1,2,3,&4

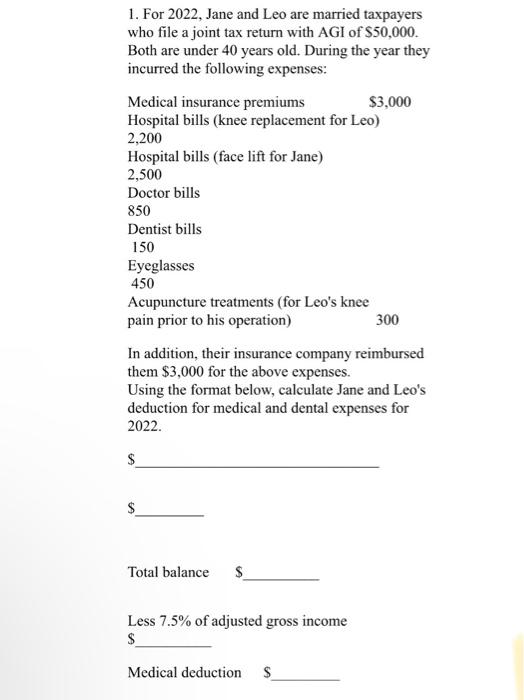

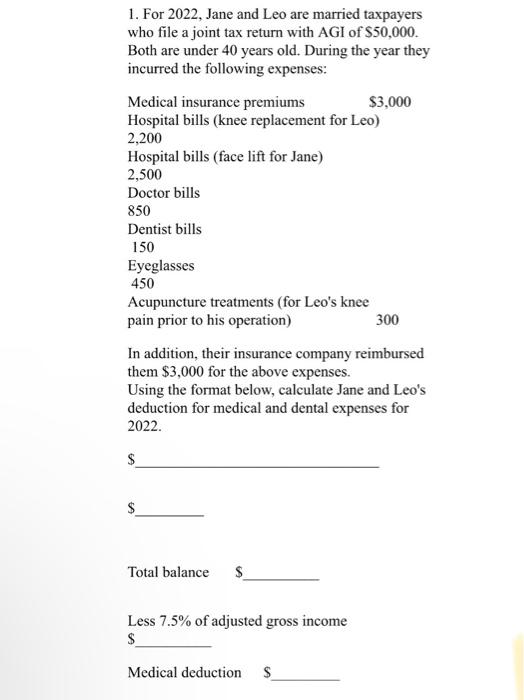

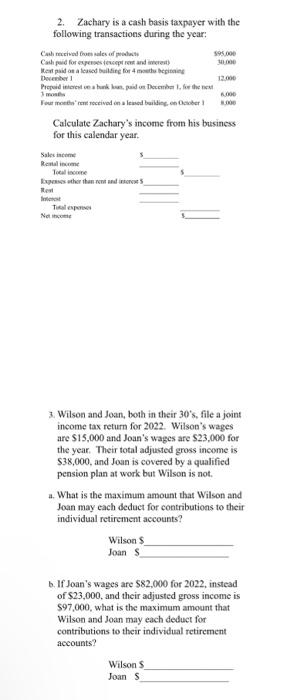

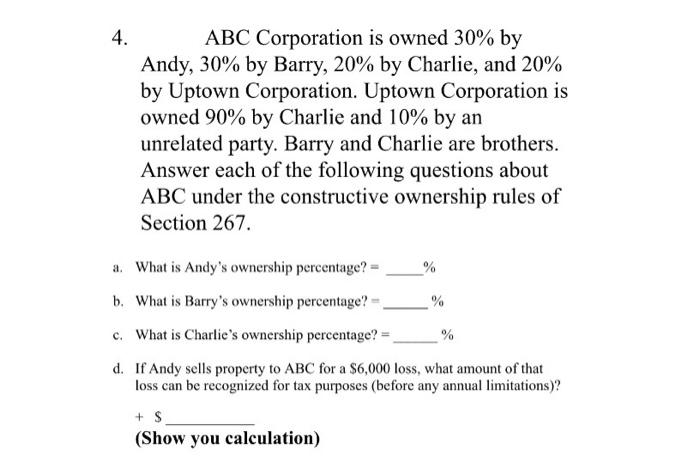

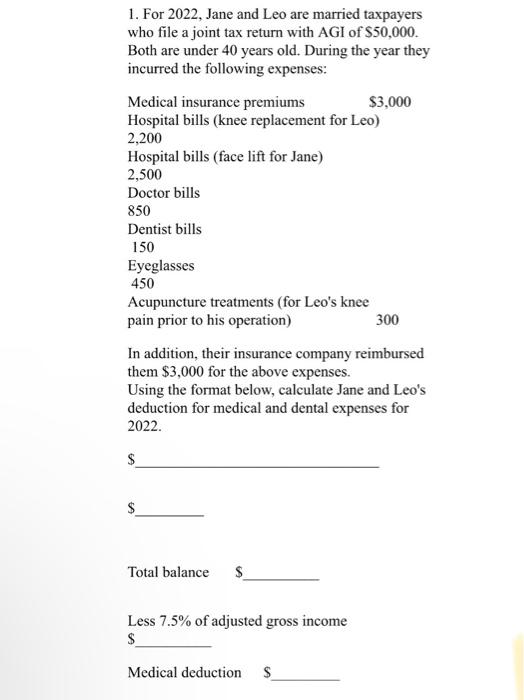

1. For 2022 , Jane and Leo are married taxpayers who file a joint tax return with AGI of $50,000. Both are under 40 years old. During the year they incurred the following expenses: Medical insurance premiums $3,000 Hospital bills (knee replacement for Leo) 2,200 Hospital bills (face lift for Jane) 2,500 Doctor bills 850 Dentist bills 150 Eyeglasses 450 Acupuncture treatments (for Leo's knee pain prior to his operation) 300 In addition, their insurance company reimbursed them $3,000 for the above expenses. Using the format below, calculate Jane and Leo's deduction for medical and dental expenses for 2022. $ $ Total balance $ Less 7.5% of adjusted gross income Medical deduction $ 2. Zachary is a cash basis taxpayer with the following transactions during the year: Calculate Zachary's income from his business for this calendar year. 3. Wilson and Joan, both in their 30, , file a joint income tax return for 2022 . Wilsos's wages are $15,000 and Joan's wages are $23,000 for the year. Their total adjusted gross income is $38,000, and Joun is covered by a qualified pension plan at work but Wilson is not. a. What is the maximum amount that Wilson and Joan may each deduct for contributioas to their individual retirement accounts? Wilson 5 Joan $ b. If Joan's wages are $82,000 for 2022, instead of $23,000, and their adjusted gross income is $97,000, what is the maximum amount that Wilson and Joan may each deduct for contributions to their individual retirement accounts? Wilson $ 4. ABC Corporation is owned 30% by Andy, 30% by Barry, 20% by Charlie, and 20% by Uptown Corporation. Uptown Corporation is owned 90% by Charlie and 10% by an unrelated party. Barry and Charlie are brothers. Answer each of the following questions about ABC under the constructive ownership rules of Section 267. a. What is Andy's ownership percentage? = % b. What is Barry's ownership percentage? = % c. What is Charlie's ownership percentage? = % d. If Andy sells property to ABC for a $6,000 loss, what amount of that loss can be recognized for tax purposes (before any annual limitations)? +s (Show you calculation)