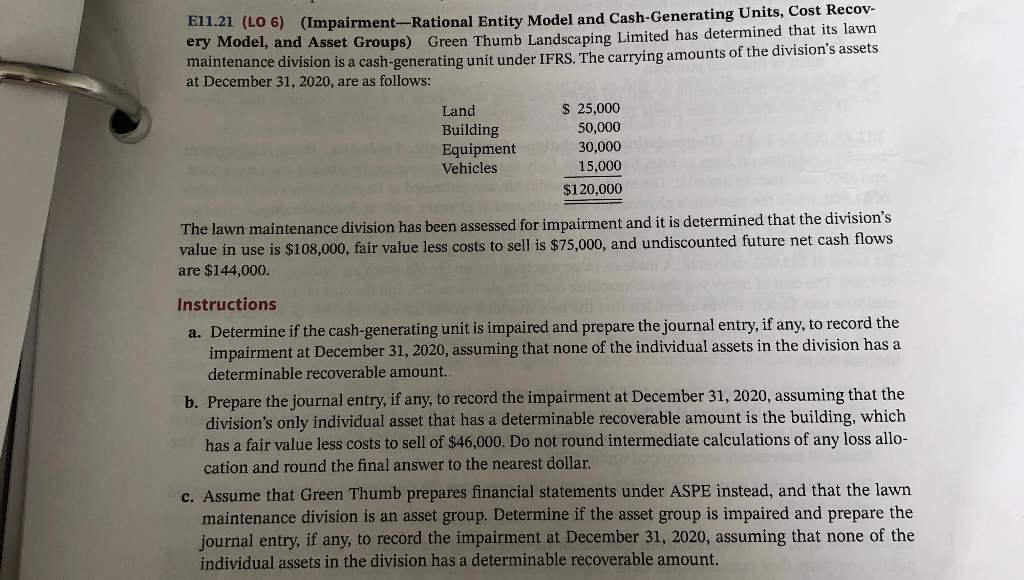

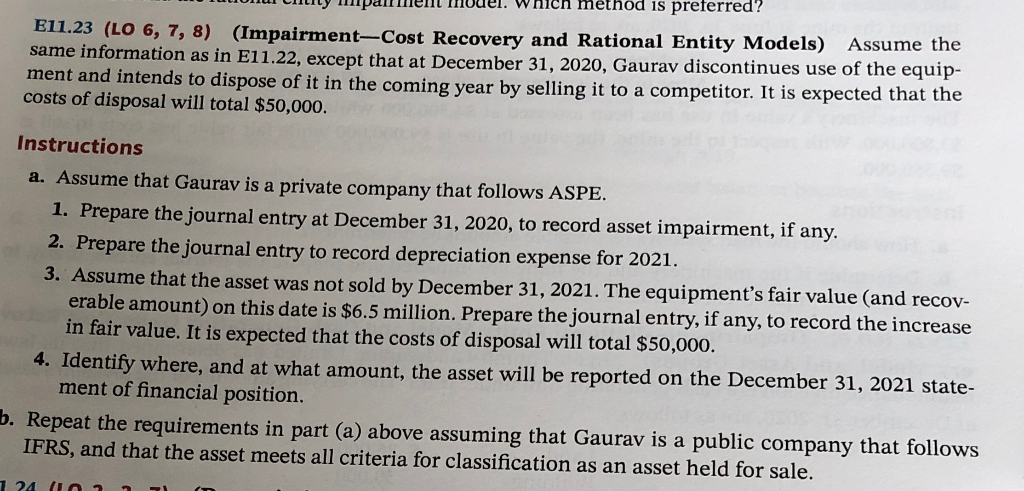

1.21 (LO 6) (Impairment-Rational Entity Model and Cash-Generating Units, Cost Recov- ery Model, and Asset Groups) Green Thumb Landscaping Limited has determined that its law maintenance division is a cash-generating unit under IFRS. The carrying amounts of the division's assets at December 31, 2020, are as follows: Land Building Equipment Vehicles $ 25,000 50,000 30,000 15,000 $120,000 The lawn maintenance division has been assessed for impairment and it is determined that the division's value in use is $108,000, fair value less costs to sell is $75,000, and undiscounted future net cash flows are $144,000. Instructions a. Determine if the cash-generating unit is impaired and prepare the journal entry, if any, to record the impairment at December 31, 2020, assuming that none of the individual assets in the division has a determinable recoverable amount. b. Prepare the journal entry, if any, to record the impairment at December 31, 2020, assuming that the division's only individual asset that has a determinable recoverable amount is the building, which has a fair value less costs to sell of $46,000. Do not round intermediate calculations of any loss allo- cation and round the final answer to the nearest dollar, c. Assume that Green Thumb prepares financial statements under ASPE instead, and that the lawn maintenance division is an asset group. Determine if the asset group is impaired and prepare the journal entry, if any, to record the impairment at December 31, 2020, assuming that none of the individual assets in the division has a determinable recoverable amount. m anIIL Divuer. WHICH MetriuU IS pieleeu! Any upanum mouer. E11.23 (LO 6, 7, 8) (Impairment Cost Recovery and Rational Entity Models) Assume the same information as in E11.22, except that at December 31, 2020, Gaurav discontinues use of the equip- ment and intends to dispose of it in the coming year by selling it to a competitor. It is expected that the costs of disposal will total $50,000. Instructions a. Assume that Gaurav is a private company that follows ASPE. 1. Prepare the journal entry at December 31, 2020, to record asset impairment, if any. 2. Prepare the journal entry to record depreciation expense for 2021. 3. Assume that the asset was not sold by December 31, 2021. The equipment's fair value (and recov- erable amount) on this date is $6.5 million. Prepare the journal entry, if any, to record the increase in fair value. It is expected that the costs of disposal will total $50,000. 4. Identify where, and at what amount, the asset will be reported on the December 31, 2021 state- ment of financial position. b. Repeat the requirements in part (a) above assuming that Gaurav is a public company that follows IFRS, and that the asset meets all criteria for classification as an asset held for sale