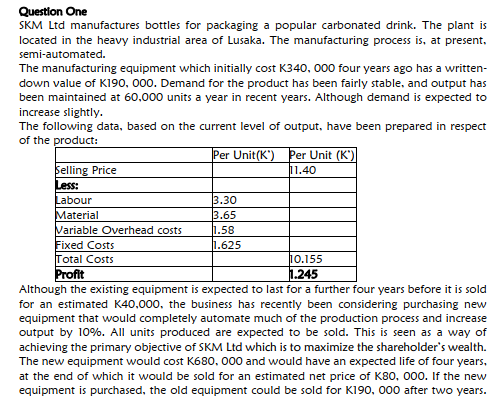

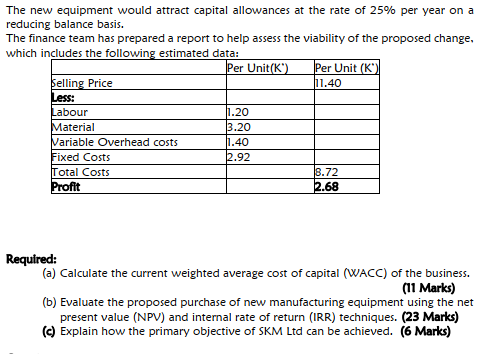

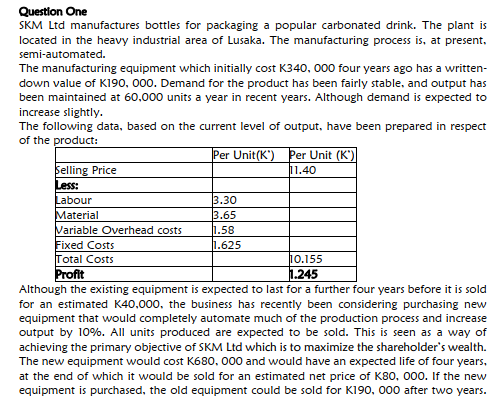

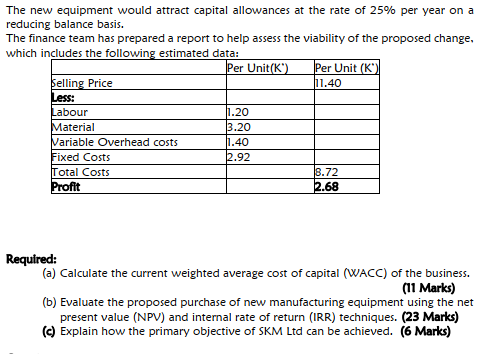

11.40 Question One SKM Ltd manufactures bottles for packaging a popular carbonated drink. The plant is located in the heavy industrial area of Lusaka. The manufacturing process is, at present, semi-automated. The manufacturing equipment which initially cost K340, 000 four years ago has a written- down value of K190, 000. Demand for the product has been fairly stable, and output has been maintained at 60,000 units a year in recent years. Although demand is expected to increase slightly. The following data, based on the current level of output, have been prepared in respect of the product: Per Unit(K) Per Unit (K) Selling Price Less: Labour 3.30 Material 3.65 Variable Overhead costs 1.58 Fixed Costs 1.625 Total Costs 10.155 Profit 1.245 Although the existing equipment is expected to last for a further four years before it is sold for an estimated K40,000, the business has recently been considering purchasing new equipment that would completely automate much of the production process and increase output by 10%. All units produced are expected to be sold. This is seen as a way of achieving the primary objective of SKM Ltd which is to maximize the shareholder's wealth. The new equipment would cost K680,000 and would have an expected life of four years, at the end of which it would be sold for an estimated net price of K80, 000. If the new equipment is purchased, the old equipment could be sold for K190,000 after two years. The new equipment would attract capital allowances at the rate of 25% per year on a reducing balance basis. The finance team has prepared a report to help assess the viability of the proposed change, which includes the following estimated data: Per Unit(K) Per Unit (K) Selling Price 11.40 Less: Labour 1.20 Material 3.20 Variable Overhead costs 1.40 Fixed Costs 2.92 Total Costs 8.72 Profit 2.68 Required: (a) Calculate the current weighted average cost of capital (WACC) of the business. (11 Marks) (b) Evaluate the proposed purchase of new manufacturing equipment using the net present value (NPV) and internal rate of return (IRR) techniques. (23 Marks) (c) Explain how the primary objective of SKM Ltd can be achieved. (6 Marks) 11.40 Question One SKM Ltd manufactures bottles for packaging a popular carbonated drink. The plant is located in the heavy industrial area of Lusaka. The manufacturing process is, at present, semi-automated. The manufacturing equipment which initially cost K340, 000 four years ago has a written- down value of K190, 000. Demand for the product has been fairly stable, and output has been maintained at 60,000 units a year in recent years. Although demand is expected to increase slightly. The following data, based on the current level of output, have been prepared in respect of the product: Per Unit(K) Per Unit (K) Selling Price Less: Labour 3.30 Material 3.65 Variable Overhead costs 1.58 Fixed Costs 1.625 Total Costs 10.155 Profit 1.245 Although the existing equipment is expected to last for a further four years before it is sold for an estimated K40,000, the business has recently been considering purchasing new equipment that would completely automate much of the production process and increase output by 10%. All units produced are expected to be sold. This is seen as a way of achieving the primary objective of SKM Ltd which is to maximize the shareholder's wealth. The new equipment would cost K680,000 and would have an expected life of four years, at the end of which it would be sold for an estimated net price of K80, 000. If the new equipment is purchased, the old equipment could be sold for K190,000 after two years. The new equipment would attract capital allowances at the rate of 25% per year on a reducing balance basis. The finance team has prepared a report to help assess the viability of the proposed change, which includes the following estimated data: Per Unit(K) Per Unit (K) Selling Price 11.40 Less: Labour 1.20 Material 3.20 Variable Overhead costs 1.40 Fixed Costs 2.92 Total Costs 8.72 Profit 2.68 Required: (a) Calculate the current weighted average cost of capital (WACC) of the business. (11 Marks) (b) Evaluate the proposed purchase of new manufacturing equipment using the net present value (NPV) and internal rate of return (IRR) techniques. (23 Marks) (c) Explain how the primary objective of SKM Ltd can be achieved. (6 Marks)