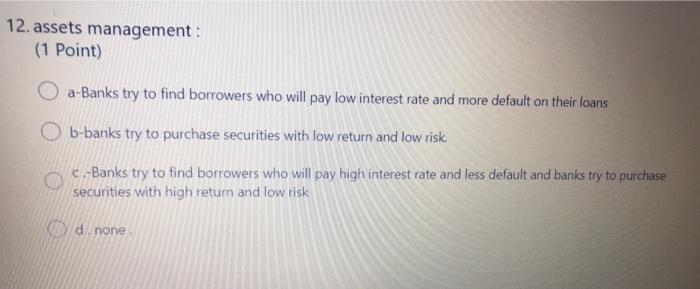

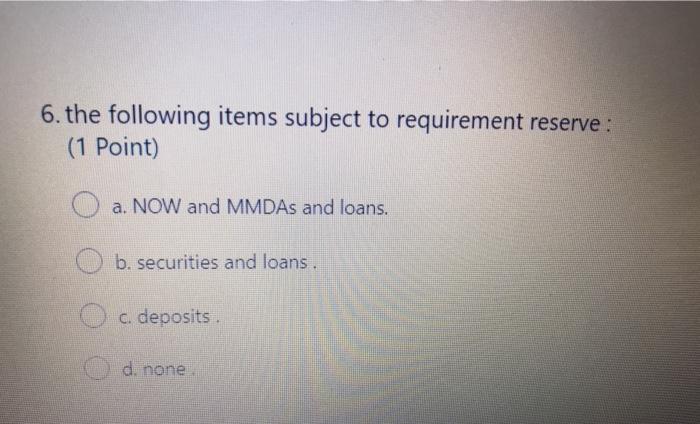

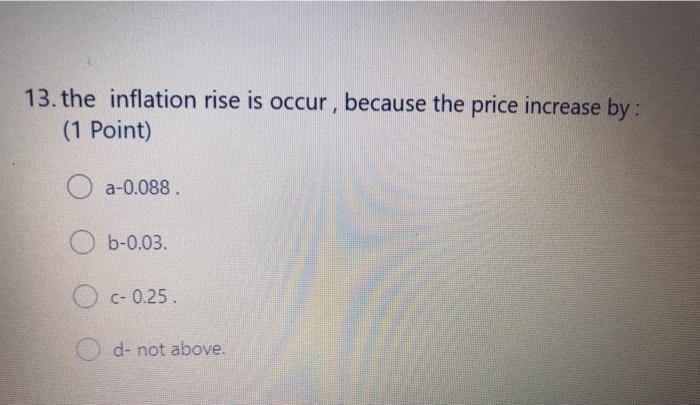

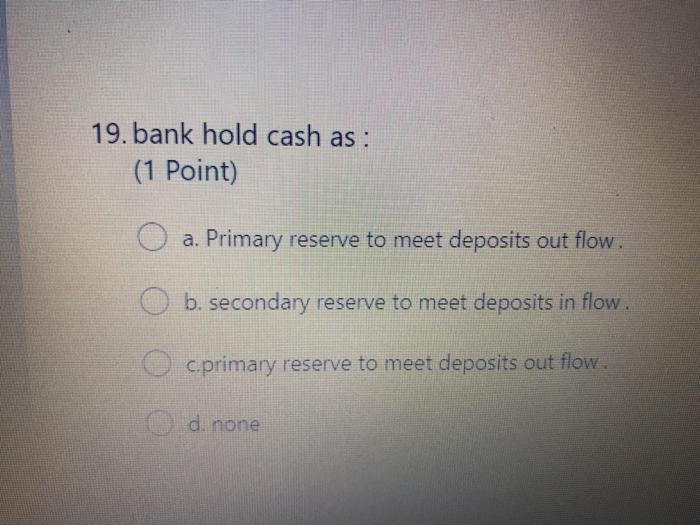

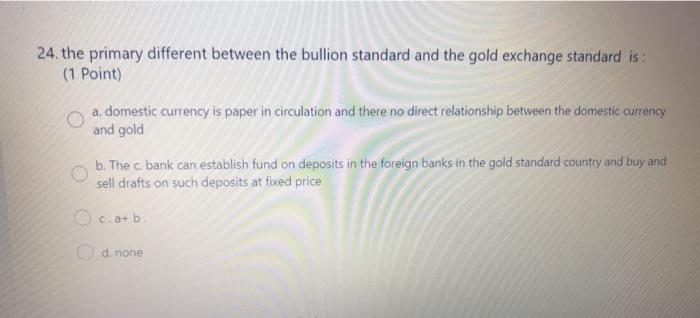

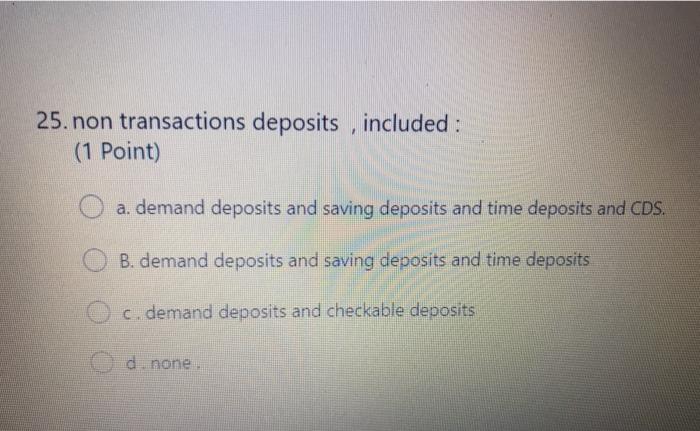

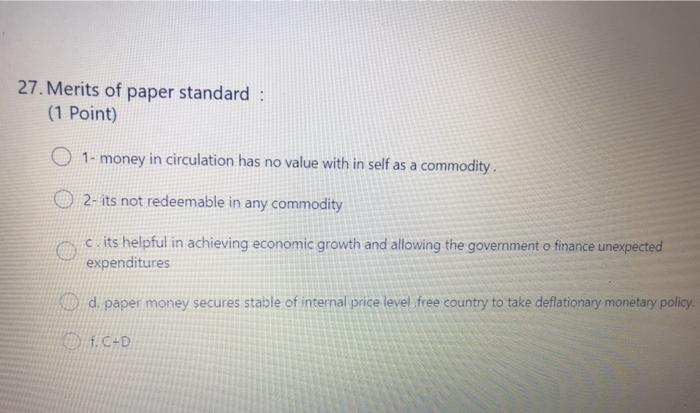

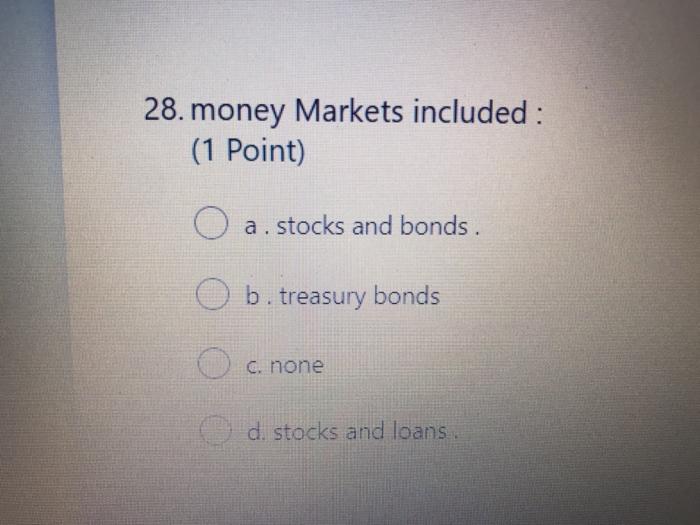

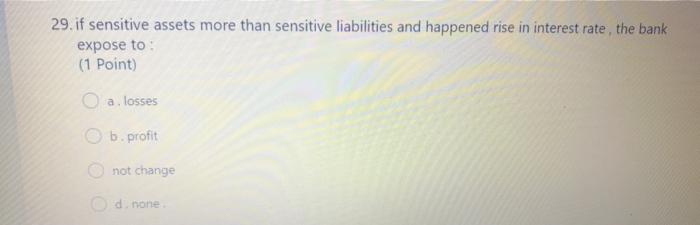

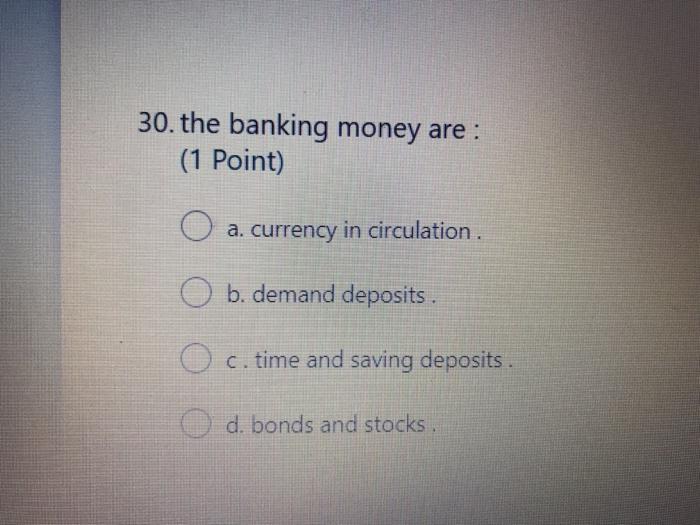

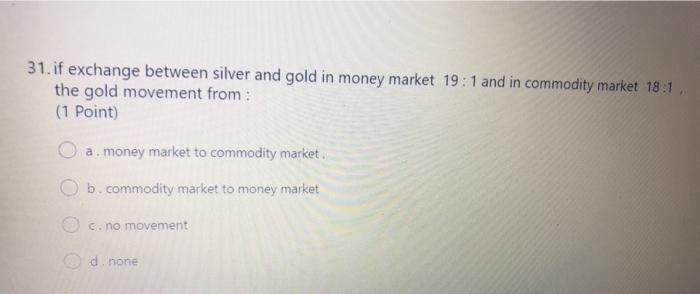

12. assets management: (1 Point) a-Banks try to find borrowers who will pay low interest rate and more default on their loans O b-banks try to purchase securities with low return and low risk. c.-Banks try to find borrowers who will pay high interest rate and less default and banks try to purchase securities with high return and low risk Od none 13. the inflation rise is occur, because the price increase by: (1 Point) a-0.088. b-0.03. C-0.25 d- not above. 19. bank hold cash as: (1 Point) O a. Primary reserve to meet deposits out flow. b. secondary reserve to meet deposits in flow. O c.primary reserve to meet deposits out flow. d. none 24. the primary different between the bullion standard and the gold exchange standard is: (1 Point) a domestic currency is paper in circulation and there no direct relationship between the domestic currency and gold b. The c bank can establish fund on deposits in the foreign banks in the gold standard country and buy and sell drafts on such deposits at fixed price c.at b. O d. none 25. non transactions deposits included : (1 Point) a. demand deposits and saving deposits and time deposits and CDS. B. demand deposits and saving deposits and time deposits c. demand deposits and checkable deposits O d. none 27. Merits of paper standard: (1 Point) 1- money in circulation has no value with in self as a commodity. 2- its not redeemable in any commodity cits helpful in achieving economic growth and allowing the government o finance unexpected expenditures d. paper money secures stable of internal price level free country to take deflationary monetary policy OfCD 28. money Markets included: (1 Point) O a.stocks and bonds. O b. treasury bonds O c c. none d. stocks and loans 29. if sensitive assets more than sensitive liabilities and happened rise in interest rate, the bank expose to (1 Point) a losses b. profit not change d none 30. the banking money are : (1 Point) O a. currency in circulation. O b. demand deposits. O c. time and saving deposits. d. bonds and stocks . 31. if exchange between silver and gold in money market 19:1 and in commodity market 18:1 the gold movement from: (1 Point) O a.money market to commodity market. Ob.commodity market to money market O c. no movement d. none