Question

12. In what year does the capital expense (CAPEX) occur for Roof Repair? 13. If the Exodus Building goes on the market after five years

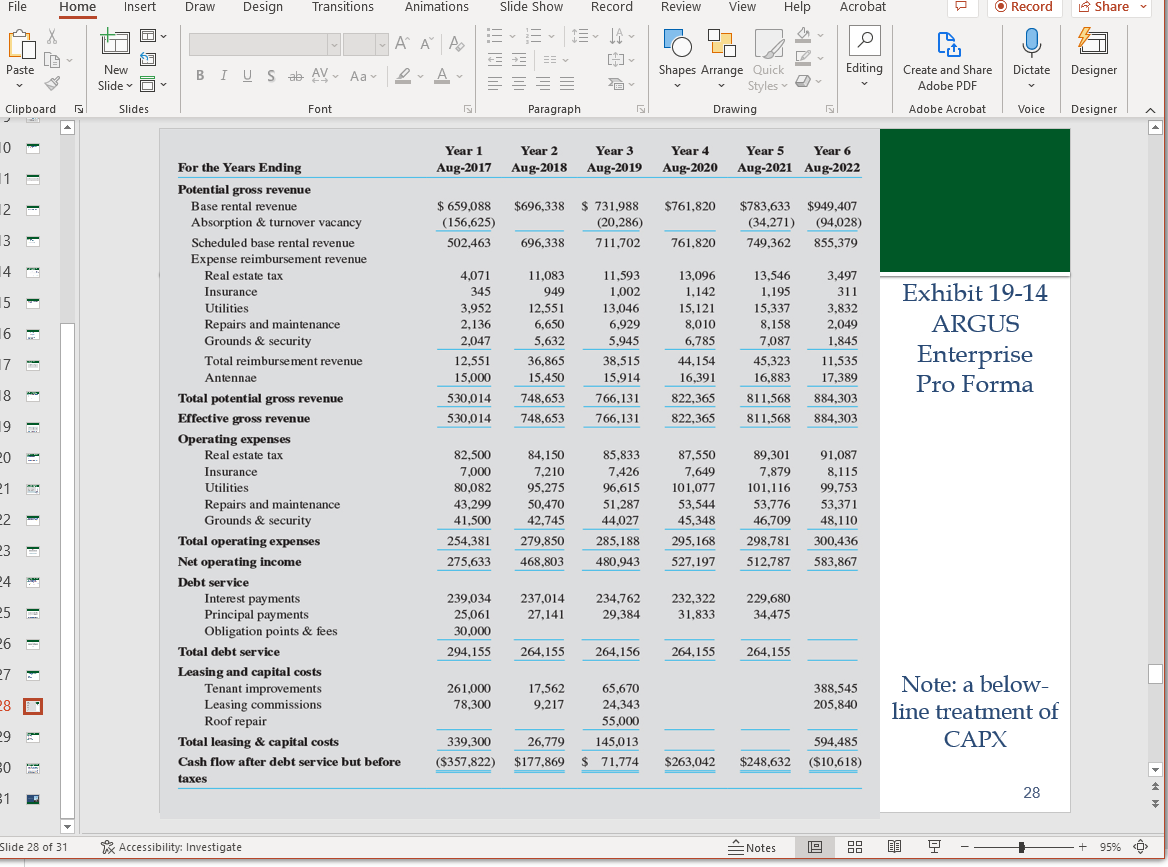

12. In what year does the capital expense (CAPEX) occur for Roof Repair?

13. If the Exodus Building goes on the market after five years of operation, calculate the reversion sale price using a going out cap rate of 9.0%. What is the sales price (round to the nearest thousand)?

14. The lender obligation points and fees were upfront costs for the borrower. In what year of operation does the lender pay these and how much is the cost?

15. The acquisition price of the Exodus Office Building was $4,900,000 with acquisition costs of $20,000. The initial investment was $3,920,000 and the investors target IRR is 11.00%. The holding period is five years. Using the Cash Flows for Year 1 through Year 5 and the calculated reversion sale price (found in #4), calculate the IRR.

What is the calculated IRR?

Does the IRR exceed the investors target?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started