Answered step by step

Verified Expert Solution

Question

1 Approved Answer

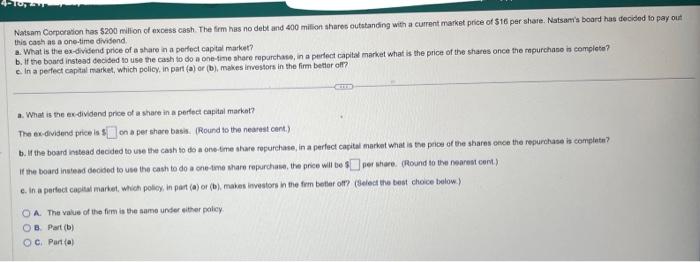

12. Natsam Corporadion has $200 milfon of excess cash. The frm has no debt and 400 milion ahares outatanding with a current market price of

12.

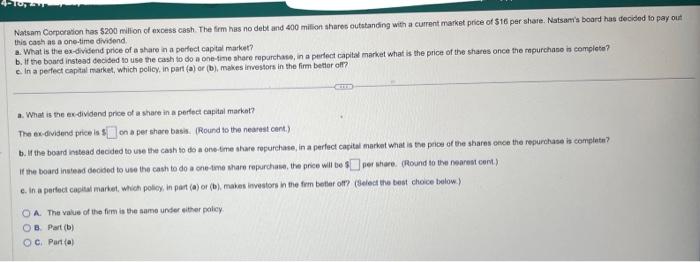

Natsam Corporadion has $200 milfon of excess cash. The frm has no debt and 400 milion ahares outatanding with a current market price of $16 per share. Natsamis board has decidod to pay ou this cash as a one-time divisend. 8. What is the ex-divisend price of a share in a porfoct captal market? b. If the board instead decised to use the cash to do a one-time shere roparchase, in a perfect capita market what is the price of the shares once the mpurchace in complete? c. In a perfect capitul market, which policy. in pant (a) or (b), makes irrestors in the firm bettor off?? a. What is the ex-dividend price of a share in a perfoct capital markat? The ex-divisend price is 1 on a pet share basis. (Round to the nearest cant.) b. It the board instead decided to use the cash to do a one-tme share topurchase, in a perlect caritai markst what is the poice of the shares once the repurchase is conplate? c. In a parfect capied mariet, Which policy, in par (a) or (b), makes inrestors in the frm betler of?? (Beied the best choice below.) A. The value of the fim is the aame unser either policy. B. Part(b) c. Part (a)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started