Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. Insured private pension funds tend to invest in because A) riskier; they do not have to guarantee future fund benefits B) more conservative;

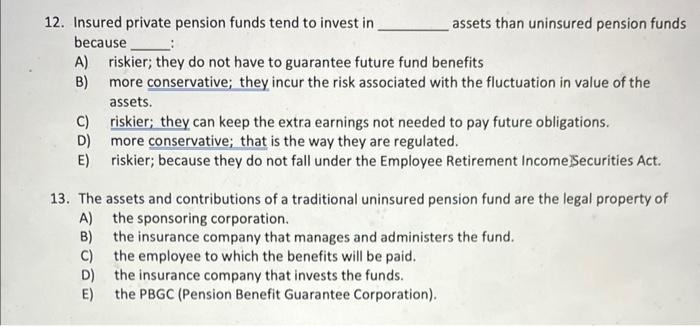

12. Insured private pension funds tend to invest in because A) riskier; they do not have to guarantee future fund benefits B) more conservative; they incur the risk associated with the fluctuation in value of the assets. riskier; they can keep the extra earnings not needed to pay future obligations. more conservative; that is the way they are regulated. E) riskier; because they do not fall under the Employee Retirement Income Securities Act. C) D) assets than uninsured pension funds 13. The assets and contributions of a traditional uninsured pension fund are the legal property of A) the sponsoring corporation. B) the insurance company that manages and administers the fund. C) the employee to which the benefits will be paid. D) E) the insurance company that invests the funds. the PBGC (Pension Benefit Guarantee Corporation).

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started