Answered step by step

Verified Expert Solution

Question

1 Approved Answer

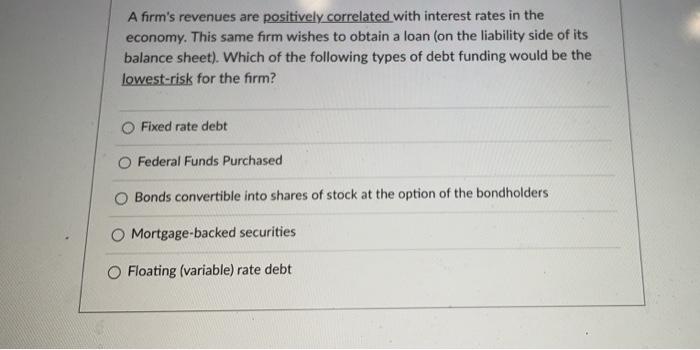

11121314 A firm's revenues are positively correlated with interest rates in the economy. This same firm wishes to obtain a loan (on the liability side

11121314

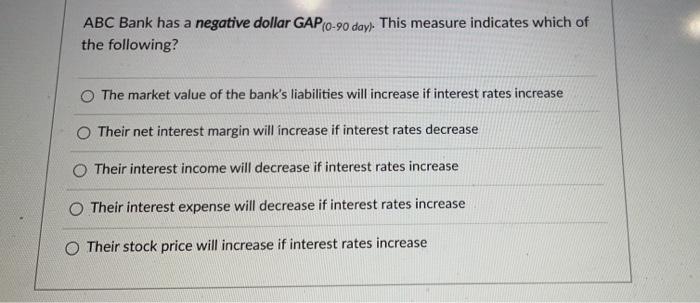

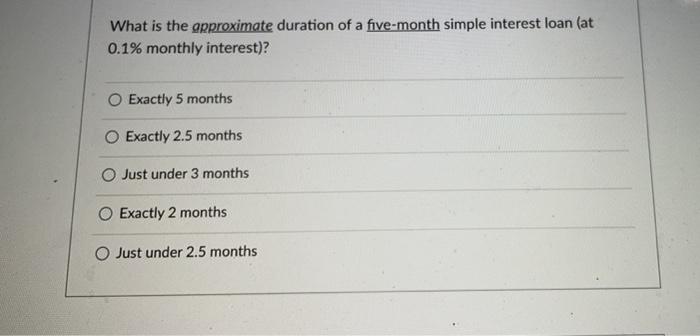

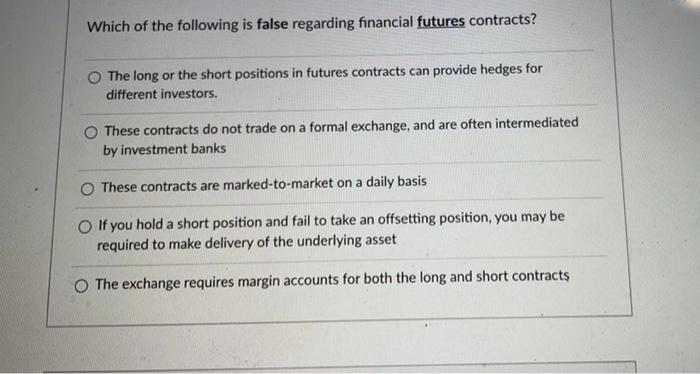

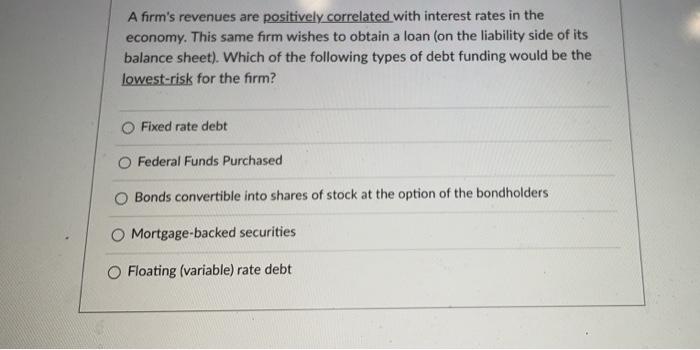

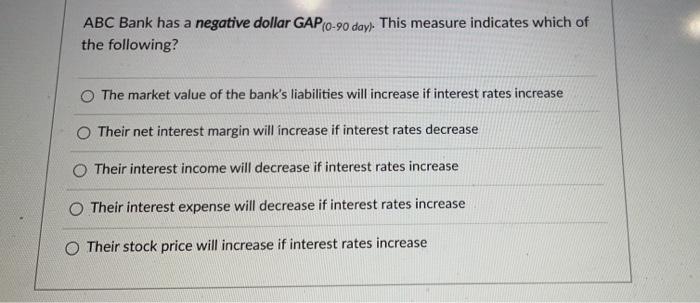

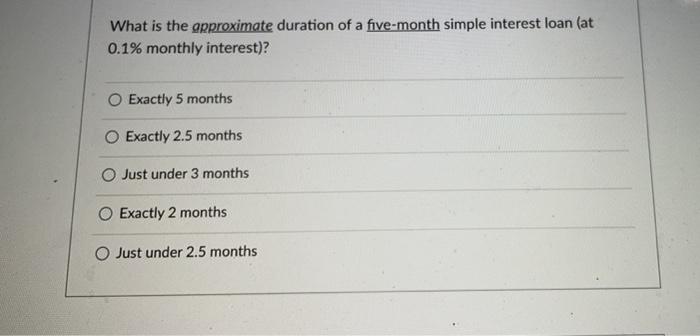

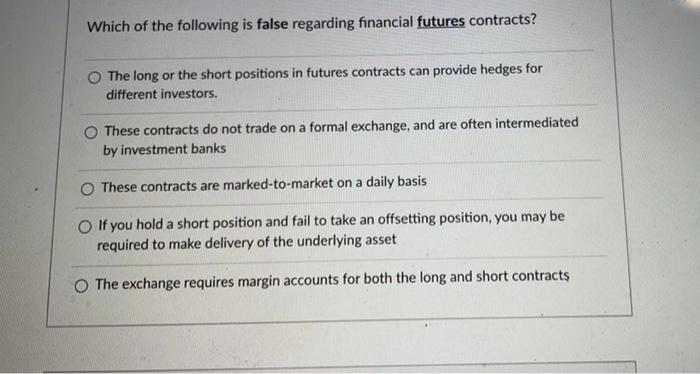

A firm's revenues are positively correlated with interest rates in the economy. This same firm wishes to obtain a loan (on the liability side of its balance sheet). Which of the following types of debt funding would be the lowest-risk for the firm? Fixed rate debt O Federal Funds Purchased O Bonds convertible into shares of stock at the option of the bondholders O Mortgage-backed securities Floating (variable) rate debt ABC Bank has a negative dollar GAP10-90 day). This measure indicates which of the following? The market value of the bank's liabilities will increase if interest rates increase O Their net interest margin will increase if interest rates decrease O Their interest income will decrease if interest rates increase O Their interest expense will decrease if interest rates increase Their stock price will increase if interest rates increase What is the approximate duration of a five-month simple interest loan (at 0.1% monthly interest)? O Exactly 5 months O Exactly 2.5 months Just under 3 months Exactly 2 months O Just under 2.5 months Which of the following is false regarding financial futures contracts? The long or the short positions in futures contracts can provide hedges for different investors. O These contracts do not trade on a formal exchange, and are often intermediated by investment banks These contracts are marked-to-market on a daily basis If you hold a short position and fail to take an offsetting position, you may be required to make delivery of the underlying asset The exchange requires margin accounts for both the long and short contracts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started