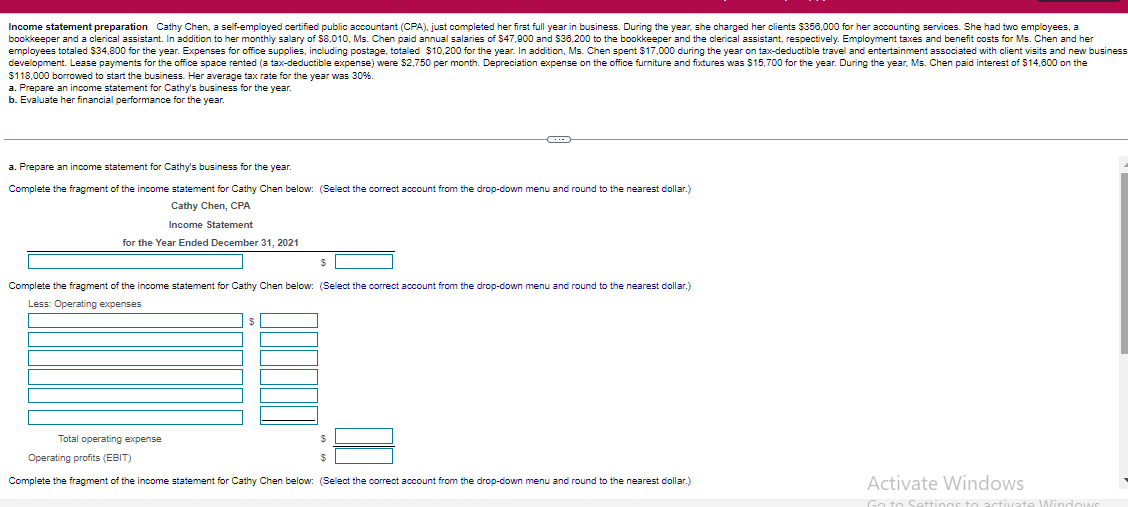

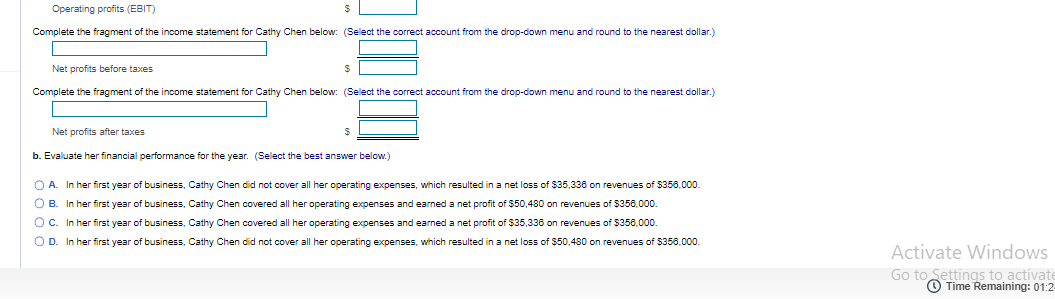

$118,000 borrowed to start the business. Her average tax rate for the year was 30%. a. Prepare an income statement for Cathy's business for the year. b. Evaluate her financial performance for the year. a. Prepare an income statement for Cathy's business for the year. Complete the fragment of the income statement for Cathy Chen below: (Select the correct account from the drop-down menu and round to the nearest dollar.) A. In her first year of business, Cathy Chen did not cover all her operating expenses, which resulted in a net loss of $35,336 on revenues of $356,000. B. In her first year of business, Cathy Chen covered all her operating expenses and earned a net profit of $50,480 on revenues of $356,000. C. In her first year of business, Cathy Chen covered all her operating expenses and earned a net profit of $35,336 on revenues of $356,000. D. In her first year of business, Cathy Chen did not cover all her operating expenses, which resulted in a net loss of $50,480 on revenues of $356,000. Activate Windows Go to Settings to activate (1) Time Remaining: 01:2 $118,000 borrowed to start the business. Her average tax rate for the year was 30%. a. Prepare an income statement for Cathy's business for the year. b. Evaluate her financial performance for the year. a. Prepare an income statement for Cathy's business for the year. Complete the fragment of the income statement for Cathy Chen below: (Select the correct account from the drop-down menu and round to the nearest dollar.) A. In her first year of business, Cathy Chen did not cover all her operating expenses, which resulted in a net loss of $35,336 on revenues of $356,000. B. In her first year of business, Cathy Chen covered all her operating expenses and earned a net profit of $50,480 on revenues of $356,000. C. In her first year of business, Cathy Chen covered all her operating expenses and earned a net profit of $35,336 on revenues of $356,000. D. In her first year of business, Cathy Chen did not cover all her operating expenses, which resulted in a net loss of $50,480 on revenues of $356,000. Activate Windows Go to Settings to activate (1) Time Remaining: 01:2