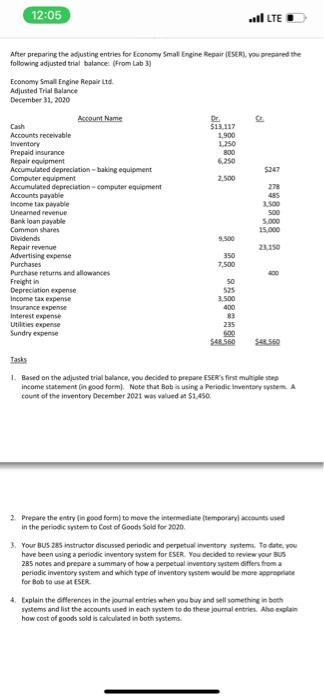

12:05 all LTE After preparing the adjusting entries for Economy Smal Engine Repair (ESER. you prepared the following adjusted trial balance (From Lab 3) Economy Small Engine Repair Ltd. Adjusted Trial Balance December 31, 2020 Account Name Cash $13.117 Accounts receivable 1.900 Inventory 1.250 Prepaid insurance 800 Repair equipment 250 Accumulated depreciation - baking equipment $247 Computer equipment 2.500 Accumulated depreciation - computer equipment Accounts payable 485 Income tax payable 2.500 Uneamed revenue 500 Bank loan payable 5.000 Common shares 15.000 Dividends 9.500 Repair revenue Advertising expense 350 Purchases 7.500 Purchase returns and allowances Freight in 50 Depreciation expense 525 Income tax expense Insurance expense 400 Interest expense Utilities expense 235 Sundry expense S48550 Tasks 1500 S4560 1. Based on the adjusted trial balance, you decided to prepare ESER's first multiple step income statement in good form. Note that Bob is using a Periodic Inventory system. A count of the inventory December 2021 was valued at $1.450 2. Prepare the entry in good form to move the intermediate (temporary counted In the periodic item to Cost of Goods Sold for 2020 3. Your BUS 285 Instructor discussed periode and perpetual inventory system. To date, you have been using a periodic inventory system for ESER You decided to review your Bus 285 notes and prepare a summary of how a perpetual inventory system offers from a periodic inventory system and which type of inventory system would be more propriate for Bob to use ESER 4. Explain the differences in the journal entries when you buy and sell something in both systems and list the accounts used in each system to do these journal entries. Aho explain how cost of goods sold is calculated in both systems. 12:05 all LTE After preparing the adjusting entries for Economy Smal Engine Repair (ESER. you prepared the following adjusted trial balance (From Lab 3) Economy Small Engine Repair Ltd. Adjusted Trial Balance December 31, 2020 Account Name Cash $13.117 Accounts receivable 1.900 Inventory 1.250 Prepaid insurance 800 Repair equipment 250 Accumulated depreciation - baking equipment $247 Computer equipment 2.500 Accumulated depreciation - computer equipment Accounts payable 485 Income tax payable 2.500 Uneamed revenue 500 Bank loan payable 5.000 Common shares 15.000 Dividends 9.500 Repair revenue Advertising expense 350 Purchases 7.500 Purchase returns and allowances Freight in 50 Depreciation expense 525 Income tax expense Insurance expense 400 Interest expense Utilities expense 235 Sundry expense S48550 Tasks 1500 S4560 1. Based on the adjusted trial balance, you decided to prepare ESER's first multiple step income statement in good form. Note that Bob is using a Periodic Inventory system. A count of the inventory December 2021 was valued at $1.450 2. Prepare the entry in good form to move the intermediate (temporary counted In the periodic item to Cost of Goods Sold for 2020 3. Your BUS 285 Instructor discussed periode and perpetual inventory system. To date, you have been using a periodic inventory system for ESER You decided to review your Bus 285 notes and prepare a summary of how a perpetual inventory system offers from a periodic inventory system and which type of inventory system would be more propriate for Bob to use ESER 4. Explain the differences in the journal entries when you buy and sell something in both systems and list the accounts used in each system to do these journal entries. Aho explain how cost of goods sold is calculated in both systems