Question

12 3,4,5 3 Insegrevious, Inc., is engaged in the business of manufacturing widgets. Insegrevious is unsure of how to classify certain transactions on its

12\

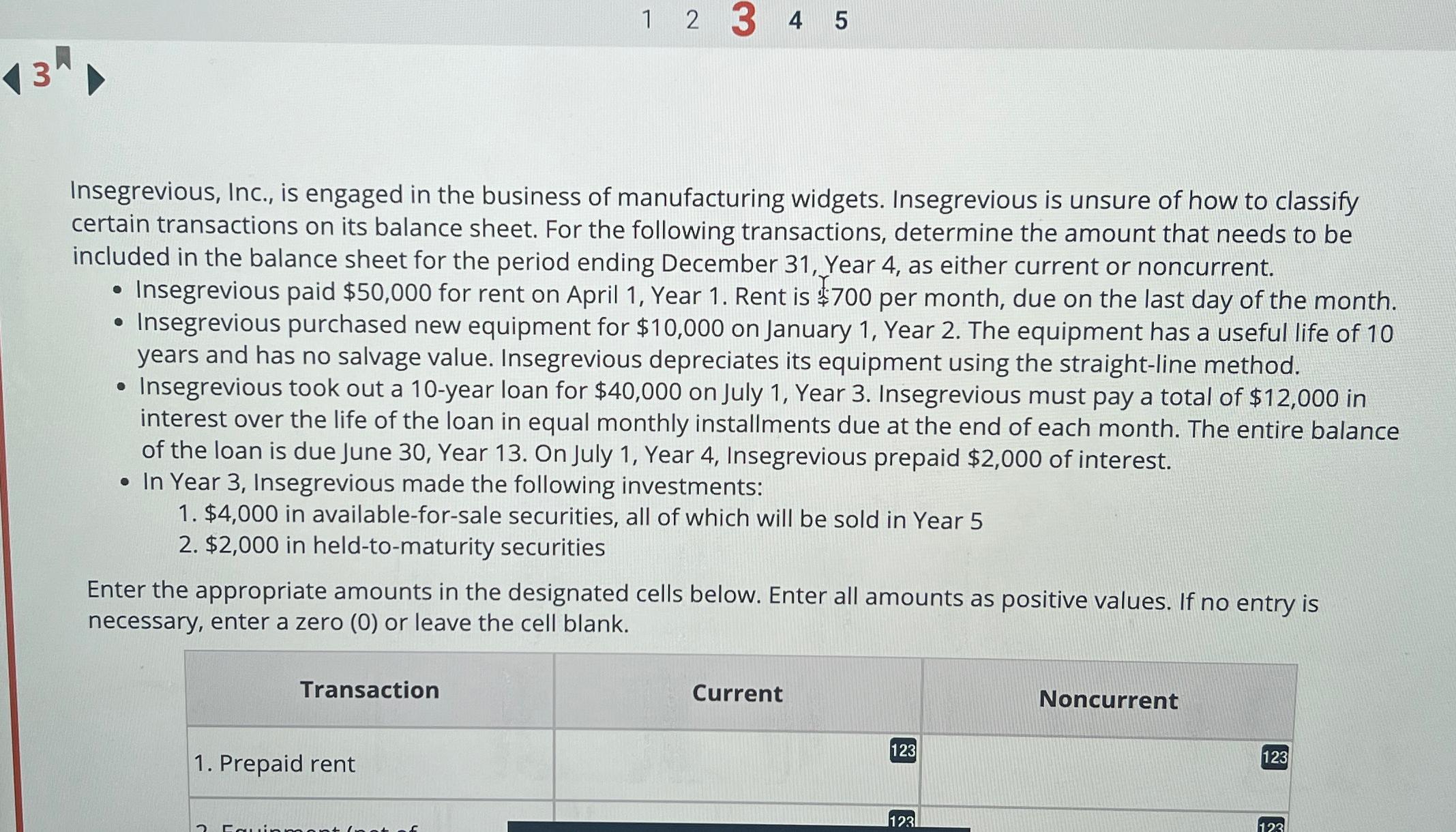

3,4,5\ 3\ Insegrevious, Inc., is engaged in the business of manufacturing widgets. Insegrevious is unsure of how to classify certain transactions on its balance sheet. For the following transactions, determine the amount that needs to be included in the balance sheet for the period ending December 31, Year 4, as either current or noncurrent.\ Insegrevious paid

$50,000for rent on April 1, Year 1. Rent is

$700per month, due on the last day of the month.\ Insegrevious purchased new equipment for

$10,000on January 1 , Year 2 . The equipment has a useful life of 10 years and has no salvage value. Insegrevious depreciates its equipment using the straight-line method.\ Insegrevious took out a 10-year loan for

$40,000on July 1 , Year 3. Insegrevious must pay a total of

$12,000in interest over the life of the loan in equal monthly installments due at the end of each month. The entire balance of the loan is due June 30 , Year 13 . On July 1, Year 4, Insegrevious prepaid

$2,000of interest.\ In Year 3, Insegrevious made the following investments:\

$4,000in available-for-sale securities, all of which will be sold in Year 5\

$2,000in held-to-maturity securities\ Enter the appropriate amounts in the designated cells below. Enter all amounts as positive values. If no entry is necessary, enter a zero ( 0 ) or leave the cell blank.\ \\\\table[[Transaction,Current,Noncurrent],[1. Prepaid rent,123,123]]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started