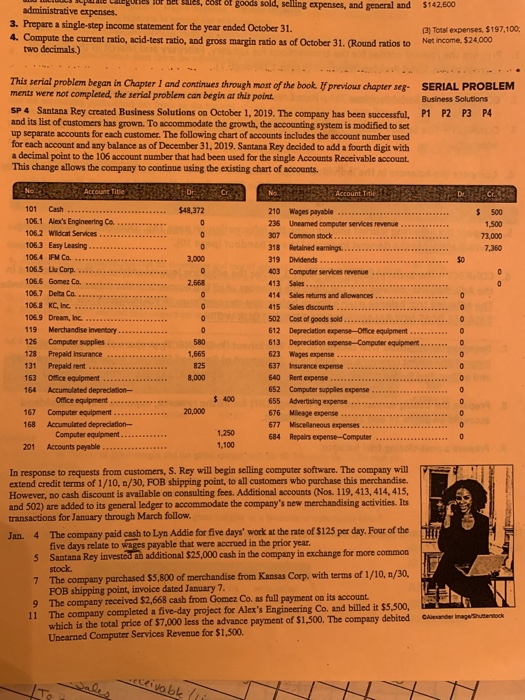

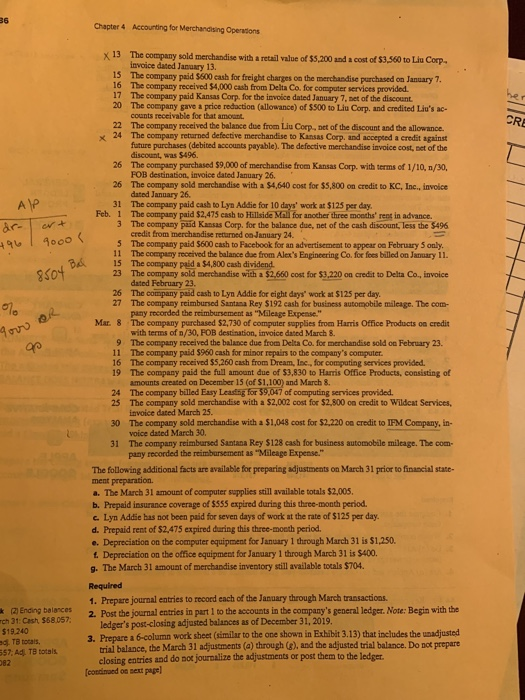

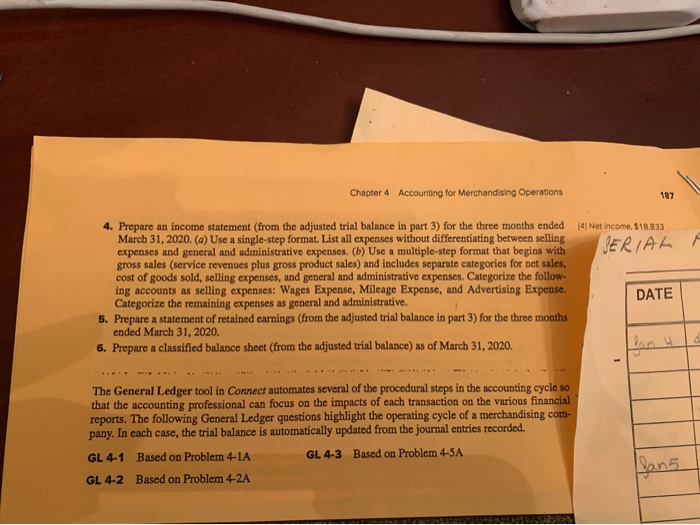

$122.600 Us of goods sold, selling expenses and reland administrative expenses 3. Prepare a single-step income statement for the year ended October 31. 4. Compute the current ratio, acid-test ratio, and gross margin ratio as of October 31. (Round ratios to two decimals.) Total expenses. $197.100 SERIAL PROBLEM Business Solutions P1 P2 P3 P4 This serial problem began in Chapter 1 and continues through most of the book. It previous chapters ments were not completed, the serial problem can begin at this point. SP 4 Santana Rey created Business Solutions on October 1, 2019. The company has been successful. and its list of customers has grown. To accommodate the growth, the accounting system is modified to set up separate accounts for each customer. The following chart of accounts includes the account number used for each account and any balance as of December 31, 2019. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This change allows the company to continue using the existing chart of accounts. Account $48372 $ 500 73.000 7.359 101 Cash ************* 1051 La's Engineering Ca. 1052 Wildcat Services.. 1063 Emy Leasing 106.4 FMC ***** 1065 L Corp..... . 106.6 Gomer ca. 106.7 Delta Co. 105.8 KC Inc. ... 106,9 Dream, Inc. ... 119 Merchandise inventory. 126 Computer supplies.. . 128 Prepaid insurance ... 131 Prepaid rent.... 163 ce equipment 164 Accumulated depreciation- Omice equipment.********** 167 Computer equipment...... 168 Accumulated depreciation Computer equipment............. 201 Accounts payable .............. 210 Wages payable 236 Uhearned computer services 307 Common tod..... 313 ned earning... 319 Dividends. 493 Computer services revenue 413 Sales ********** 414 Sales returns and lowances 415 Sales discounts ....... 502 Cost of goods sold... 612 Depreciation expense Office equipment .... 613 Depreciation expense Computer equipment 623 Wages expense. ********* 637 insurance expense . .. 640 Rent expense .. . 652 Computer supplies expense 655 Advertising expense. 676 Mileage expense.... 677 Miscellaneous expenses.... 684 Rears expense Computer $ 400 1.250 1.100 In response to requests from customers, S. Rey will begin selling computer software. The company will extend credit terms of 1/10, 1/30, FOB shipping point, to all customers who purchase this merchandise However, no cash discount is available on consulting fees. Additional accounts (Nos. 119,413, 414, 415, and 502) are added to its general ledger to accommodate the company's new merchandising activities. It transactions for January through March follow Jan. 4 The company paid cash to Lyn Addie for five days' work at the rate of $125 per day. Four of the five days relate to wares payable that were accrued in the prior year. 5 Santana Rey invested in additional $25,000 cash in the company in exchange for more common stock 7 The company purchased 55,800 of merchandise from Kansas Corp, with terms of 1/10, n/30, FOB shipping point, invoice dated January 7. 9 The company received $2,668 cash from Gomez Co. as full payment on its account. 11 The company completed a five-day project for Alex's Engineering Co. and billed it $5,500, which is the total price of $7,000 less the advance payment of $1,500. The company debited Unearned Computer Services Revenue for $1,500. wanderinge Stock -Seivab Chapter 4 Accounting for Merchandising Operations (4) Net income, $18.833 SERIAL 4. Prepare an income statement (from the adjusted trial balance in part 3) for the three months ended March 31, 2020. (a) Use a single-step format. List all expenses without differentiating between selling expenses and general and administrative expenses. (b) Use a multiple-step format that begins with gross sales (service revenues plus gross product sales) and includes separate categories for net sales cost of goods sold, selling expenses, and general and administrative expenses. Categorize the follow ing accounts as selling expenses: Wages Expense, Mileage Expense, and Advertising Expense Categorize the remaining expenses as general and administrative. 5. Prepare a statement of retained earnings from the adjusted trial balance in part 3) for the three months ended March 31, 2020. 6. Prepare a classified balance sheet (from the adjusted trial balance) as of March 31, 2020, DATE The General Ledger tool in Connect automates several of the procedural steps in the accounting cycle so that the accounting professional can focus on the impacts of each transaction on the various financial reports. The following General Ledger questions highlight the operating cycle of a merchandising com, pany. In cach case, the trial balance is automatically updated from the journal entries recorded. GL 4-1 Based on Problem 4-1A GL 4-3 Based on Problem 4-5A GL 4-2 Based on Problem 4-2A Vans