Answered step by step

Verified Expert Solution

Question

1 Approved Answer

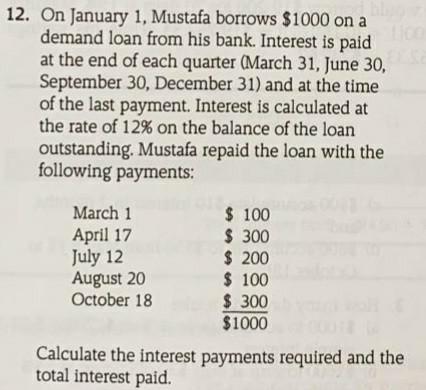

12. On January 1, Mustafa borrows $1000 on a demand loan from his bank. Interest is paid at the end of each quarter (March 31,

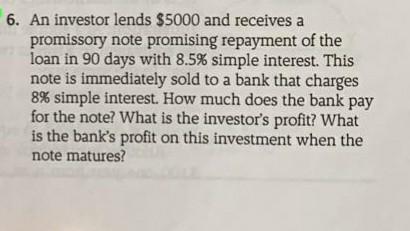

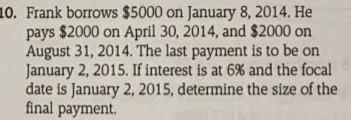

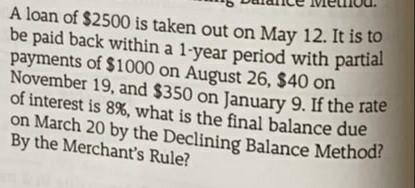

12. On January 1, Mustafa borrows $1000 on a demand loan from his bank. Interest is paid at the end of each quarter (March 31, June 30, September 30, December 31) and at the time of the last payment. Interest is calculated at the rate of 12% on the balance of the loan outstanding. Mustafa repaid the loan with the following payments: March 1 $ 100 April 17 $ 300 July 12 $ 200 August 20 $ 100 October 18 $ 300 $1000 Calculate the interest payments required and the total interest paid. 6. An investor lends $5000 and receives a promissory note promising repayment of the loan in 90 days with 8.5% simple interest. This note is immediately sold to a bank that charges 8% simple interest. How much does the bank pay for the note? What is the investor's profit? What is the bank's profit on this investment when the note matures? 10. Frank borrows $5000 on January 8, 2014. He pays $2000 on April 30, 2014, and $2000 on August 31, 2014. The last payment is to be on January 2, 2015. If interest is at 6% and the focal date is January 2, 2015, determine the size of the final payment. A loan of $2500 is taken out on May 12. It is to be paid back within a 1-year period with partial payments of $1000 on August 26, $40 on November 19, and $350 on January 9. If the rate of interest is 8%, what is the final balance due on March 20 by the Declining Balance Method? By the Merchant's Rule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started