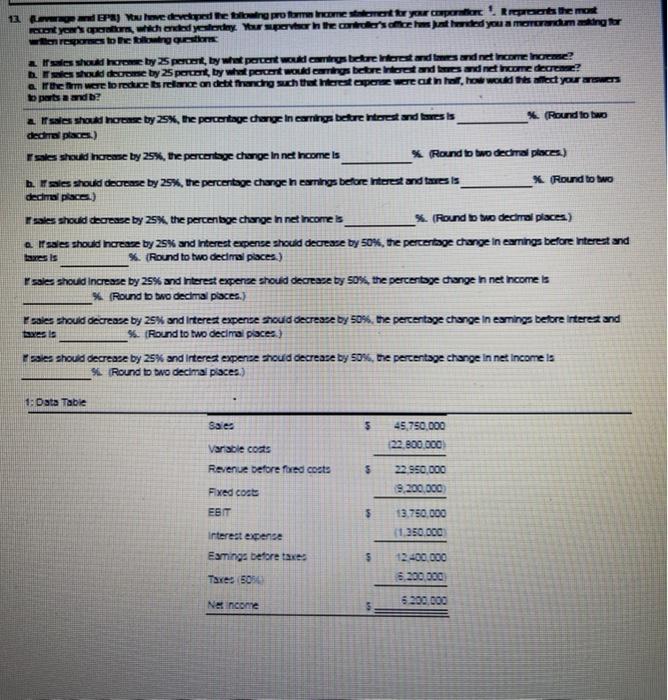

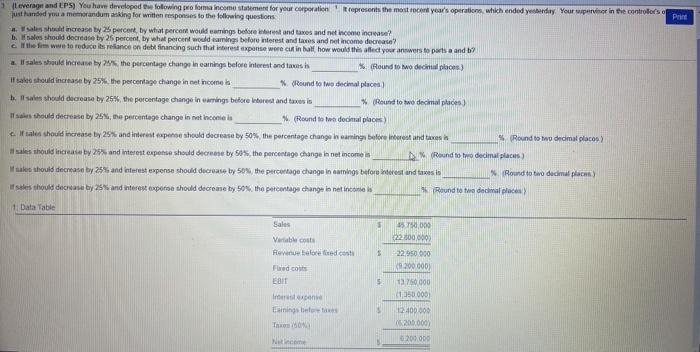

12 mdr) We dorped the protocometeor your compartier Roberts the most yer's age, which added yesterday. Your portar the controler's contended you a moradming for ngocngon les should come by Sport, by what percent would comingstore estand and income thouse? ha should come by 25 porn, by w picon would comingsbetore rodando and income are? a them were to reducerende onde tranch with the intrapre ceathe, would let your answers o parts and b? 2 sales should hoes by 25%, the percentage change in carings beterentrestand is (Round to wo decal place) sales should increase by 25%, the percentage change in net income is * Round wo decimal places.) h. Isles should decrease by 25%, the percentage change h earnings before interest and mis * Round to two decimal place) Isales should decrease by 25%, the percenbe change in net income %. Round in to decimal places) e sales should increase by 25% and interest expense should decrease by 50%, the percentage change in earnings before interest and %. Round to two decimal places.) Isales should increase by 25% and interest expence should decreazety 50%, the percentage change in net comes % Round to bwo decimal places.) Psales should decrease by 25% and interest expense should decresze by 50%, the percentage change in earnings before interest and faves is %. Round to two decimal piace) Psales should decrease by 23% and interest expenze should decrease by 50%, the percentage change in net income is 9. Round to be decimal pisces.) 1: Data Table sales 45.750.000 22.800,000 Variable costs Revenue before ford coets $ 22.950.000 9,200,000 Fixed cost ESIT 5 13.750.000 1.250.000 Interest expense Esmings before taxe $ 12.400.000 6.200.000 Taxes 5050 Net income 5200,000 Print Leverage and LPS) You have developed the following proforma income statement for your corporation represents the most recent year's operation, which ended yesterday. Your wpervisor in the controles just handed you a memorandum asking for written responses to the following questions sho increase by 25 percenk by what percent would earrings before best and taxes and net income increase? bles should decrease by 25 percent, by what percent would earnings before interest and taxes and net income decrease? chem were to reduce its reliance on debt financing such that interest expense were cut in half how would this affect your answers to pulsa and be 2. Il sales should increase by the percentage change in earnings before interest and taxes is (Round to two decal pos) If should increase by 25%, the percentage change in net income is Round to two decimal places same should decrease by 25%, the percentage change in earnings before Wrest and taxes is Round to two decimal places s should decrease by 25, na percentage change in net incontes 4. Round to decimal places te should increase by 25% and interest expense should decrease by 50% the percentage change hearing before interest and the Round to tou decimal places) sales should not by 25 and interest expense should decree by 50%, the percentage change in net income (Round to be decimal places Wales should decrease by 25% and interest expense should decrease by 50% the percentage change in eamings before interest and Round to two decimal places) les should decrease by 25 and interest expense should decrease by 50%. the percentage change in net incones Round to decimal places 1 Data Table 35 000 22800.000 Sales Vable costs Feven before.co Fedco EBIT S 22 950 000 200.000 $ ene taining The 50 13700 1350.000 12400000 200.000 6200.000