Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1,2,3,4 solve showing steps please dont use exell Mini-Case Barry Neill, 60, has just retired from his job at the city council Barry has estimated

1,2,3,4 solve showing steps please dont use exell

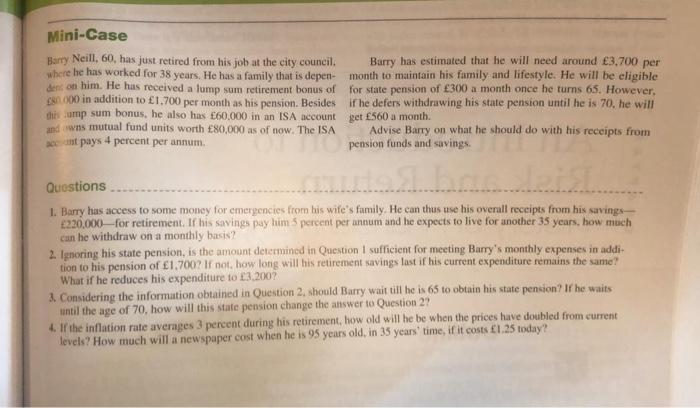

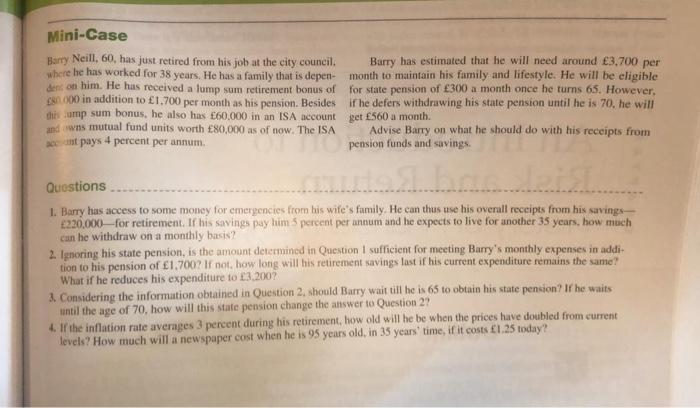

Mini-Case Barry Neill, 60, has just retired from his job at the city council Barry has estimated that he will need around 3,700 per where he has worked for 38 years. He has a family that is depen-month to maintain his family and lifestyle. He will be eligible dent on him. He has received a lump sum retirement bonus of for state pension of 300 a month once he turns 65. However, ES (300 in addition to 1.700 per month as his pension. Besides if he defers withdrawing his state pension until he is 70. he will this sump sum bonus, he also has 60,000 in an ISA account get 560 a month. and wns mutual fund units worth 80,000 as of now. The ISA Advise Barry on what he should do with his receipts from 3 st pays 4 percent per annum pension funds and savings Questions 1. Barry has access to some money for emergencies from his wife's family. He can thus use his overall receipts from his savings 230,000 for retirement. If his savings pay him 5 percent per annum and he expects to live for another 35 years, how much can he withdraw on a monthly basis? 2. Ignoring his state pension, is the amount determined in Question I sufficient for meeting Barry's monthly expenses in addi tion to his pension of 1,700? If not, how long will bis retirement savings last if his current expenditure remains the same? What if he reduces his expenditure to 3.2007 3. Considering the information obtained in Question 2 should Barry wait till he is 65 to obtain his state pension? If he waits until the age of 70, how will this state pension change the answer to Question 2? 4. If the inflation rate averages 3 percent during his retirement, how old will he be when the prices have doubled from current levels? How much will a newspaper cost when he is 95 years old, in 35 years' time, if it costs 1.25 today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started