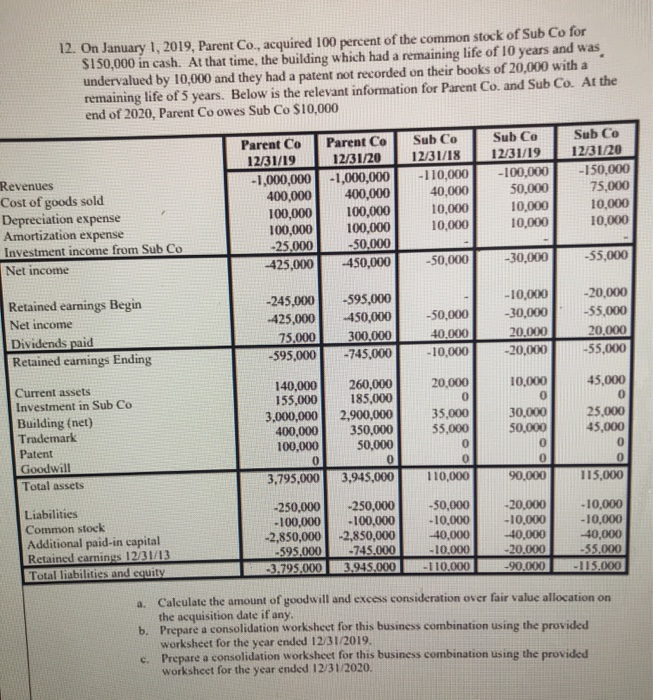

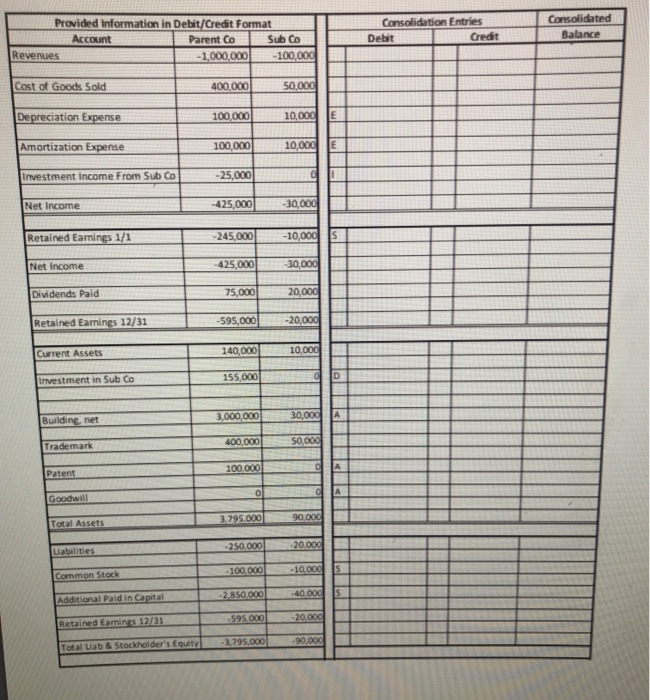

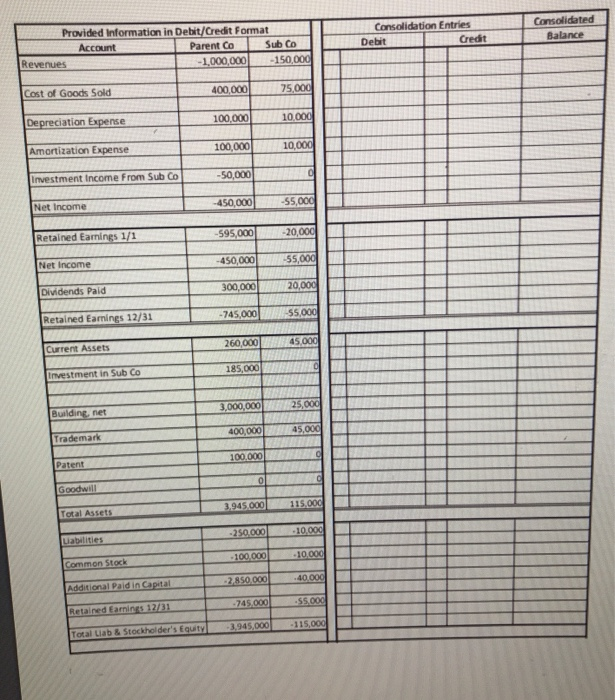

12. On January 1, 2019, Parent Co., acquired 100 percent of the common stock of Sub Co for $150,000 in cash. At that time, the building which had a remaining life of 10 years and was undervalued by 10,000 and they had a patent not recorded on their books of 20,000 with a remaining life of 5 years. Below is the relevant information for Parent Co. and Sub Co. At the end of 2020, Parent Co owes Sub Co $10,000 Parent Co Parent Co 12/31/19 12/31/20 -1,000,000 -1,000,000 400,000 400,000 100,000 100,000 100,000 100,000 -25.000 -50,000 -425,000 -450,000 Revenues Cost of goods sold Depreciation expense Amortization expense Investment income from Sub Co Net income Sub Co 12/31/18 -110,000 40,000 10,000 10,000 Sub Co 12/31/20 - 150.000 75,000 10,000 10,000 Sub Co 12/31/19 -100,000 50.000 10,000 10,000 -50,000 -30,000 -35,000 Retained earnings Begin Net income Dividends paid Retained earnings Ending -245.000 -425,000 75,000 -595,000 -595,000 -450,000 300.000 -745,000 -50,000 40.000 -10,000 - 10,000 -30,000 20.000 -20,000 -20.000 -55,000 20.000 -55,000 Current assets Investment in Sub Co Building (net) Trademark Patent Goodwill Total assets 140,000 155,000 3,000,000 400,000 100,000 0 3,795,000 260,000 185.000 2,900,000 350,000 50,000 0 3,945,000 20,000 0 35,000 53,000 0 0 110,000 10.000 0 30,000 50,000 0 0 90.000 45,000 0 25,000 45,000 0 0 115,000 Liabilities Common stock Additional paid-in capital Retained earnings 12/31/13 Total liabilities and equity -250,000 -250,000 -100,000 -100,000 -2,850,000 -2,850,000 -595,000 -745.000 -3.795.000 3.945,000 -50,000 -10,000 40.000 -10.000 -110.000 -20,000 -10.000 40,000 -20.000 -90.000 -10,000 -10,000 -40,000 -55.000 -115,000 a. Calculate the amount of goodwill and excess consideration over fair value allocation on the acquisition date if any. b. Prepare a consolidation worksheet for this business combination using the provided Worksheet for the year ended 12/31/2019 c. Prepare a consolidation worksheet for this business combination using the provided worksheet for the year ended 12/31/2020. Provided Information in Debit/Credit Format Account Parent Co Sub Co Revenues -1,000,000 -100,000 Consolidation Entries Debit Credit Consolidated Balance Cost of Goods Sold 400,000 50,000 Depreciation Expense 100,000 10,000 E Amortization Expense 100,000 10,000 E Investment Income From Sub Co -25,000 d Net Income -425,000 -30,000 Retained Earnings 1/1 -245,000 -10,000 IS Net Income 425,000 -30,000 Dividends Paid 75,000 20,000 Retained Earnings 12/31 -595,000 -20,000 Current Assets 140,000 10,000 155,000 D Investment in Sub Co 3,000,000 30,000 Building, net Trademark 400,000 50,000 Patent 100,000 A 0 Goodwill 3.795.000 Total Assets 90,000 -250,000 Uabilities -20.000 -100,000 -10.000 s Common Stock -2.850.000 .40.000 s Additional Paid in Capital 595.000 -20.000 Retained Earnings 12/31 -3.795,000 Total Liab & Stockholder's Equity -90,000 Consolidation Entries Debit Credit Consolidated Balance Provided Information in Debit/Credit Format Account Parent Co Sub Co Revenues -1,000,000 - 150,000 Cost of Goods Sold 400,000 75.000 100,000 10.000 Depreciation Expense Amortization Expense 100,000 10,000 Investment Income From Sub Co -50,000 -450,000 -55,000 Net Income -595,000 -20,000 Retained Eamings 1/1 -450,000 -55,000 Net Income 300,000 20,000 Dividends Paid - 745,000 -55,000 Retained Earnings 12/31 260,000 45.000 Current Assets 185,000 Investment in Sub Co 3,000,000 25,000 Building, net 400,000 45,000 Trademark 100,000 Patent 0 Goodwill 3.945.000 115.000 Total Assets -250.000 -10.000 Liabilities - 100.000 .10.000 Common Stock 2.850.000 40,000 Additional Paidin Capital -745.000 .55.000 Retained Earnings 12/31 3,945,000 - 115,000 Total Liab & Stockholder's Equity 12. On January 1, 2019, Parent Co., acquired 100 percent of the common stock of Sub Co for $150,000 in cash. At that time, the building which had a remaining life of 10 years and was undervalued by 10,000 and they had a patent not recorded on their books of 20,000 with a remaining life of 5 years. Below is the relevant information for Parent Co. and Sub Co. At the end of 2020, Parent Co owes Sub Co $10,000 Parent Co Parent Co 12/31/19 12/31/20 -1,000,000 -1,000,000 400,000 400,000 100,000 100,000 100,000 100,000 -25.000 -50,000 -425,000 -450,000 Revenues Cost of goods sold Depreciation expense Amortization expense Investment income from Sub Co Net income Sub Co 12/31/18 -110,000 40,000 10,000 10,000 Sub Co 12/31/20 - 150.000 75,000 10,000 10,000 Sub Co 12/31/19 -100,000 50.000 10,000 10,000 -50,000 -30,000 -35,000 Retained earnings Begin Net income Dividends paid Retained earnings Ending -245.000 -425,000 75,000 -595,000 -595,000 -450,000 300.000 -745,000 -50,000 40.000 -10,000 - 10,000 -30,000 20.000 -20,000 -20.000 -55,000 20.000 -55,000 Current assets Investment in Sub Co Building (net) Trademark Patent Goodwill Total assets 140,000 155,000 3,000,000 400,000 100,000 0 3,795,000 260,000 185.000 2,900,000 350,000 50,000 0 3,945,000 20,000 0 35,000 53,000 0 0 110,000 10.000 0 30,000 50,000 0 0 90.000 45,000 0 25,000 45,000 0 0 115,000 Liabilities Common stock Additional paid-in capital Retained earnings 12/31/13 Total liabilities and equity -250,000 -250,000 -100,000 -100,000 -2,850,000 -2,850,000 -595,000 -745.000 -3.795.000 3.945,000 -50,000 -10,000 40.000 -10.000 -110.000 -20,000 -10.000 40,000 -20.000 -90.000 -10,000 -10,000 -40,000 -55.000 -115,000 a. Calculate the amount of goodwill and excess consideration over fair value allocation on the acquisition date if any. b. Prepare a consolidation worksheet for this business combination using the provided Worksheet for the year ended 12/31/2019 c. Prepare a consolidation worksheet for this business combination using the provided worksheet for the year ended 12/31/2020. Provided Information in Debit/Credit Format Account Parent Co Sub Co Revenues -1,000,000 -100,000 Consolidation Entries Debit Credit Consolidated Balance Cost of Goods Sold 400,000 50,000 Depreciation Expense 100,000 10,000 E Amortization Expense 100,000 10,000 E Investment Income From Sub Co -25,000 d Net Income -425,000 -30,000 Retained Earnings 1/1 -245,000 -10,000 IS Net Income 425,000 -30,000 Dividends Paid 75,000 20,000 Retained Earnings 12/31 -595,000 -20,000 Current Assets 140,000 10,000 155,000 D Investment in Sub Co 3,000,000 30,000 Building, net Trademark 400,000 50,000 Patent 100,000 A 0 Goodwill 3.795.000 Total Assets 90,000 -250,000 Uabilities -20.000 -100,000 -10.000 s Common Stock -2.850.000 .40.000 s Additional Paid in Capital 595.000 -20.000 Retained Earnings 12/31 -3.795,000 Total Liab & Stockholder's Equity -90,000 Consolidation Entries Debit Credit Consolidated Balance Provided Information in Debit/Credit Format Account Parent Co Sub Co Revenues -1,000,000 - 150,000 Cost of Goods Sold 400,000 75.000 100,000 10.000 Depreciation Expense Amortization Expense 100,000 10,000 Investment Income From Sub Co -50,000 -450,000 -55,000 Net Income -595,000 -20,000 Retained Eamings 1/1 -450,000 -55,000 Net Income 300,000 20,000 Dividends Paid - 745,000 -55,000 Retained Earnings 12/31 260,000 45.000 Current Assets 185,000 Investment in Sub Co 3,000,000 25,000 Building, net 400,000 45,000 Trademark 100,000 Patent 0 Goodwill 3.945.000 115.000 Total Assets -250.000 -10.000 Liabilities - 100.000 .10.000 Common Stock 2.850.000 40,000 Additional Paidin Capital -745.000 .55.000 Retained Earnings 12/31 3,945,000 - 115,000 Total Liab & Stockholder's Equity