Answered step by step

Verified Expert Solution

Question

1 Approved Answer

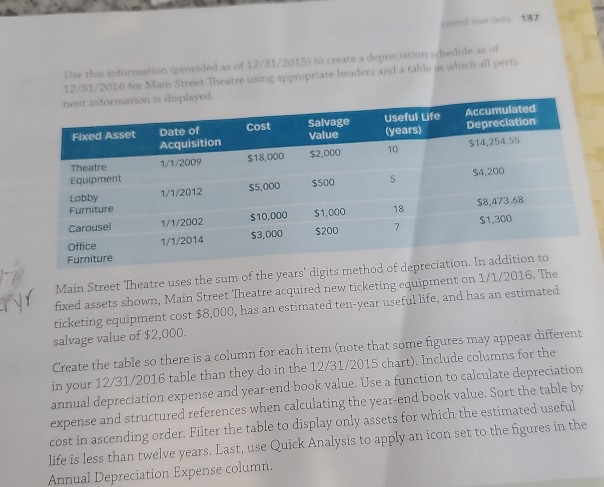

12/31/2016 for Main Street Theatre using appropriate headers and table in which allt Fixed Asset Date of Acquisition Cost Salvage Value $2,000 Useful Life (years)

12/31/2016 for Main Street Theatre using appropriate headers and table in which allt Fixed Asset Date of Acquisition Cost Salvage Value $2,000 Useful Life (years) Accumulated Depreciation $14.254 55 1/1/2009 $18,000 1/1/2012 $5,000 $500 $4,200 Theatre Equipment Lobby Furniture Carousel Office Furniture 18 1/1/2002 1/1/2014 $10,000 $3,000 $1,000 $200 58,473.68 $1,300 Main Street Theatre uses the sum of the years' digits method of depreciation. In addition to fixed assets shown, Main Street Theatre acquired new ticketing equipment on 1/1/2016. The ticketing equipment cost $8,000, has an estimated ten-year useful life, and has an estimated salvage value of $2,000. Create the table so there is a column for each item (note that some figures may appear different! in your 12/31/2016 table than they do in the 12/31/2015 chart). Include columns for the annual depreciation expense and year-end book value. Use a function to calculate depreciation expense and structured references when calculating the year-end book value. Sort the table by cost in ascending order. Filter the table to display only assets for which the estimated useful life is less than twelve years. Last, use Quick Analysis to apply an icon set to the figures in the Annual Depreciation Expense column 12/31/2016 for Main Street Theatre using appropriate headers and table in which allt Fixed Asset Date of Acquisition Cost Salvage Value $2,000 Useful Life (years) Accumulated Depreciation $14.254 55 1/1/2009 $18,000 1/1/2012 $5,000 $500 $4,200 Theatre Equipment Lobby Furniture Carousel Office Furniture 18 1/1/2002 1/1/2014 $10,000 $3,000 $1,000 $200 58,473.68 $1,300 Main Street Theatre uses the sum of the years' digits method of depreciation. In addition to fixed assets shown, Main Street Theatre acquired new ticketing equipment on 1/1/2016. The ticketing equipment cost $8,000, has an estimated ten-year useful life, and has an estimated salvage value of $2,000. Create the table so there is a column for each item (note that some figures may appear different! in your 12/31/2016 table than they do in the 12/31/2015 chart). Include columns for the annual depreciation expense and year-end book value. Use a function to calculate depreciation expense and structured references when calculating the year-end book value. Sort the table by cost in ascending order. Filter the table to display only assets for which the estimated useful life is less than twelve years. Last, use Quick Analysis to apply an icon set to the figures in the Annual Depreciation Expense column

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started