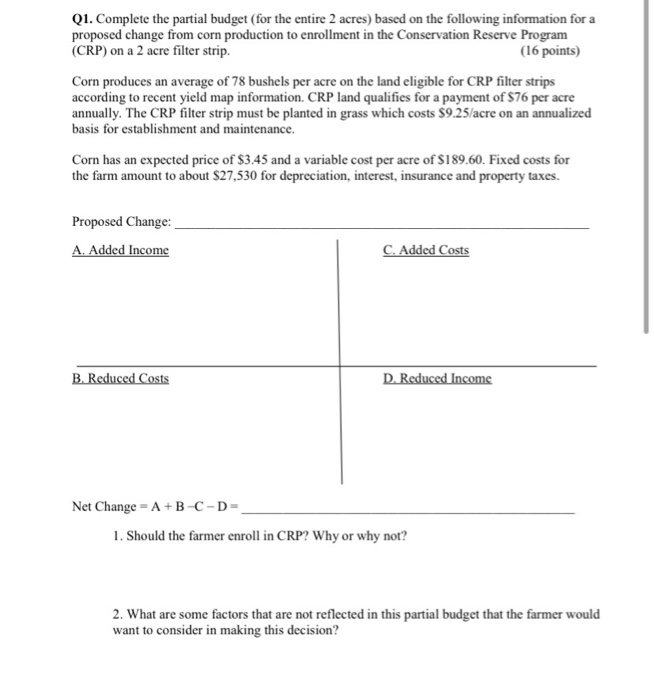

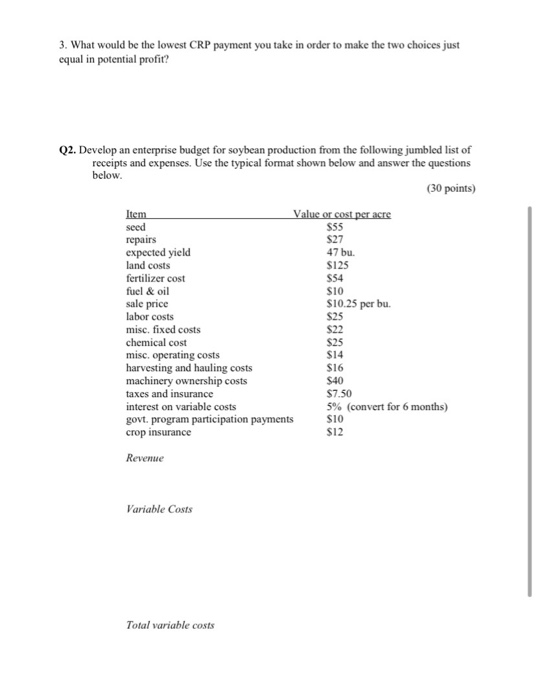

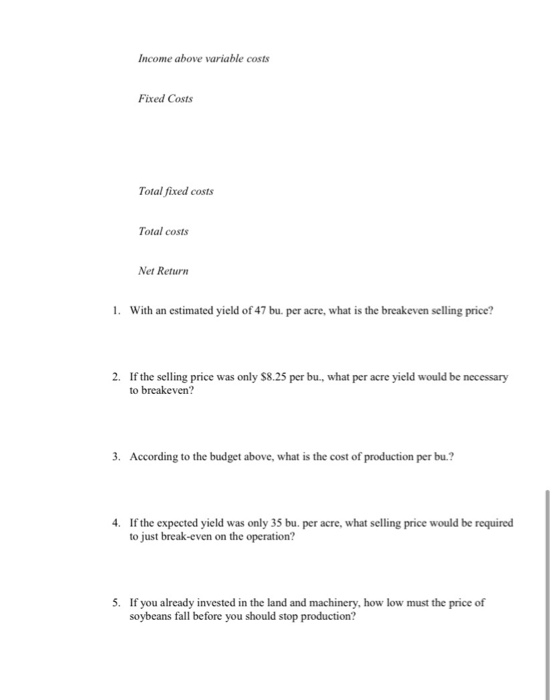

Q1. Complete the partial budget (for the entire 2 acres) based on the following information for a proposed change from corn production to enrollment in the Conservation Reserve Program (CRP) on a 2 acre filter strip. (16 points) Corn produces an average of 78 bushels per acre on the land eligible for CRP filter strips according to recent yield map information. CRP land qualifies for a payment of $76 per acre annually. The CRP filter strip must be planted in grass which costs $9.25/acre on an annualized basis for establishment and maintenance. Corn has an expected price of $3.45 and a variable cost per acre of $189.60. Fixed costs for the farm amount to about $27,530 for depreciation, interest, insurance and property taxes. Proposed Change: A. Added Income C. Added Costs B. Reduced Costs D. Reduced Income Net Change - A+B-C-D- 1. Should the farmer enroll in CRP? Why or why not? 2. What are some factors that are not reflected in this partial budget that the farmer would want to consider in making this decision? 3. What would be the lowest CRP payment you take in order to make the two choices just equal in potential profit? $54 Q2. Develop an enterprise budget for soybean production from the following jumbled list of receipts and expenses. Use the typical format shown below and answer the questions below. (30 points) Item Value or cost per acre seed S55 repairs S27 expected yield 47 bu. land costs $125 fertilizer cost fuel & oil SIO sale price $10.25 per bu. labor costs $25 misc, fixed costs $22 chemical cost S25 misc, operating costs $14 harvesting and hauling costs $16 machinery ownership costs S40 taxes and insurance $7.50 interest on variable costs 5% (convert for 6 months) govt. program participation payments SIO crop insurance $12 Revenue Variable Costs Total variable costs Income above variable costs Fixed Costs Total fixed costs Total costs Net Return 1. With an estimated yield of 47 bu. per acre, what is the breakeven selling price? 2. If the selling price was only $8.25 per bu., what per acre yield would be necessary to breakeven? 3. According to the budget above, what is the cost of production per bu.? 4. If the expected yield was only 35 bu. per acre, what selling price would be required to just break-even on the operation? 5. If you already invested in the land and machinery, how low must the price of soybeans fall before you should stop production