Answered step by step

Verified Expert Solution

Question

1 Approved Answer

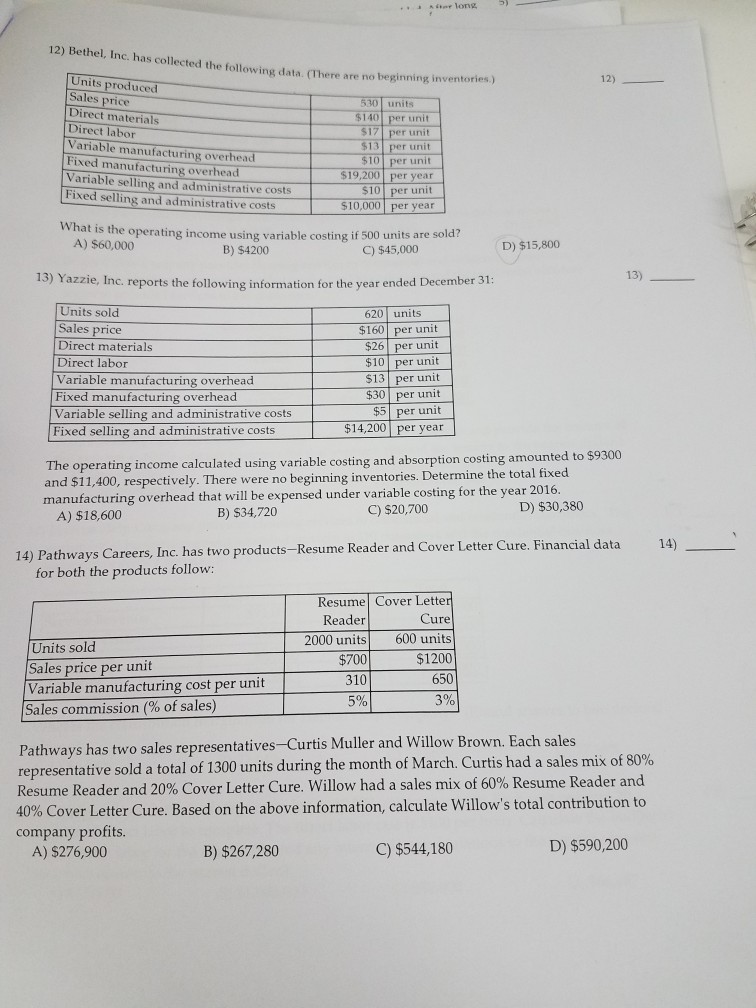

12) Bethel, Inc, has collected the following data. (There are no beginning inventor 12)_ Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufactuing

12) Bethel, Inc, has collected the following data. (There are no beginning inventor 12)_ Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufactuing overhead Variable selling and administrative costs Fixed selling and administrative costs 301 units r unit r unit per unit $10 per unit $19,200 per year $10 per unit 510,000 per yea What is the operating income using variable costing if 500 units are so ld? A) $60,000 B) $4200 C) $45,000 D) $15,800 13) Yazzie, Inc. reports the following information for the year ended December 31 13) Units sold Sales price Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative costs Fixed selling and administrative costs 620 units $160 er unit $26 per unit $10 per unit $13 per unit $30 per unit per unit $14,200 per year $9300 The operating income calculated using variable costing and absorption costing amounted to and $11,400, respectively. There were no beginning inventories. Determine the tota manufacturing overhead that will be expensed under variable costing for the year 2016. A) $18,600 B) $34,720 C) $20,700 D) $30,380 14) 14) Pathways Careers, Inc. has two products-Resume Reader and Cover Letter Cure. Financial data for both the products follow: Resume Cover Lette Reader Units sold Sales price per unit Variable manufacturing cost per unit Sales commission (% of sales) ure 2000 units 600 units $1200 650 $700 310 Pathways has two sales representatives-Curtis Muller and Willow Brown. Each sales representative sold a total of 1300 units during the month of March. Curtis had a sales mix of 80% Resume Reader and 20% Cover Letter Cure, Willow had a sales mix of 60% Resume Reader and 40% Cover Letter Cure. Based on the above information, calculate Willow's total contribution to company profits. A) $276,900 B) $267,280 C) $544,180 D) $590,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started