Answered step by step

Verified Expert Solution

Question

1 Approved Answer

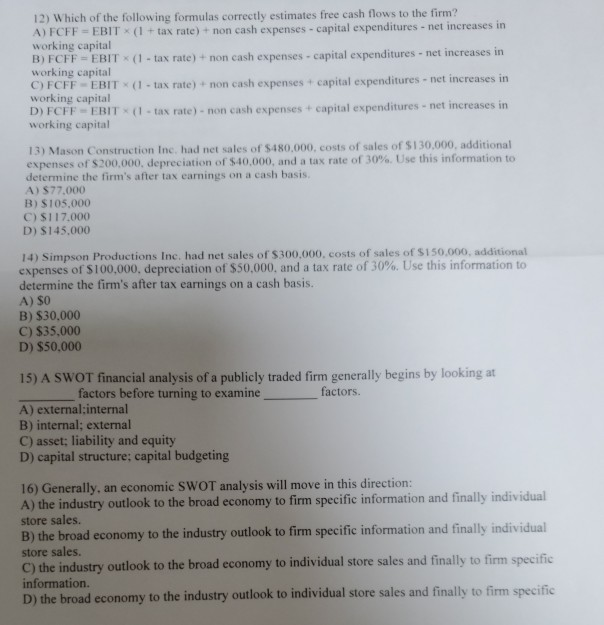

12) Which of the following formulas correctly estimates free cash flows to the firm? A) FCFF EBIT (1+tax rate) + non cash expenses - capital

12) Which of the following formulas correctly estimates free cash flows to the firm? A) FCFF EBIT (1+tax rate) + non cash expenses - capital expenditures - net increases in working capital B) FCFF EBIT (1-tax rate)+non cash expenses - capital expenditures - net increases in working capital C) FCFF EBIT (1-tax rate) + non cash expenses + capital expenditures net increases in working capital D) FCFF EBIT (1-tax rate)- non cash expenses + capital expenditures- net increases in working capital 13) Mason Construction Inc. had net sales of $480,000, costs of sales of $130,000, additional expenses of $200,000, depreciation of $40,000, and a tax rate of 30%. Use this information to determine the firm's after tax earnings on a cash basis. A) $77,000 B) $105.000 C) SI17.000 D) $145,000 14) Simpson Productions Inc. had net sales of $300,000, costs of sales of S150,000, additional expenses of S100,000, depreciation of $50,000, and a tax rate of 30%. Use this information to determine the firm's after tax earnings on a cash basis A) $0 B) $30,000 C) $35,000 D) $50,000 15) A SWOT financial analysis of a publicly traded firm generally begins by looking at factors before turning to examine factors. A) external;internal B) internal; external C) asset; liability and equity D) capital structure; capital budgeting 16) Generally, an economic SWOT analysis will move in this direction: A) the industry outlook to the broad economy to firm specific information and finally individual store sales. B) the broad economy to the industry outlook to firm specific information and finally individual store sales. C) the industry outlook to the broad economy to individual store sales and finally to firm specific information. D) the broad economy to the industry outlook to individual store sales and finally to firm specific

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started