Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. Art is applying for CPP (Canada Pension Plan) at his current age of 72. He has contributed the full amount to CPP over his

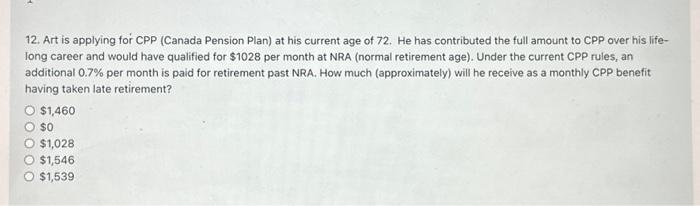

12. Art is applying for CPP (Canada Pension Plan) at his current age of 72. He has contributed the full amount to CPP over his life- long career and would have qualified for $1028 per month at NRA (normal retirement age). Under the current CPP rules, an additional 0.7% per month is paid for retirement past NRA. How much (approximately) will he receive as a monthly CPP benefit having taken late retirement? $1,460 $0 $1,028 $1,546 $1,539

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started