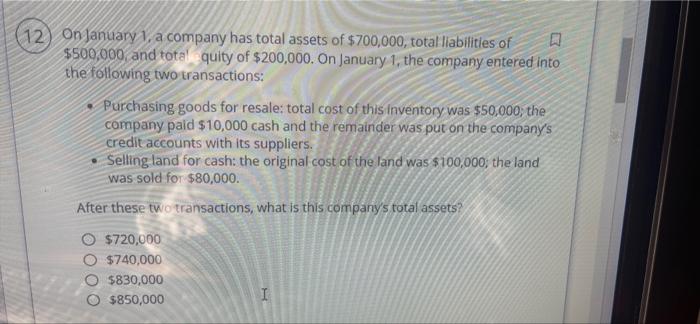

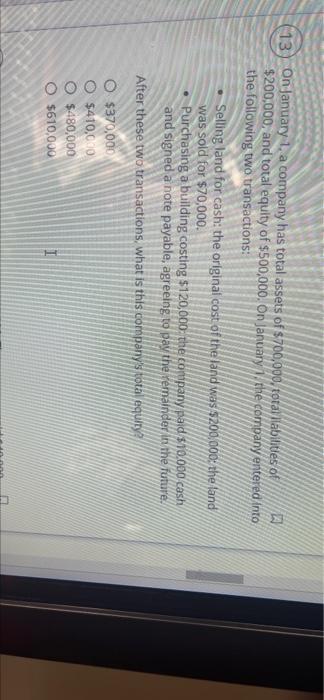

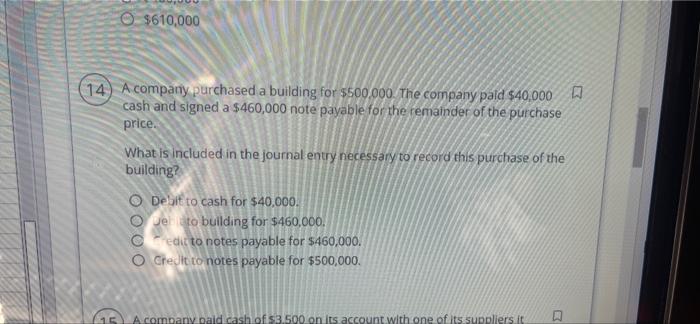

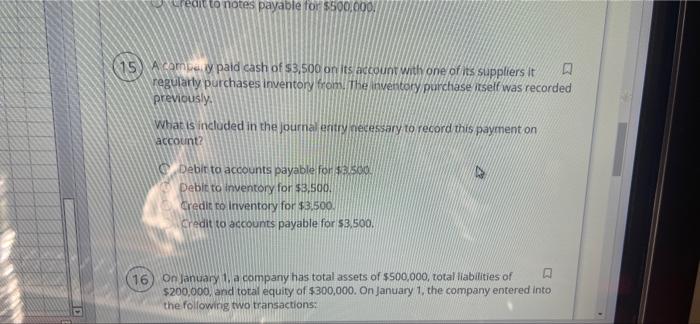

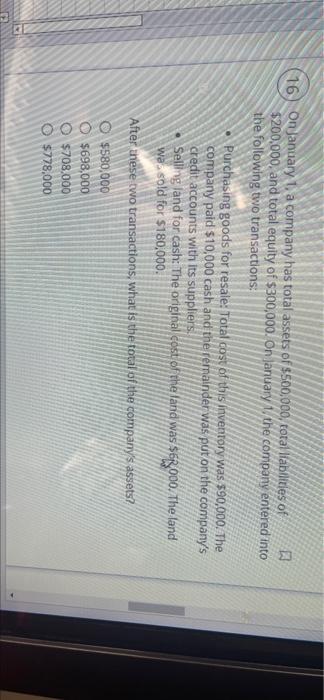

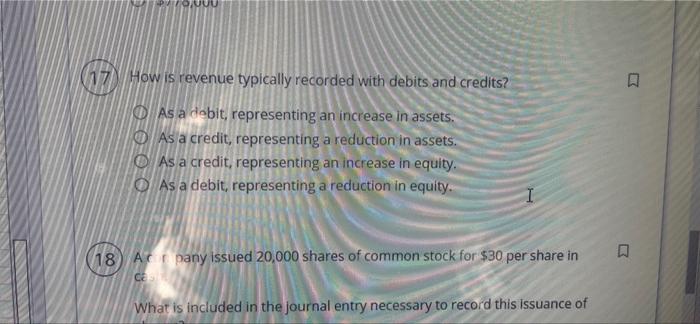

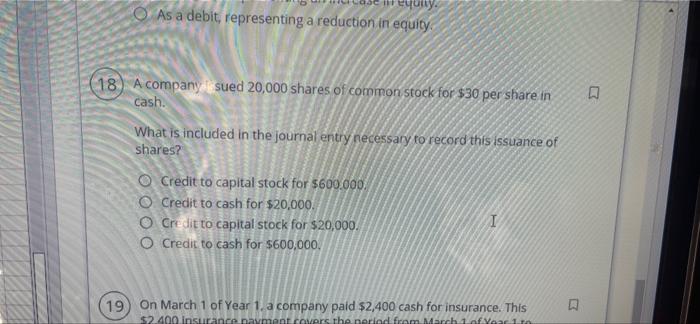

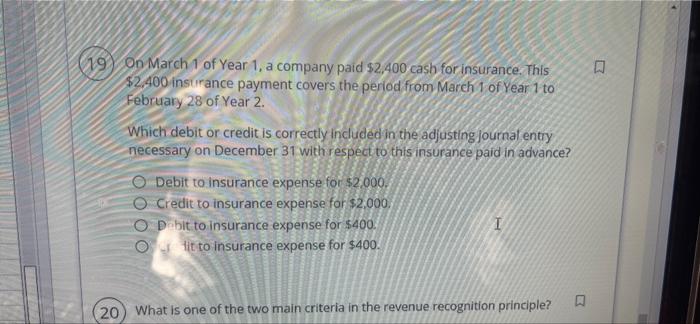

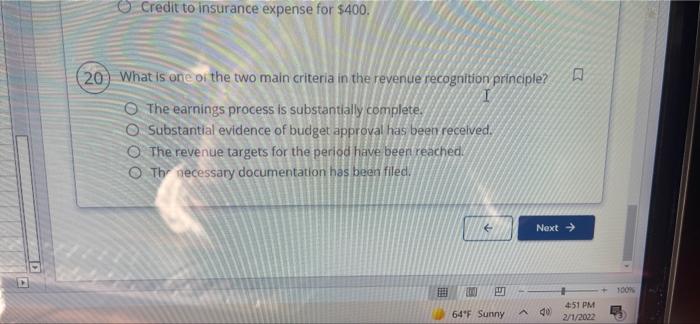

12) On January 1, a company has total assets of $ 700,000, total liabilities of $500,000 and total quity of $200,000. On January 1, the company entered into the following two transactions: Purchasing goods for resale: total cost of this inventory was $50,000, the company paid $10,000 cash and the remainder was put on the company's credit accounts with its suppliers. Selling land for cash: the original cost of the land was $100,000; the land was sold for $80,000. After these two transactions, what is this company's total assets? $720,000 $740,000 $830,000 O $850,000 I (13) On January 1, a company has total assets of $700,000, total abilities of $200,000, and total equity of $500,000. On January 1 the company entered into the following two transactions: Selling land for cash: the original cost of the land was $200,000+ the land was sold for $70,000. Purchasing a building costing $120,000 the company paid $10.000 cash and signed a note payable, agreeing to pay the remainder in the future. After these two transactions, what is this company's total equity OOOO O $370,000 O $410,00 $480,000 $610,000 O $610,000 14) A company purchased a building for 5500,000. The company pald $40,000 cash and signed a $460,000 note payable for the remainder of the purchase price. What is included in the journal entry necessary to record this purchase of the building? O Debit to cash for $40,000. well to building for $460,000. Credit to notes payable for $460,000. O Credit to notes payable for $500,000. 15 Acompany caldi cash of $3.500 on its account with one of its suppliers.it to notes payable for $500,000/ (15) A come i paid cash of $3.500 on its account with one of its suppliers it regularly purchases inventory from The inventory purchase itself was recorded previously What is included in the journal entry necessary to record this payment on account Debit to accounts payable for 3.500. Debit to inventory for $3,500, credit to Inventory for $3,500 credit to accounts payable for $3.500. 16) On January 1, a company has total assets of $500,000, total liabilities of $200,000, and total equity of $300,000. On January 1, the company entered into the following two transactions: (16) on January 1, a company has total assets of $500,000, total liabilities of $200,000, and total equity of $300,000. On January the company entered into the following two transactions: Purchasing goods for resale: Total cost of this inventory was $90,000. The company paid $10,000 cash and the remainder was put on the company's credit accounts with its suppliers, Selling land for cash: The original cost of the land was $6,000. The land wa. sold for $180,000. After inese two transactions, what is the total of the company's assets? $580,000 O $698,000 $708.000 $778,000 TOZU G How is revenue typically recorded with debits and credits? A As a debit, representing an increase in assets. As a credit, representing a reduction in assets. As a credit, representing an increase in equity. As a debit, representing a reduction in equity. 18 Arpany issued 20,000 shares of common stock for $30 per share in CE What is included in the journal entry necessary to record this issuance of yuny: As a debit, representing a reduction in equity 18) A company sued 20,000 shares of common stock for $30 per share in cash. What is included in the journal entry necessary to record this issuance of shares? O Credit to capital stock for $600.000 O Credit to cash for $20,000. O Credit to capital stock for $20,000. O Credit to cash for $600,000 19) On March 1 of Year 1, a company paid $2,400 cash for insurance. This $2400 insurance payment covers the period from March of year (19) On March 1 of Year 1, a company paid $2,400 cash for insurance. This $2,400 insurance payment covers the period from March 1 of Year 1 to February 28 of Year 2. Which debit or credit is correctly included in the adjusting journal entry necessary on December 31 with respect to this insurance paid in advance? O Debit to insurance expense for $2.000. O Credit to insurance expense for $2,000. O Dobit to insurance expense for $400. I Olit to insurance expense for $400. (20) What is one of the two main criteria in the revenue recognition principle? O Credit to insurance expense for $400. A 20 What is one of the two main criteria in the revenue recognition principle? I The earnings process is substantially complete. O Substantial evidence of budget approval has been received. The revenue targets for the period have been reached. The necessary documentation has been filed. Next > 100% A 64F Sunny 49 4:51 PM 2/1/2022 ES