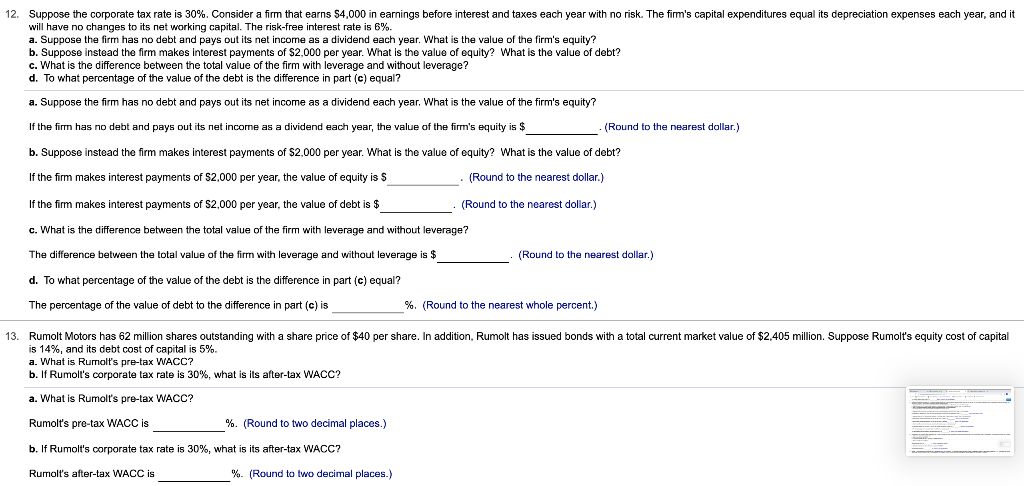

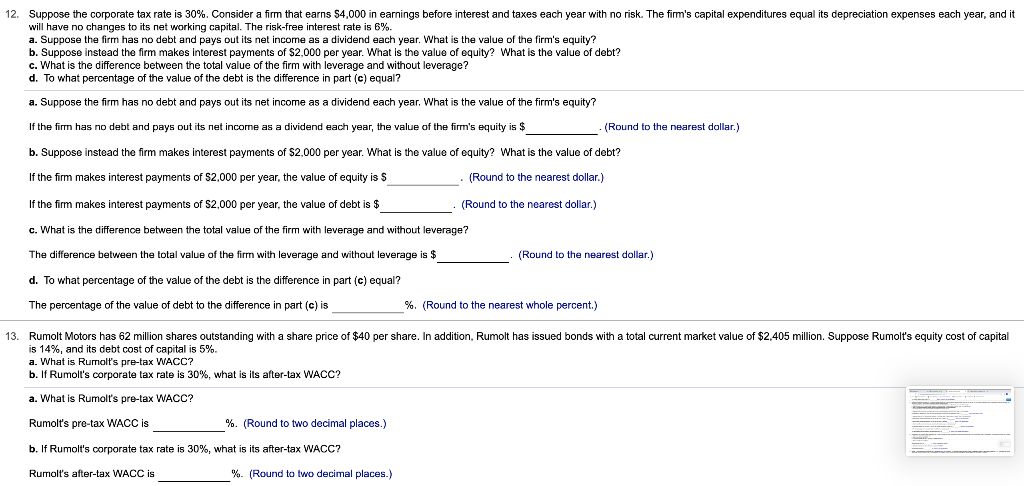

12. Suppose the corporate tax rate is 30%. Consider a firm that earns $4,000 in earnings before interest and taxes each year with no risk. The firm's capital expenditures equal its depreciation expenses each year, and it will have no changes to its net working capital. The risk-free interest rate is 6%. a. Suppose the firm has no debt and pays out its net income as a dividend each year. What is the value of the firm's equity? b. Suppose instead the firm makes interest payments of $2,000 per year. What is the value of equity? What is the value of debt? c. What is the difference between the total value of the firm with leverage and without leverage? d. To what percentage of the value of the debt is the difference in part (c) equal? a. Suppose the firm has no debt and pays out its net income as a dividend each year. What is the value of the firm's equity? If the firm has no debt and pays out its net income as a dividend each year, the value of the firm's equity is $ . (Round to the nearest dollar.) b. Suppose instead the firm makes interest payments of $2,000 per year. What is the value of equity? What is the value of debt? If the firm makes interest payments of $2,000 per year, the value of equity is $ (Round to the nearest dollar.) If the firm makes interest payments of $2,000 per year, the value of debt is $ (Round to the nearest dollar) c. What is the difference between the total value of the firm with leverage and without leverage? The difference between the total value of the firm with leverage and without leverage is $ (Round to the nearest dollar.) d. To what percentage of the value of the debt is the difference in part (c) equal? The percentage of the value of debt to the difference in part (c) is %. (Round to the nearest whole percent.) 13. Rumolt Motors has 62 million shares outstanding with a share price of $40 per share. In addition, Rumolt has issued bonds with a total current market value of $2,405 million. Suppose Rumolt's equity cost of capital is 14%, and its debt cost of capital is 5%. What is Rumolt's pre-tax WACC? b. If Rumolt's corporate tax rate is 30%, what is its after-tax WACC? What is Rumolt's pre-lax WACC? Rumolt's pre-tax WACC is %. (Round to two decimal places.) b. If Rumolt's corporate tax rate is 30%, what is its after-tax WACC? Rumolt's after-tax WACC is % (Round to two decimal places.)