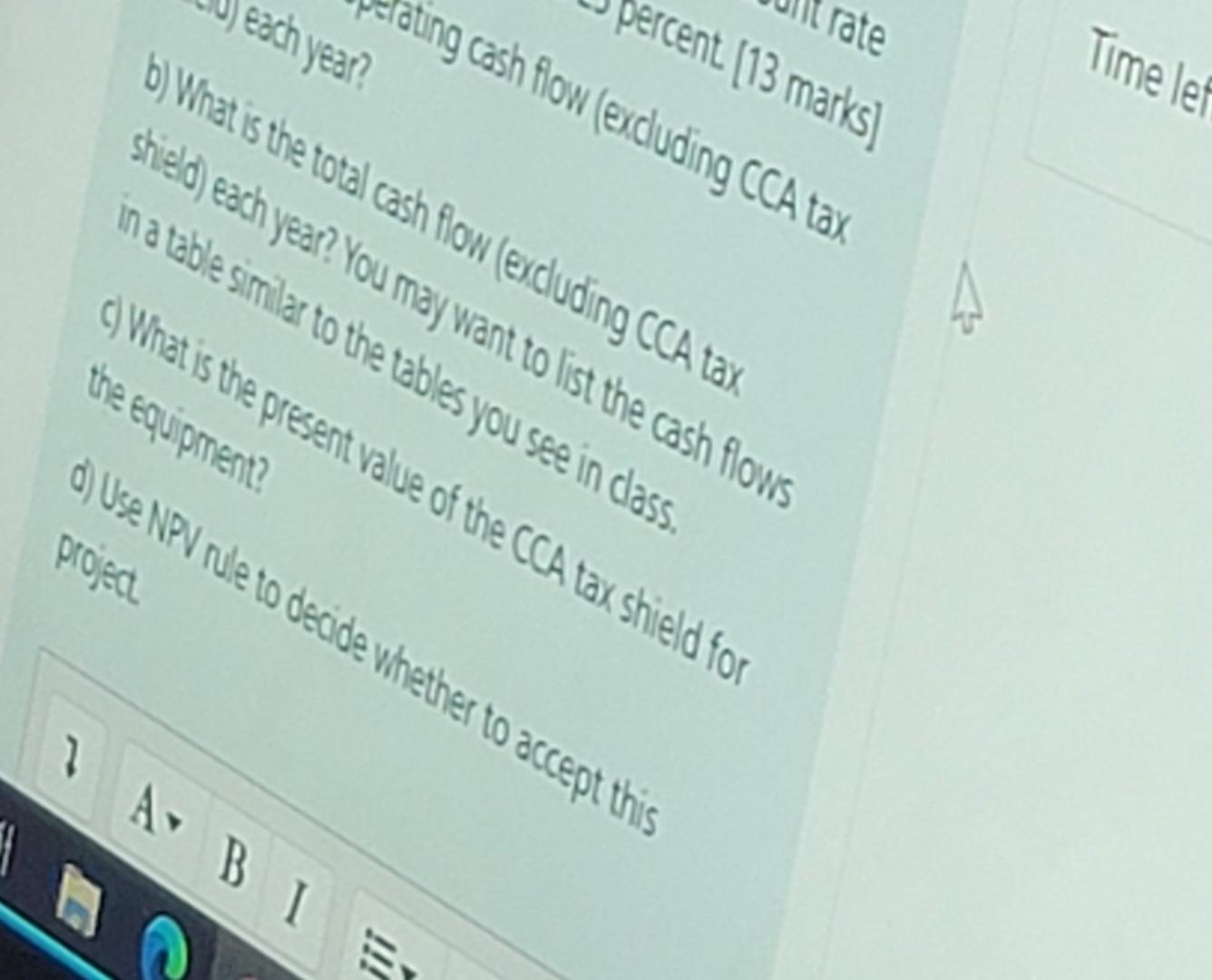

1100 Cedarglen Inc. is considering a new investment. It paid $8,000 to a research firm to study the market for the new product . The project will require an immediate capital expenditure of $100,000 for the required equipment Cedarglen Inc. will house the equipment in an unused warehouse. The company has no other intended use for the warehouse. The project provides $180,000 in revenues annually for two years. The fixed 19 cost is $25.000 per year and the variable cost is 50 percent of the revenue. The project requires $20,000 in net working capital to start. Cedarglen Inc. expects its net working capital for this project to decrease to $12,000 in year 1 and recover all its working capital by the end of the project. This equipment falls into Class 8 for tax purposes (20 percent). In two years, this equipment can be sold for $10,000. The discount rate Prob 21 22 is 10 percent and the tax rate is 25 percent. [13 marks) a) What is the operating cash flow (excluding CCA tax shield each year Finish atten b) What is the total cash flow (excludin shield, each yearl You may natabe similar Time left 2:59 w ating cash flow (excluding CCA tax Each year? rate ercent (13 marks) Timele b) What is the total cash flow (excluding CCA tax shield) each year? You may want to list the cash flows in a table similar to the tables you see in class. c) What is the present value of the CCA tax shield for the equipment: a) Use NPV rule to decide whether to accept this project 1 A A BI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started